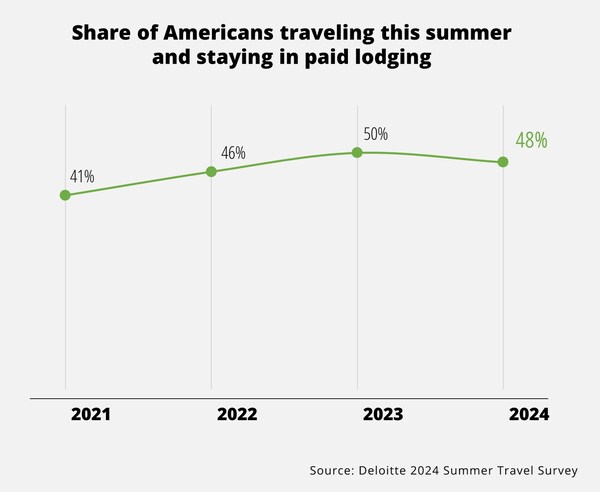

According to the Deloitte 2024 Summer Travel Survey, Americans plan to travel and stay in paid lodging this summer. Key takeaways include the following:

- Amid rising prices, Americans still value their travel plans, as 48 percent of those surveyed plan to travel and stay in paid lodging, on par with last year, but take fewer vacations this summer.

- Higher prices are raising budgets, as 1-in-5 of those surveyed said they will spend significantly more on their 2024 travels than last year.

- Air travel soars at home and abroad as 52 percent of all summer travelers surveyed plan to fly domestically, and 22 percent plan to fly internationally.

- Summer traveler demographics are shifting as a larger share of higher-income and older travelers has a significant impact on travel budgets.

- Workplace flexibility and remote work continue to drive travel plans, as 21 percent of those surveyed plan to work during, and for more of, their most extended trip this summer.

According to the Deloitte 2024 Summer Travel Survey, 48% of Americans surveyed plan to travel and stay in paid lodging this summer.

Why This Matters

Perceptions of rising costs and other economic pressures are likely leading some Americans to reconsider how they travel. While some feel priced out of travel, those taking trips remain determined to maximize their travel experiences. In its new report, “Vacations Pass the Value Test: 2024 Deloitte Summer Travel Survey,” Deloitte examines the trends and preferences that could shape the upcoming summer travel season.

Vacations Pass The Value Test Despite Pricing Pressures

While economic pressures may have some reconsidering the frequency and duration of their trips, most remain committed to traveling this summer. In addition, many Americans are reevaluating what travel means to them, putting more emphasis on rest and reconnection, and seeking opportunities to make the most of their trip experiences.

- Six in 10 Americans surveyed plan to travel this summer, and 48 percent plan to stay in paid lodging, down from 50 percent in 2023.

- Americans plan to travel like 2022, taking 2.3 trips this summer, down from 3.1 in 2023 but on par with 2022.

- For those traveling, nearly 1-in-5, or 19 percent, said they will spend significantly more on their 2024 travels, mainly due to rising prices and travelers taking more ambitious trips.

- More higher-income travelers are driving up average travel budgets. The rise in higher-income travelers has increased the budget for travelers’ most extended trips by 18 percent. Households with income over $100,000 represented 35 percent of travelers in summer 2023. In 2024, they represent 44 percent.

- Many are determining budgets based on their overall financial situation. Travelers who feel their finances have improved in the last year will spend $528 more than the average traveler on their most extended trip, compared to those who think it has worsened, who will pay $855 less.

- Two-thirds of Boomers are traveling this summer but plan to spend more conservatively on their most extended trip, primarily to allow for more yearly trips.

- Price is causing some to reconsider travel altogether. One-third (32 percent) of non-travelers are planning to stay home due to the current costs of travel, up eight percentage points from 2023.

- Rest (53 percent) and romance (35 percent) surge as travel motivators, while travel planning for a specific event is up five percentage points year-over-year. Though travel motivators do not typically shift much, they have been relatively inconsistent in recent years, indicating Americans could be rethinking travel’s role in their lives.

- Similar to last year, many travelers plan to engage in in-destination travel experiences, such as an adventure or outdoor activity (49 percent), visiting a major attraction (48 percent) or taking a guided tour (34 percent). Interest in ticketed events like festivals or concerts continues to climb, as nearly 3-in-10 (28 percent) said they will do so.

