Dicks Sporting Goods is feeling the pinch that other full-line sporting goods retailers are feeling these days as most struggle with issues with upper-end hardgoods items and apparel. Fitness has been an issue and now the largest sporting goods retailer in the U.S. is feeling the pain in team sports as well. Offsetting these negative influences are solid performances in athletic footwear and surprisingly — golf.

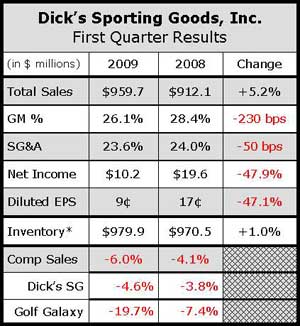

DKS bested analysts and their own projections for the first quarter ended May 2, but the company continues to experience significant softness from its Golf Galaxy business as the consumer pinches pennies in a weak market that has been magnified within the golf spectrum. Overall same-store sales for DKS slipped 6.0%, impacted largely by a 19.7% comp store sales plummet at Golf Galaxy. Comps from the DSG retail stores were down 4.6%, driven in part by a 2.5% decline in transactions and a 2.1% decline in average tickets — effects the company attributed to an overall decrease in consumer spending. Same-store sales for the first quarter excluded the former Chicks Sporting Goods stores.

Management noted that the golf business at the DSG stores significantly outperformed business at Golf Galaxy, but maintained that they expect to improve results at Golf Galaxy following the liquidation of older inventory and the “reassortment” of other business segments. Management expects Golf Galaxy, which was acquired by DKS in February of 2007, to generate EPS of 2 cents as compared to 8 cents a year ago. Management said the work done to-date at GG has focused on merging the back-end with the DKS systems. With that complete, the company now plans to turn its attention to product assortments and marketing. The golf business at the DSG stores was said to have benefited from an strong promotional campaign supported by the vendors, but company Chairman and CEO Ed Stack also called out the new TaylorMade r9 driver as a successful product as well-even with its $399 price tag.

Total company revenues, driven largely by the opening of new stores and the addition of e-commerce sales that were moved over from GSI Commerce, increased 5.2% to $959.5 million from $912.1 million in the year-ago period.

Management noted that a merchandise margin decline of 160 basis points was primarily driven by clearance activity at Golf Galaxy stores, an increase in promotions at DSG stores — which resulted in better-than-anticipated margin dollars — and the planned liquidation at Chicks prior to their conversion to Dicks stores.

Non-GAAP net income decreased to $12.8 million, or 11 cents per diluted share, compared to a net income of $19.6 million, or 17 cents per diluted share, in the year-ago period. Earnings include a $1.1 million successful resolution of a tax audit from a prior fiscal year.

In the conference call with analysts, DKS management said that while apparel and golf were soft for the quarter, the hunting and outdoor category was “very strong.” Likewise, athletic footwear comped positive and performed “reasonably well” due to boosts from the Under Armour running shoe and strong offerings from Nike and Asics.

Management said weakness in the team sports business came as a result of the consumer postponing purchases longer than anticipated.

Regarding the golf business, management noted that the company has not replaced primary brands with private label or private brands as some have asserted, but confirmed that some secondary vendors (Wilson and Spalding, among others) have been replaced. “We are going to make a bit of a move to more branded product and a bit less private product,” said Stack. He assured analysts that primary brands, which include Taylor-Made, Callaway, and Titleist, among others, would not be replaced by private labels.

Regarding the golf business, management noted that the company has not replaced primary brands with private label or private brands as some have asserted, but confirmed that some secondary vendors (Wilson and Spalding, among others) have been replaced. “We are going to make a bit of a move to more branded product and a bit less private product,” said Stack. He assured analysts that primary brands, which include Taylor-Made, Callaway, and Titleist, among others, would not be replaced by private labels.

Regarding outlook, management raised the low-end of its annual guidance and increased the expected same-store sales for the remainder of fiscal 2009. Consolidated EPS is expected to be in the range of 88 cents to $1 excluding merger and integration costs as compared to the original guidance of between 80 cents and $1 for the year. Comps are expected to decrease approximately between 9% and 6% for the year. For the second fiscal quarter, consolidated EPS is expected to be approximately 28 cents to 31 cents, excluding merger and integration costs. Comps are expected to decline to the range of 9% to 6% for the period.

DKS anticipates reducing operating costs by $40 to $50 million in 2009, with the savings coming from reduced costs from payroll, advertising, and pre-opening expenses during the second and third quarters. Net CAPEX is expected to decline approximately $60 million, or $100 million on a gross basis. The expected decline is driven by the opening of fewer stores in 2009, by the completion of a new distribution center, and by “managing capital spend more tightly in this tough economic environment.”

DKS opened ten stores in the first quarter of 2009, including nine Dicks Sporting Goods locations and one Golf Galaxy location. This brings total stores to 394 at quarter-end. Management confirmed that the company has converted the remaining Chicks Sporting Goods stores to Dicks Sporting Goods stores in May and had closed two other stores. DKS acquired Covina, CA-based Chicks Sporting Goods in 2007.

Management added that the company is planning to open approximately 20 new Dicks Sporting Goods stores, relocate one DSG store, add one Golf Galaxy, convert the Golf Shop to a Golf Galaxy and close two Chicks stores in fiscal 2009. They see opening fewer stories in 2010 than in 2009, but do expect to take advantage of real estate opening in markets where Joes and Sportsmans Warehouse have closed.