Dick's Sporting Goods reported second-quarter earnings slid 17.5 percent but reached the high-end of its guidance. The quarter included pre-tax charges totaling $20.4 million related to the restructuring of its golf business. Consolidated same store sales increased 3.2 percent.

The retailer maintained its guidance for the year.

Second Quarter Results

The company reported consolidated non-GAAP net income for the second quarter ended Aug. 2, 2014 of $81.7 million, or 67 cents per diluted share, excluding golf restructuring charges, compared to the company's expectations provided on May 20, 2014 of 62 to 67 cents per diluted share. For the second quarter ended August 3, 2013, the company reported consolidated non-GAAP net income of $88.9 million, or 71 cents per diluted share, excluding an asset impairment charge.

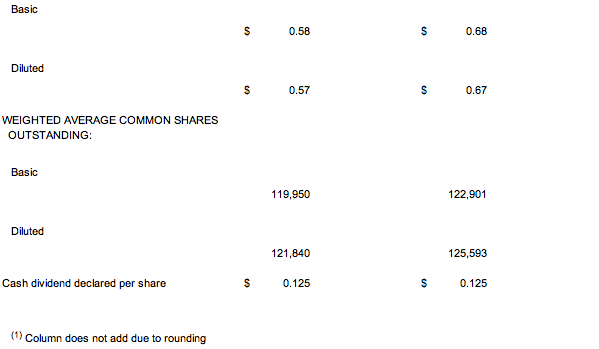

On a GAAP basis, the company reported consolidated net income for the second quarter ended August 2, 2014 of $69.5 million, or 57 cents per diluted share. For the second quarter ended August 3, 2013, the company reported consolidated net income of $84.2 million, or 67 cents per diluted share.

Net sales for the second quarter of 2014 increased 10.3 percent to approximately $1.7 billion. Consolidated same store sales increased 3.2 percent, compared to the company's guidance of an approximate 1 to 3 percent increase. Same store sales for Dick's Sporting Goods increased 4.1 percent, while Golf Galaxy decreased 9.3 percent. Second quarter 2013 consolidated same store sales decreased 0.4 percent, adjusted for the shifted retail calendar due to the 53rd week in 2012.

“Our second quarter results came in at the high end of our expectations,” said Edward W. Stack, chairman and CEO. “As anticipated, the golf and hunting businesses continued to experience negative comps. However, excluding these two categories, the remainder of the business delivered a 7.8 percent same store sales increase. We saw significant strength in several areas, including categories that have received more space within our stores, such as women's and youth athletic apparel.”

Stack continued, “The headwinds in our hunting business continued in the second quarter. However, as we look at the entirety of our outdoor business, strength in other outdoor categories offset the declines in hunting, and our total outdoor comps were flat for the quarter. This gives us confidence and enthusiasm for the outdoor business as we continue to grow our Field & Stream and Dick's stores.”

Golf Restructuring

In the second quarter, the company recorded pre-tax charges totaling $20.4 million related to the restructuring of its golf business. These actions were taken to align the cost structure with current and expected trends in golf.

The pre-tax charges include:

- A $14.3 million non-cash impairment of trademarks and store assets used in the company's golf business;

- Severance charges totaling $3.7 million relating to the elimination of specific golf positions from the Dick's stores, and from the combination of Dick's golf and Golf Galaxy corporate and administrative functions; and,

- A $2.4 million write-down of golf-related inventory.

Stack concluded, “We have consolidated our Golf Galaxy merchandising, marketing and store operations into Dick's Sporting Goods. In addition, we have eliminated specific staff in our golf area within our Dick's Sporting Goods stores. These changes are necessitated by the current and expected trends in golf. We will invest these cost savings into other aspects of our store operations and into the growth areas of our business.”

Omni-channel Development

E-commerce penetration for the second quarter of 2014 was 6.3 percent of total sales, compared to 5.6 percent in the second quarter last year.

In the second quarter, the company opened eight new Dick's Sporting Goods stores and one new Field & Stream store. These stores are listed in a table later in the release under the heading “Store Count and Square Footage.” The company also relocated three Dick's Sporting Goods stores during the second quarter. As of August 2, 2014, the company operated 574 Dick's Sporting Goods stores in 46 states, with approximately 30.9 million square feet and 79 Golf Galaxy stores in 29 states, with approximately 1.4 million square feet.

