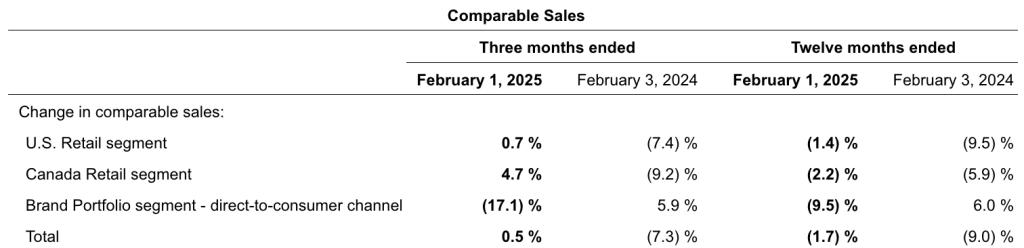

Designer Brands Inc. (DBI) CEO Doug Howe said positive comparable sales in the fourth quarter reflected a return to growth for the first time in nine quarters, highlighting the success of strategic initiatives throughout the year.

The company is the parent company of the DSW, The Shoe Co., and Rubino retail brands, and owner of the Topo Athletic, Keds, Le Tigre, Hush Puppies, and other footwear brands, still fell short of Wall Street’s expectations for the 2024 fiscal fourth quarter ended February 1 as total sales fell 5.5 percent year-over-year, due in part to the 53rd week in the prior fiscal year, and GAAP net loss came in 66.7 percent below analysts’ consensus estimates.

Still, Wall Street apparently liked what it heard on the company’s conference call with analysts as DBI shares increased more than 6 percent in mid-day trading activity on Thursday, March 20.

“As I reflect upon our performance this year, the improvement we saw was a direct result of our commitment to executing on those initiatives within our control,” offered Howe. “This included decisive actions to refresh our leadership team, revitalize and modernize our assortment, optimize our marketing, right size our Brand Portfolio organization and continuously improve our customers omni-channel experience.”

The CEO said DSW ended 2024 with a more relevant and balanced assortment that includes more athleisure than ever before, which he shared had increased penetration by five percentage points while grabbing market share.

“We also rekindled and expanded our relationship with our top brand partners, deepening the number of styles offered with key brands to build an eye catching in-store and online selection,” he added. “Our top eight brands remain a primary driver of positive performance with sales of those brands up 25 percent on a full year basis.”

