Nautilus Inc. reported strong sales of its newest products and a higher mix of Retail revenues resulted in positive operating income in the usually unprofitable second quarter ended June 30.

Nautilus Inc. reported strong sales of its newest products and a higher mix of Retail revenues resulted in positive operating income in the usually unprofitable second quarter ended June 30.

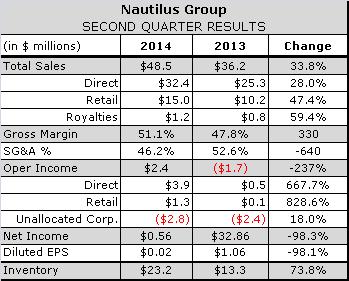

The maker of exercise equipment reported net sales increased $12.3 million, or 33.8 percent to $48.5 million in the second quarter ended June 30, compared with the same quarter of 2013. The strong growth was driven by higher sales at both its Direct and Retail segments during what is typically its slowest quarter of the year.

In Direct, sales grew by $7.1 million, or 28 percent primarily driven by sales of the Bowflex MAX Trainer product line that was launched in the first quarter of this year. This growth was partially offset by the continued decline of strength products, which are shifting into the Retail segment. NLS COO Bill McMahon said the company caught up on its backlog of Max Trainer orders late in the second quarter.

In Retail, sales grew 4.8 million, or 47.4 percent thanks to strong retailer and consumer acceptance of new cardio products, including a line of Schwinn branded exercise bikes and elliptical machines launched in Fall 2013 and the TreadClimber. The growth was somewhat inflated by muted sales in a year earlier, when retailers deferred purchases in anticipation of the Schwinn cardio launch.

Gross margin improved 330 basis points to 51.1 percent. That broke out to an increase of 490 basis points in the retail segment, and 410 basis points in the direct segment, where gross margins reached 24.4 percent and 61.7 percent respectively in the second quarter. NLS CO Sid Nayar said those margins should be sustainable long term.

The higher sales and improved margins enabled NLS to boost spending and still reduce SG&A expenses as a percentage of sales by a whopping 640 basis points to 46.2 percent during the quarter. Increased spending on fees to register and enforce intellectual property rights contributed to a $5.2 million, or 10.2 percent, increase in general and administrative expenses. The company also boosted R&D spending by $1.3 million, or 54 percent, to $3.7 million. Still, the higher sales reduced SG&A expenses to 46.2 percent of net sales, compared with 52.6 percent in the second quarter last year.

Operating income swung to $2.4 million, or 4.9 percent of net sales, from a loss of $1.7 million a year earlier. Net income reached $600,000, or 2 cents per diluted share, including a loss of $900,000 from discontinued operations. That compares with net income of $32.9 million, or $1.05 per diluted share in the year ago quarter, including $200,000 from discontinued operations and an income tax benefit of $34.3 million, or $1.09 per diluted share. Net income from continuing operations reached $1.5 million, or 5 cents per diluted share compared with $32.7 million, or $1.04 per diluted share in the second quarter of 2013.

NLS ended the quarter with inventory valued at $23.2 million, up 73.8 percent from a year earlier.

“Our current inventory level is intentionally elevated to support several business factors, including the launch of our new second US distribution center, which will occur in the third quarter, along with some buy ahead of certain key, high velocity retail products in anticipation of a supplier factory move,” McMahon explained.

While NLS does not provide quarterly or annual guidance, executives said sales growth will slow substantially in the back half as comps become very challenging. Sales at NLS Retail segment have grown on average 49 percent over the last four quarters, but will slow dramatically in the third quarter as it comps against 70 percent growth achieved in the third quarter of 2013, when the Schwinn line began shipping. NLS expects sales to grow overall in the back half, but at more modest rates, thanks to fourth quarter launches of its next line of Nautilus-branded cardio machines and the first upgrade to its Bowflex 560 dumbbells in six years. The upgrade will include ‘3DT technology,’ which enables users to track reps and weight use and download coaching videos.

“We feel like this has to become a fundamental part of our business going forward,” said McMahon. “Most products we launch will have some element of digital in them, whether it's an app or actual integration in the product that elevates our game from where it was in the previous line of products.”

Additionally, a new distribution center in Columbus, OH coming on line in the third quarter will cut U.S. fulfillment times from 10 to less than five days. Finally, higher consumer financing approval rates and lower media costs should allow the company to generate more and close more sales, McMahon said.