Travel Products Pack a Balance Between Experience and Cost

Travelers are willing to pay for an enhanced vacation experience this summer but are considering alternative lodging and transportation and new travel locations to stretch their budgets. Non-hotel lodging could see a bump in demand while international travel intent remains consistent, though the destination mix is shifting.

- Hotels still account for a majority of summer travel bookings but are down. Sixty-three percent of paid lodging travelers only stay at hotels on their marquee trip, down 10 percentage points from 2023. At the same time, more travelers are exploring alternative lodging: 23 percent plan to stay in private rentals, and those planning to stay in other places such as bed and breakfasts (B&Bs) or recreational vehicles (RVs) are up 8 percent from 2023 to 14 percent.

- Six in 10 paid lodging travelers who are flying will take a domestic flight (62 percent) for their marquee trip, and 38 percent will take an international flight.

- After a rush to Europe last year, international travelers are diversifying destinations for their season’s longest trip. Intent to travel to Asia has seen the most significant leap, up three percentage points from 2023.

- Forty-three percent of air travelers are willing to pay for more comfortable flight experiences, such as upgraded seats, up from 39 percent in 2023.

- More Americans plan to hit the road for their marquee trips this year (66 percent compared to 56 percent in 2023), with nearly half driving to save money and 42 percent said it is because they are traveling to a closer destination.

“Despite many Americans feeling financial turbulence, travelers continue to place a premium on experiences, and intent to travel is similar to last summer. There is a perception that airfares and room rates are high, and some Americans are sitting out travel this summer as they look for softer pricing, showing signs they are hungry for deals and being intentional about pursuing experiences they perceive as special enough to be worth the higher spend. As travelers look to pack the most value into their summer trips, providers have an opportunity to balance quality and cost to provide unforgettable moments for those who are looking to make the most of their travels this summer,” said Mike Daher, vice chair, Deloitte LLP and U.S. transportation, hospitality and services non-attest leader.

Travelers Navigate New Tools For Planning

Americans leverage new tools to uncover deals as they plan their summer excursions.

- While more said they plan to book their lodging directly, intent to book through online travel agencies (OTAs) is up (20 percent versus 16 percent in 2023), primarily driven by younger, higher-income travelers.

- Only one-third (35 percent) of this year’s summer trips were fully booked as of March.

- Younger travelers (44 percent of Gen Z and one-third of Millennials) are leaning into short videos to find activities to fill their vacation itineraries. Of them, Millennials are more likely to do so to find restaurants (61 percent).

- The use of GenAI in travel planning has slowed, with minimal gains. One in 10 plan to use GenAI in trip planning, compared to 8 percent during the 2023 holiday season.

Laptop Luggers Bring More Work Along

The flexibility of remote work, perhaps the pandemic’s most lasting impact on the travel industry, continues to show its effects as more “laptop luggers” plan to work more often during their summer trips.

- One in 5 (21 percent) travelers plan to work on their most extended trip this summer, up slightly from last year, but more said they will work throughout the entire trip rather than just part of it.

- Laptop luggers continue to extend their travel plans due to the flexibility to work remotely. They expect to expand their seasonal travel by nine days and their longest trip by four days.

- Those who plan to work on their trips are also more likely to have higher budgets than disconnectors ($4,157 compared to $3,259).

- Laptop luggers consider several key elements when making travel plans: availability of stable internet, good food near their accommodations, and refundable activity bookings.

“Workplace flexibility continues to fuel travel decisions for laptop luggers and opportunities for providers. While financial concerns are keeping some Americans grounded, a delay in booking provides an opportunity for travel suppliers to double-down on offerings that maximize value and lure additional travelers to destinations near and far,” said Eileen Crowley,

vice chair, Deloitte LLP, and U.S. transportation, hospitality and services attest leader

Methodology

Deloitte’s “2024 Summer Travel Survey” is based on a survey of 4,022 Americans fielded between March 20 and April 2, 2024. Of these, 2,348 qualified as travelers, and a smaller subset of 1,936 travelers who said they would stay in paid lodging rather than only with family or friends, completed the longest version of the survey.

Deloitte provides audit, consulting, tax, and advisory services to nearly 90 percent of the Fortune 500 companies and over 8,500 U.S.-based private companies.

Image courtesy Living Greenwich, graph courtesy Deloitte