Balance Sheet

The company ended the second quarter of 2014 with $100 million in cash and cash equivalents and no outstanding borrowings under its revolving credit facility. This compares to cash and cash equivalents of approximately $135 million and no outstanding borrowings under its $500 million revolving credit facility at the end of the second quarter of 2013. Over the course of the past twelve months, the company utilized capital to invest in omni-channel growth, including Field & Stream stores, and returned over $360 million to shareholders through share repurchases and quarterly dividends.

Total inventory was 11.2 percent higher at the end of the second quarter of 2014 as compared to the end of the second quarter of 2013. Approximately 2 percent of inventory growth reflects inventory to support Field & Stream, including the seven new stores scheduled to open in the third quarter.

Year-to-Date Results

The company reported consolidated non-GAAP net income for the 26 weeks ended August 2, 2014 of $143.0 million, or $1.17 per diluted share. For the 26 weeks ended August 3, 2013, the company reported consolidated non-GAAP net income of $149.4 million, or $1.19 per diluted share.

On a GAAP basis, the company reported consolidated net income for the 26 weeks ended August 2, 2014 of $139.5 million, or $1.14 per diluted share. For the 26 weeks ended August 3, 2013, on a GAAP basis, the company reported consolidated net income of $149.0 million, or $1.18 per diluted share. The GAAP to non-GAAP reconciliations are included in a table later in the release under the heading “Non-GAAP Net Income and Earnings Per Share Reconciliations.”

Net sales for the 26 weeks ended August 2, 2014 increased 9.2 percent from last year's period to $3.1 billion due to the opening of new stores coupled with a consolidated same store sales increase of 2.4 percent.

Capital Allocation

In the second quarter of 2014, the company repurchased approximately 2.2 million shares of its common stock at an average cost of $44.51 per share, for a total cost of $100.0 million. To date, the company has repurchased $380.6 million of common stock under its $1 billion share repurchase authorization.

On August 14, 2014, the company's Board of Directors authorized and declared a quarterly dividend in the amount of $0.125 per share on the company's Common Stock and Class B Common Stock. The dividend is payable in cash on September 26, 2014 to stockholders of record at the close of business on September 5, 2014.

Current 2014 Outlook

For the second half of 2014, the company is cautiously optimistic although it does expect, due to the cautious consumer, an increase in promotional activity with margins and advertising expense continuing to be under pressure and impacting earnings per diluted share by approximately 4 cents.

Full Year 2014

Based on an estimated 122 million diluted shares outstanding, the company currently anticipates reporting consolidated non-GAAP earnings per diluted share of approximately $2.70 to 2.85, excluding a gain on the sale of an asset and golf restructuring charges. For the 52 weeks ended February 1, 2014, the company reported consolidated earnings per diluted share of $2.69.

Consolidated same store sales are currently expected to increase approximately 1 to 3 percent, compared to a 1.9 percent increase in fiscal 2013.

The company now expects to open approximately 46 new Dick's Sporting Goods stores, relocate five Dick's Sporting Goods stores and remodel five Dick's Sporting Goods stores in 2014. The company also expects to open approximately eight new Field & Stream stores, relocate two Golf Galaxy stores and open one new Golf Galaxy store in 2014.

Third Quarter 2014

Based on an estimated 121 million diluted shares outstanding, the company currently anticipates reporting consolidated earnings per diluted share of approximately $0.38 to 0.42 in the third quarter of 2014, compared to consolidated earnings per diluted share of $0.40 in the third quarter of 2013.

Consolidated same store sales are currently expected to increase approximately 1 to 3 percent in the third quarter of 2014, as compared to a 3.3 percent increase in the third quarter of 2013, adjusted for the shifted retail calendar due to the 53rd week in 2012.

The company expects to open approximately 24 new Dick's Sporting Goods stores, relocate one Dick's Sporting Goods store and remodel five Dick's Sporting Goods stores in the third quarter of 2014. The company also expects to open seven new Field & Stream stores and one new Golf Galaxy store, and relocate one Golf Galaxy store in the third quarter of 2014.

Capital Expenditures

In 2014, the company now anticipates capital expenditures to be approximately $340 million on a gross basis and approximately $245 million on a net basis.