Fiscal Fourth Quarter Summary

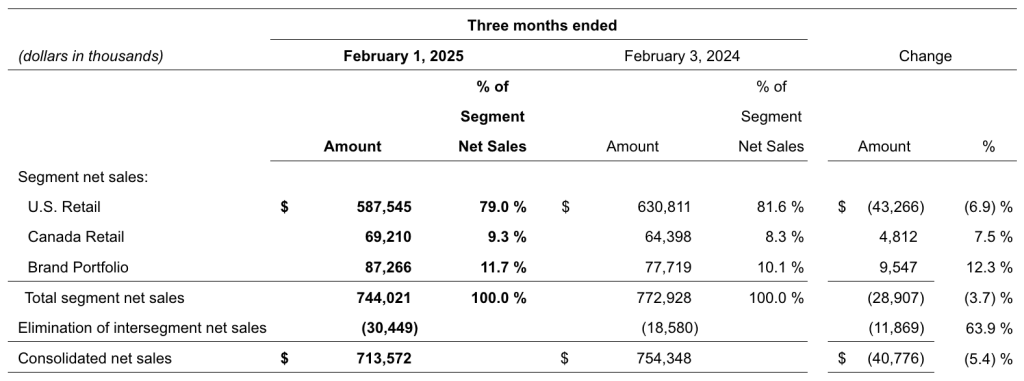

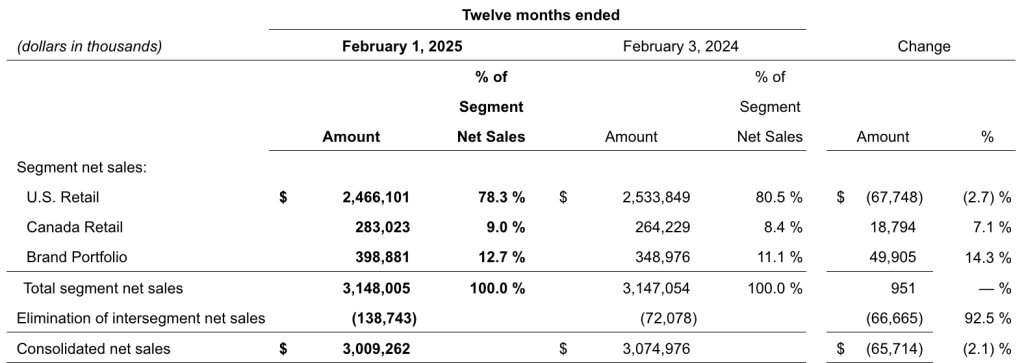

Total net sales for the fourth quarter of fiscal 2024 amounted to $714 million, up 0.5 percent on a 13-week comparative basis. Due to the 14th week in the fourth quarter of 2023, net sales were down 5.4 percent versus the prior-year Q4 period, as reported.

Company CFO Jared Poff reminded the call participants that DBI changed its financial statement presentation related to expenses associated with distribution and fulfillment and store occupancy for the U.S. Retail and Canada Retail segments. These expenses were previously included within cost of sales and are now included within operating expenses in order to present all of operating segments on a consistent basis.

“We also changed the presentation of segment performance by including an operating profit measurement in addition to the previously reported gross margin measurement for our reportable segments,” Poff added. “We have restated quarterly and annual historical results to be on a comparable basis and our remarks will be based on this restated basis.”

U.S. Retail Segment

In U.S. Retail, comp sales for the fourth quarter were up 0.7 percent, reflecting a return to positive comps for the first time since the third quarter of 2022. Howe said this was driven by strength in athletic, women’s dress and luxury, accessories and kids. Poff said the company saw positive comps across the majority of its footwear categories with the strongest performance in kids’, athletic, accessories, namely socks, and women’s dress shoes.

“According to Circana data, DSW sales growth versus last year outpaced the footwear market in the fourth quarter, resulting in a 10 basis-point gain of footwear market share versus last year for DSW,” Howe noted. “Sales for the quarter were down 7 percent, primarily due to the impact of the 53rd week last year.”

Canada Retail Segment

In Canada, fourth quarter comps were up 4.7 percent, reportedly driven by strong performance in most categories led by the athletic and kids’ categories and the reintroduction of Nike women’s casual. Dress and boots also delivered for the quarter as the retailer became more promotional in the quarter to help clear through seasonal product.

Total net sales were up over 7 percent versus the prior-year Q4 period.

Brand Portfolio Segment

Brand Portfolio segment net sales were up 12.3 percent in the fourth quarter.

“Within our Brand Portfolio organization, we remain focused on cost reduction, brand optimization, higher product margins and improved SKU productivity through streamlined operations. I’m pleased to share that we successfully delivered on these goals, driving top line growth and margin expansion,” Howe shared.

“As a reminder, starting in fiscal 2024 we have “harmonized” our approach to how we transact business between our brand portfolio segment and our retail segments,” Poff noted. “This change resulted in approximately $21 million of year-over-year additional sales for our Brand [Portfolio] segment in the fourth quarter that were eliminated in consolidation.”

The Brand Portfolio segment also reportedly benefited from notable sales growth in Topo Athletic, which was up 57 percent versus Q4 2023, driven by both the Wholesale and DTC channels.

“On the product side, we are excited to have seen continued growth in Topo Athletic and Jessica Simpson. Both brands have been significantly outperforming expectations throughout the year,” added Howe.

Howe said they have outlined a number of ways they expect to deliver growth in the Brand Portfolio segment, notably re-establishing private label brands as margin drivers and building a more profitable wholesale business which includes investing in core names like Keds and Topo Athletic to drive top-line revenue.

“Our private label brands are those only sold at DSW including Kelly & Katie, Mix No. 6 and Crown Vintage,” How explained. “All have a position of strength within key DSW women’s categories and we plan to leverage these strengths to grow our top line and drive margins for the business. Given our control over the design and production of these brands, we deliver over 1500 basis points of incremental margin rate above our national brands which drives our overall margin.”

Private label brands currently penetrate at less than 20 percent of DSW sales and Howe said he believes this has the opportunity to expand in the future.

“We plan to continue to invest in fueling growth in our Topo Athletic and Keds brands,” he suggested. “Both brands are uniquely positioned within the portfolio, have compelling heritage and are situated in growing categories. They already have access to excellent distribution and are delivering strong operational income contribution to the segment.”

