Delta Apparel, Inc. sacked its president and chief operating officer last week as part of a comprehensive restructuring triggered by its first decline in year-over-year sales in more than a decade.

Delta Apparel, Inc. sacked its president and chief operating officer last week as part of a comprehensive restructuring triggered by its first decline in year-over-year sales in more than a decade.

DLA Chairman and CEO Robert W. Humphreys said he was in the process of eliminating positions throughout the company to remove layers from its management structure and was evaluating ways to reduce manufacturing costs and capacity in response to diminished demand for its cotton basics, which include both T-shirt blanks and branded apparel such as Soffe’s shorts and Junk Food graphic tees.

“Historically, our broad customer base across most channels of distribution has allowed us to continue to grow even in periods of weak retail demand,” said Humphreys, who took back day-to-day operations from departed President and COO Steven Cochran July 28. “That has not proved to be true over the past 12 months, where we have experienced a decline in sales for the first time in more than a decade.”

While acknowledging challenging conditions, DLA competitor Hanes Brands International reported an 8.0 percent increase in Activewear sales in the second quarter driven by strong performance by its Champion brand and double-digit growth in its branded print wear and Gear for Sports business. At Gildan Activewear, Printwear and Branded Apparel sales increased 11.6 and 16 percent respectively during the quarter.

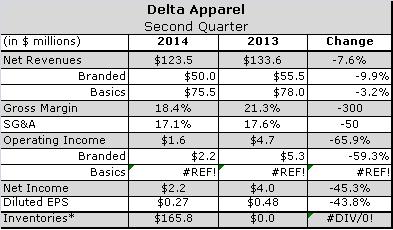

DLA reported earnings fell 45 percent in the third quarter ended June 28 on a 7.6 percent decline in revenue. Delta said net sales were off $22.4 million, or 6.7 percent for the nine months ended June 30, during which it produced a net loss of $195,000, or 2 cents per diluted share, compared with net income of $5.6 million, or 67 cents in the prior year period.

The company said a 5.8 percent decline in sales at its Basics segment were driven primarily by the expiration of a licensing program with a private-label customer. Sales to its core private-label customers increased during the quarter, but not enough to offset the decline of the one licensed program. Unit sales were flat, but weak demand and healthy supply encouraged price shopping, driving down wholesale prices for undecorated T-shirts. Lower prices and higher cotton and other input costs further compresses margins, particularly for blanks. Cotton prices alone trimmed quarterly earnings by 12 cents compared to the second quarter of last year and will continue to flow through until the back half of 2015.

Sales at the company’s branded segment, declined by $5.5 million, or 9.9 percent to $50.0 million. Salt Life and Art Gun continued double-digit sales growth during the quarter, but could not offset declines at Soffe and Junk Food.

Sales of Salt Life branded products increased 16 percent over the prior-year quarter and were up 24 percent year to date driven by the brand’s new performance line. Strong growth at department stores and active lifestyle retail chains offset declines in sales to independent retailers in beach and resort destinations, where retail traffic appeared to diminish compared with a year ago.

Sales of Salt Life branded products increased 16 percent over the prior-year quarter and were up 24 percent year to date driven by the brand’s new performance line. Strong growth at department stores and active lifestyle retail chains offset declines in sales to independent retailers in beach and resort destinations, where retail traffic appeared to diminish compared with a year ago.

At Art Gun, which enables consumers to order customer graphic tees online, sales grew nearly 25 percent. At graphic tees maker Junk Food, sales fell 20 percent despite strong growth at boutiques and specialty retailers due to tumult at one of its large retail customers. Soffe sales were not as strong as anticipated, despite returned placements at certain major mid-tier retailers.

“Business remains challenging with better department stores and, to a certain extent, with sporting-goods retailers,” DLA VP and CFO Deb Merrill said of Soffe. “Order deferrals by customers across sales channels also hurt revenue during the quarter, resulting in an overall sales decline at Soffe of about 10 percent in the third fiscal quarter.”

Lower sales accounted for 200 basis points of the 270 bps decline in DLA operating margins, which fell to 0.8 percent in the quarter compared with 3.5 percent a year earlier. Humphreys said the company should be able to reach operating margins in the mid- to high-single digits.

DLA announced it will reorganize its administrative structure at all levels to streamline decision-making and information flow as well as reduce duplicative and excess fixed costs. In addition, the company is currently evaluating how its manufacturing operations in the United States, El Salvador, Honduras and Mexico to see how it can lower product cost and reduce capacity on certain product lines. The effort will include a comprehensive rationalization of all business units, product lines and sales channels.

“We have invested in a number of new product lines and distribution channels over the past several years,” said Humphreys. “Some, such as Art Gun and Salt Life, have become our current growth engines and have strong profit potential. Others have not met our expectations and may be reduced or eliminated, with the capital currently associated with these initiatives redirected to areas where we can achieve a superior return.”

As an example, Humphreys announced DLA had terminated a contract with a third-party logistics provider it had hired to handle distribution of Delta tees in Canada. It will now serve Canadian customers from a U.S. distribution facility at an annual costs savings of $500,000.

This administrative reorganization is expected to result in approximately $7 million in annualized savings, with about $5 million recognized in fiscal year 2015. DLA expects to incur approximately $2.5 million in severance-related expenses, with the majority being expensed in the 2014 fourth fiscal quarter.

“As a part of this, our president and chief operating officer has resigned from the company,” said Humphreys. “I have assumed those duties and have returned to the role of overseeing the day-to-day operations of our business.”

Humphreys said weak market conditions and a sluggish economy are hurting many apparel retailers and small to mid-sized brands across most sales channels and tiers of distribution.

Humphreys said weak market conditions and a sluggish economy are hurting many apparel retailers and small to mid-sized brands across most sales channels and tiers of distribution.

“This pervasive weakness is an unusual condition we have not seen in recent history, and there is no certainty when there will be a reversal of these trends,” he said. “As such, it is imperative that we adjust the fixed cost structure within Delta Apparel to give us the ability to operate profitably in the current retail environment.”