Dick’s Sporting Goods Inc. began 2014 on a weak note due to struggling golf and hunting categories but a more aggressive marketing stance and some merchandising tweaks helped the sporting goods retailing giant close the year with a winning quarter.

Dick’s Sporting Goods Inc. began 2014 on a weak note due to struggling golf and hunting categories but a more aggressive marketing stance and some merchandising tweaks helped the sporting goods retailing giant close the year with a winning quarter.

Highlights

EPS exceeds expectations on better-than-expected top-line growth;

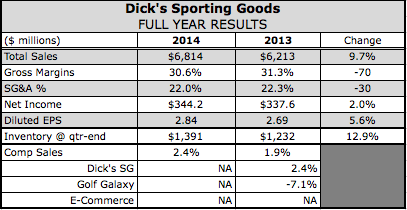

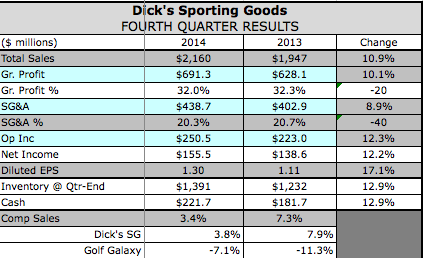

Comps grew 3.4 percent on top of a 7.3 percent gain a year ago. The Dick’s SG chain comps grew 3.8 percent while Golf Galaxy dropped 7.1 percent;

EPS for 2015 expected to climb between 8.0 percent to 11.4 percent on a 1 to 3 percent comp gain but first quarter EPS projected to be flat due to a cold February and early March and West Cost port disruptions.

Fourth-quarter earnings increased 12.2 percent to $155.5 million, or $1.30 a share, topping guidance given on Nov. 18 that called for EPS in the range of $1.18 to $1.28.

Same-store sales, including e-commerce sales, advanced 3.4 percent, also ahead of its guidance of 1 percent to 3 percent. Continued weakness in the golf category and a promotional retail climate overall was offset by effective marketing pushes at the store level and a continued robust e-commerce business.

“These results were driven by the continued growth of our omni-channel network, our powerful marketing and merchandising strategies, and the execution of these strategies by our store associates,” said Ed Stack, chairman and CEO, on a conference call with analysts.

Dick’s SG also issued strong guidance for the coming year although it projected a challenging first quarter due to the extended chilly winter in many parts of the country as well as disruptions due to the West Coast port slowdown.

Total sales in the quarter increased 10.9 percent to approximately $2.2 billion. The comp gain came despite tough comparisons against a 7.3 percent gain in the 2013 fourth quarter.

Its flagship Dick’s SG chain delivered a 3.8 percent comp gain in the quarter, driven by a 3 percent increase in traffic and a 0.8 percent lift in sales per transaction. E-commerce grew to account for 14.4 percent of sales in the quarter compared to 12.2 percent at the same period last year.

HUNT STABILIZING/GOLF STRUGGLES CONTINUE

Stack said the gains were helped by increases in most categories of apparel, footwear, and hard lines.

“The trend in hunting improved significantly during 2014, and by the end of the fourth quarter, the pressures in this category were primarily limited to the guns and related accessory purchases,” added Stack. “The golf trends also showed a slight improvement from the spring of 2014 but were down versus last year.”

Comps at Golf Galaxy dropped 7.1 percent with the Dick’s SG golf business slightly better.

Excluding hunt and golf, comps were up 6 percent for the quarter. Stack said the strong performance across remaining categories “validates our merchandising and space allocation strategies that we have put in place during this past year.” Those included shifting floor space away from golf and fitness to women's apparel and youth apparel categories, as well as expansion in footwear.

Stack said the fourth quarter was a more promotional environment as expected. He added, “Our team was able to navigate this environment and strategically execute clearance promotions while exceeding our top line and bottom line growth targets and ending the year with our inventory in great shape.”

Gross margins were down 25 basis points to 32.0 percent due primarily to a 64-basis point decrease in the merchandise margin due to more aggressive clearance activity. SG&A expenses were reduced 38 basis points to 20.3 percent of sales, primarily because of lower administrative and payroll expenses as a percentage of sales.

Clearance inventories were at historical low levels across most categories and down approximately 230 basis points across the company compared to last year. Added Stack, “Key spring businesses have been set ahead of last year, and we have opened to buy dollars available to chase hot product.”

FIRST QUARTER FACES EARLY CHALLENGES

The start of the spring season, however, has been delayed across much of the country “due to the extreme weather conditions,” said Stack.

Stack also said the company remains “a bit concerned about the West Coast port situation as some of our spring product is still sitting on the docks. As a result, we have taken a cautious view of the rest of the quarter, and our quarterly guidance contemplates the results through February with some expected recovery.”