He said that at Topo specifically, DBI remains energized by the outsized growth potential the brand represents today.

“Today, Topo represents over 10 percent of our total Brand Portfolio sales and grew over 70 percent in 2024,” Howe said. “We anticipate another year of growth in 2025 driven by a strategic approach to distribution within the core specialty running area, strong product launches and increasing investment in marketing to establish key franchise items, drive volume and overall build a brand with a strong reputation.”

Howe said the strategy to reposition the Keds brand for growth in 2025 is critical to building a healthy and sustainable brand.

“We will work to reposition ourselves in the comfort casual category, target the Gen X and above customer who already know and trust the brand, and add new technology infused at leisure offerings,” he added. “We are seeing positive results from this evolved product already and are excited about expanding this approach in 2025. We believe that we will see double-digit growth over time with gross margin improvement as well.”

Income Statement Summary

Consolidated gross profit was 39.6 percent of sales in the fourth quarter, an 80 basis-point improvement year-over-year.

The increase was said to be primarily driven by the U.S. Retail segment with less promotional offers as well as decreased DTC shipping associated with lower rates and an improvement in packages per order.

Adjusted operating expense was 43.5 percent of sales in Q4, a 40 basis-point deleverage from the 2023 fourth quarter.

“Although operating expense was down from last year, the deleverage was mostly driven by the inclusion of the 53rd week of sales last year against a partial fixed cost base,” Poff noted.

Th Adjusted operating loss was $23.5 million in Q4, compared to an operating loss of $30.2 million in the prior-year Q4 period, inclusive of the 14th week, which included $6.6 million of additional operating income. It was the second consecutive quarterly year-over-year improvement.

The effective tax rate in the fourth quarter on Adjusted results was 38.6 percent compared to 37 percent in Q4 2023.

The fourth quarter Adjusted net loss was $21.3 million in 2024, compared to $25.3 million in 2023, or a loss of 44 cents in diluted earnings per share for both years.

Fiscal Full-Year Net Sales

Liquidity

Cash and cash equivalents totaled $44.8 million at the end of 2024, compared to $49.2 million at the end of 2023, with $127.3 million available for borrowings under the company’s senior secured asset-based revolving credit facility.

Debt totaled $491.0 million at the end of 2024 compared to $427.1 million at the end of 2023.

Net cash provided by operating activities was $82.2 million for 2024 compared to $162.4 million last year.

Inventories totaled $599.8 million at the end of 2024, compared to $571.3 million at the end of 2023.

Poff said total inventories were up 5 percent versus the prior year as the company continues to emphasize a clean inventory position and prioritize placement of the newest product.

“We feel good about our inventory levels heading into the new fiscal year and our flexibility to continue to chase and take actions on opportunistic buys,” Poff commented.

Return to Shareholders

In fiscal 2024, DBI returned $79 million to shareholders through a combination of dividends and share repurchases.

During 2024, the company repurchased an aggregate 10.3 million Class A common shares at an aggregate cost of $68.6 million.

As of February 1, 2025, $19.7 million of Class A common shares remained available for future repurchase under the share repurchase program.

DBI paid $10.5 million in dividends for 2024.

A dividend of 5 cents per share of Class A and Class B common shares will be paid on April 11, 2025 to shareholders of record at the close of business on March 28, 2025.

- Cash and cash equivalents totaled $44.8 million at the end of 2024, compared to $49.2 million at the end of 2023, with $127.3 million available for borrowings under our senior secured asset-based revolving credit facility. Debt totaled $491.0 million at the end of 2024 compared to $427.1 million at the end of 2023.

- Net cash provided by operating activities was $82.2 million for 2024 compared to $162.4 million last year.

- Inventories totaled $599.8 million at the end of 2024, compared to $571.3 million at the end of 2023.

