Designer Brands Inc, formerly DSW Inc., raised its full-year guidance after reporting adjusted earnings in the first quarter ended May 4 rose 10.3 percent increase on a 23.4 percent revenue gain. Comparable sales increased 3.0 percent following a 2.2 percent increase in the first quarter of fiscal 2018.

Roger Rawlins , CEO, stated, “We had a strong start to the year, delivering double-digit increases in both revenue and earnings as we start to demonstrate the power of an integrated global Designer Brands Inc. The quarter saw strength across the board – with growth in key operating metrics, segments, and geographies. In fact, our DSW banner, the Shoe company banner and Camuto Group all performed at or above our expectations, with the U.S. Retail and ABG segments delivering positive comparable sales. Under Designer Brands’ leadership, our Canada business turned a first-quarter profit for the first time in its past five years and we are ahead of schedule in integrating the newly acquired Camuto Group. The infrastructure we have created combined with the talent of our teams have elevated our operating model giving us the platform to accelerate market share growth in North America. We expect to build upon our progress throughout the year and remain excited about our business and increased ability to generate long term value for our DBI shareholders.”

First Quarter Operating Results

- Total revenue increased by 23.4 percent to $878.5 million, including $51.8 million from the consolidation of the Canada Retail segment and $94.0 million from the Brand Portfolio segment.

- Comparable sales increased 3.0 percent for first quarter of fiscal 2019 following a 2.2 percent increase in the first quarter of fiscal 2018.

- Reported gross profit, as a percent of sales, increased by 50 bps due to margin expansion in the U.S. Retail segment and the impact of the exit of Ebuys during the previous year, partially offset by lower margins from the wholesale business of the Brand Portfolio segment.

- Reported operating expenses, as a percent of revenue, increased by 180 bps, driven by the impact of the acquired businesses.

- Reported net income was $31.2 million, or $0.40 per diluted share, including pre-tax charges totaling $3.2 million, or $0.03 per diluted share, from integration and restructuring expenses, amortization of intangible assets and foreign currency transaction losses.

- Adjusted net income was $33.6 million, or $0.43 per diluted share, a 10.3 percent increase from the first quarter of fiscal 2018.

Balance Sheet Highlights

- Cash and investments totaled $121.9 million compared to $268.9 million at the end of the first quarter last year, and debt totaled $235.0 million compared to no debt outstanding at the end of the first quarter last year, reflecting the funding of the two acquisitions in fiscal 2018 and share repurchase activity.

- The company ended the quarter with inventories of $642.0 million compared to $539.7 million last year. Excluding inventories from the acquisitions, inventories per square foot decreased 3.6 percent year over year.

- For the first quarter of fiscal 2019, the company repurchased 3.4 million shares for a total of $75.0 million with $401.6 million remaining under its share repurchase program.

Regular Dividend

The company’s Board of Directors declared a quarterly cash dividend of $0.25 per share. The dividend will be paid on July 5, 2019 to shareholders of record at the close of business on June 19, 2019.

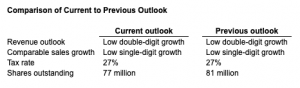

Fiscal 2019 Annual Outlook

The company raised its full year outlook for Adjusted EPS in the range of $1.87 to $1.97 per diluted share, compared to its previous range of $1.80 to $1.90 per diluted share.