He described both issues as a “first quarter event” that is not expected to impact its full-year results. Said Stack, “It is also important to note that in those handful of markets where athletes, families, and outdoor enthusiasts are starting to participate in spring related activities, we are seeing positive indicators that we have the right product for them giving us the confidence in our merchandising strategy and our pricing strategy.”

Looking at initiatives for 2015, Stack said the company will continue to invest in its e-commerce and omni-channel infrastructure. E-commerce sales for the year increased approximately 28 percent to over $625 million in 2014. During the year, a new mobile app was launched and efforts were made in its mobile, tablet, and desktop sites to increase conversion. In the first quarter of 2015, the company plans to launch GolfGalaxy.com on a new platform as it moves to bring the Dicks.com e-commerce site in-house in January 2017.

Stack said Dick’s SG will “also drive traffic and strengthen our brand equity through expanded marketing strategies, including our recently announced sponsorship of the United States Olympic Committee and Team USA,” said Stack. “We will also be continuing to scale our Field & Stream business.”

On the merchandising side, Stack was particularly enthused about the launch of CALIA, by Carrie Underwood, a private label fitness apparel line for women to be launched on Mar. 5. Said Stack, “We are very pleased with the feedback we've received from initial focus groups.”

Regarding real estate, the company opened 45 new Dick’s SG stores in 2014 and ended the year with 603 stores in 46 states. New store productivity is a strong 94.7 percent. In 2015, it expects to open up approximately 45 new Dick’s SG locations, relocate nine Dick’s SG stores, and relocate one Golf Galaxy store. It expects to open nine new Field & Stream stores this year. It ended the year with 10 Field & Stream locations as well as 78 Golf Galaxy stores.

For the first quarter, earnings are expected to arrive between 49 cents to 53 cents a share, which compares to earnings of 50 cents a year ago. Gross margins are expected to decline slightly due primarily to planned promotional events to further reduce clearance levels and transition sales from slower moving areas to “more robust categories such as apparel and footwear.” SG&A expenses as a percentage of sales are expected to slightly leverage.

For the full year, EPS is expected to rise to a range of $3.10 to $3.20, representing a gain between 8.0 percent to 11.4 percent versus adjusted 2014 EPS of $2.87 a share. Year-ago earnings were adjusted to exclude a gain on the sale of an asset and golf restructuring charges.

Same-store sales are expected to increase between 1 percent to 3 percent. Gross margin is expected to increase primarily driven by merchandise margin gains. Margins are expected to expand in every quarter except the first. SG&A is expected to deleverage slightly as it invests in its goal of having its e-commerce business become independent in 2017. EPS guidance also includes the expectation of approximately $100 million to $200 million of share repurchases in 2015.

In the Q&A session, Stack said Dicks’ SG will increase its emphasis on in-season opportunistic buys to help drive traffic or feature more value to support, for instance, a grand opening campaign or be used seasonally in certain markets. Stack said, “We're looking at these close outs a lot more aggressively than we've in the past.”

WOMEN’S/KIDS OUTPERFORM IN Q4

Regarding categories, women's and youth comps “certainly outperformed” the overall company comp in the fourth quarter. Women’s apparel is “a terrific category right now” and the launch of CALIA, by Carrie Underwood was designed to create some differentiation in the marketplace. The new line is primarily taking space formerly occupied by Adidas and Reebok.

Footwear comps in the quarter performed about the same as the company’s average, with basketball “trending better” than running.

Stack attributed basketball’s strength to strong innovation from Nike but also a fashion shift toward basketball silhouettes. Stack added, “The running business is still very good and the core people that are out there running, we service them, we've got the right product, that product is pretty good. But the kids have kind of moved to more of a basketball silhouette than a running silhouette for right now.”

Fitness wearables “continued to be very good and we expect it to be very good for the reasonable future,” Stack added.

In golf, average prices are expected to improve due to less clearance inventory in the marketplace. But even in warm weather markets, golf is improving but “still not back to last year's levels.” Stack is hoping new marketing helps spur some demand. He added, “We think that golf is going to be still a drag on the total sales, but not to the same degree that it was last year.”

Stack said weather had a “neutral to negative” impact on the fourth quarter, noting that it was “really warm through those key selling months of November and December.”

Stack said company rerouted products and flown in some product amid the West Coast port slowdown and its first-quarter guidance assumes “the worst case scenario.” The early softness in the first quarter, however, has more due to the weather than the West Coast situation, he noted.

“I was up in Boston last week,” remarked Stack. “There's a boatload of snow up there right now so we've kind of laid all of this out into our guidance. And we don't think it will impact the full year but right now, it’s having a bit of an impact on the first quarter and if it gets better, then we've got some upside to our first quarter.”