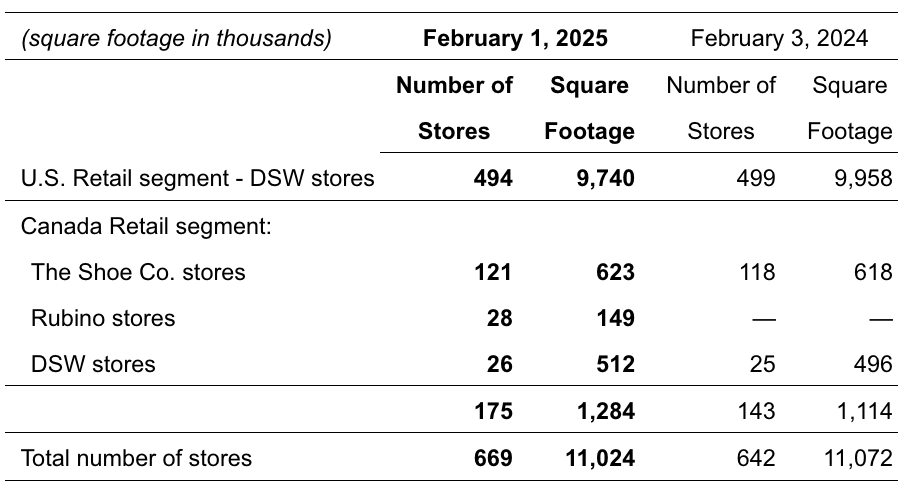

Store Count

During the fourth quarter of 2024, the company closed two stores in the U.S. and closed four stores in Canada, resulting in a total of 494 stores in the U.S. and 175 stores in Canada at year-end.

2025 Outlook and Vision

“As we move forward in 2025, we believe our ongoing business transformation will drive continued stabilization and improvement of sales and profitability, with expectations to significantly increase our adjusted EPS compared to 2024 results,” Howe said. “Additionally, we intend to continue evolving our approach to promotions and discounts to help serve customers searching for value.”

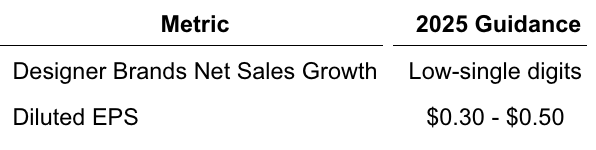

2025 Guidance

“For the U.S. Retail segment in 2025 we expect net sales growth in the low-single digits versus last year. We also expect comparable sales to be up low single digits. The comp growth is expected to be driven by our focus on improving our inventory availability, productivity and assortment strategy as well as optimizing marketing to drive DSW awareness,” Poff detailed.

“In our Canada Retail segment for 2025, we expect a mid to high single digit growth versus last year,” he continued. “The majority of this increase is expected through the addition of Rubino, modest comp growth driven by web enhancements and strategic initiatives to grow our base business.”

The CFO said they anticipate 2025 sales in the Brand Portfolio segment will increase mid-single digits driven by strong growth in Topo Athletic, Keds, Jessica and a return to growth of the private label brands at DSW.

Howe said the semiannual sale will continue to evolve as it becomes a more important promotional event to DSW.

“We will also continue to evolve our omni-channel customer experience in ways that are intended to drive both value for consumers and improve financial results,” he added. “We will continue to enhance our in-store selection and displays, a key differentiator when it comes to the in-person shopping experience that drives over 70 percent of our sales. In addition, we are rolling out simple tech enabled shoe fitting services and post purchase protective shoe cleaning which we believe will provide points of differentiation for our brand and incremental margin in 2025.”

DBI will add DSW net new stores to its fleet for the first time since 2019, expanding access to product and aligning with population migration.

“We are rationalizing unproductive product which will allow us to amplify our investments in key items and top selling products,” Howe continued. “We are also optimizing our inventory allocation and digital order management to improve product availability across our network. We expect these enhancements to directly drive increases to in stock rates, improve conversion on store traffic and lower fulfillment costs for digital orders. These efficiencies are expected to build over the course of the year.”

In delivering 2025 guidance, Howe said that while DBI does not expect a material impact on its business from currently anticipated tariff policies, they have seen consumers being more cautious starting in the back half of January as a result of ongoing inflation, rising prices and less discretionary income.

“This was a marked change from the trends we were seeing exiting December and we recognize that uncertainty remains as they continue to be selective with their discretionary income. As such, we are leaning into initiatives to drive demand and value, he said.

“On balance, we expect to post positive comps for the full year as well as meaningful operating income growth for the year. We anticipate quarterly performance will improve gradually as we move through the year,” Howe concluded.

“As Doug mentioned, our guidance incorporates continued macro uncertainty that may impact our consumers spending habits,” Poff added. “On a consolidated basis, we expect sales to be up low-single digits for the year. The mid-point of our guidance suggests a nice improvement compared to 2024, but given the soft start to the year, we do anticipate first quarter performance to be below last year.”

He said DBI expects performance will gradually improve as they move through the year.

Image courtesy DSW/Designer Brands Inc.