Shares of Deckers Brands cratered last week after the company missed its earnings guidance in its third quarter ended Dec. 31 and forecast a loss in its fourth quarter. On Friday following the earnings release Thursday night, shares tumbled $16.22 to $66.05, or 19.7 percent, in over-the-counter trading.

Shares of Deckers Brands cratered last week after the company missed its earnings guidance in its third quarter ended Dec. 31 and forecast a loss in its fourth quarter. On Friday following the earnings release Thursday night, shares tumbled $16.22 to $66.05, or 19.7 percent, in over-the-counter trading.

While Hoka One One again delivered significant gains, Teva and Sanuk both suffered revenue declines. But the shortfall was attributed to slow October and November sales of its Classic Ugg styles. Foreign exchange headwinds also impacted the quarter and was cited as the reason for the lower fourth-quarter guidance.

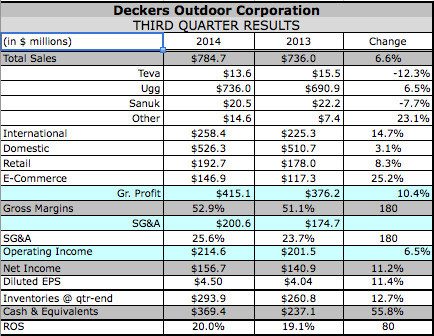

Net earnings in the quarter rose 7.5 percent to $149.4 million, or $4.50, falling short of Deckers guidance calling for $4.66. Gross margin increased 180 basis points to 52.9 percent while SG&A expenses were 25.6 percent of sales compared to 23.7 percent for the same period last year.

Sales increased 6.6 percent to $784.7 million and expanded 8.6 percent in constant dollars. It had expected sales to grow 10 percent.

Ugg sales for the quarter increased 6.5 percent to $736.0 million. Higher e-commerce sales, sales contributions from store openings and increased international wholesale and distributor sales offset a decrease in domestic wholesale sales and same store sales.

On a conference call with analysts, Angel Martinez, president and CEO, said that although the company missed its top-line guidance by 3 percent, Ugg is seeing a strong response to its diversification efforts. Women's Casual Boots were up approximately 65 percent over last year in the quarter while Weather offerings grew over 70 percent. Deckers estimated that Ugg missed between $9 million and $12 million in reorders and online sales of Casual and Weather boots due to sellouts.

Classics’ “very good second quarter” led by aggressive buys by retailers for the third quarter. However, November came in below plan due to mild temperatures in certain markets and weak store traffic trends across the industry. Said Martinez, “Sales trends accelerated as the quarter progressed; however, it wasn't enough to offset the slow start, which eventually led to some cancellations, primarily in our domestic wholesale channel in December.”

Martinez did note that consumer demand for Classics, which includes core and specialty, “remained strong.” For the second and third quarter, total units of women’s Classics increased approximately 5 percent.

Other successes for Ugg include a loungewear line of robes, hoodies, and pants that have become a number-one brand in its domestic accounts such as Nordstrom and are being expanded to other specialty and independent doors. Its home line has seen successful launches at Nordstrom, at Dillard's, Neiman Marcus, and Von Maur.

The I Heart Ugg tween line struggled by being separate from Ugg and will become a tween collection within the Ugg brand starting this July and undergo a logo redesign. Said Martinez, “This will help diversify our kids business, which is currently very Classic-centric.”

Martinez said that while Ugg is having some successes in non-Classic categories, “we clearly have work to do in further adjusting our merchandise planning and inventory management to help our wholesale customers succeed in this rapidly changing retail environment.”

As part of the changes, Ugg will shift its marketing focus less on lifestyle and more on product attributes such as luxury and comfort. Marketing will also focus more on the Classic Ugg line. Martinez noted that management has been “almost taking our largest business for granted,” especially the way it first introduces many fans to the brand.

Finally, based on current booking trends, about 10 percent of its core Classic order bookings for Fall 2015 will shift to non-core collections in the fall 2015 line better to reflect consumer demand. For Fall 2015, Casual Boots are expected to represent 15 percent of its EMEA and domestic wholesale women's orders, and Weather Boots, 10 percent. Said Martinez, “This is a great indication that our major wholesale accounts are on board with our product strategies.”

Among other brands, Teva’s sales decreased 12.1 percent to $13.6 million. The decrease was driven by lower international wholesale and international distributor sales, partially offset by an increase in domestic wholesale sales and e-commerce.

Martinez described Teva’s performance as “solid,” in what’s the smallest quarter for the brand, with “exceptional growth of women's boots, a category that performed very well at retail.” Spring will strongly focus on its Original sandals collection.

“The Teva lifestyle is coming back into favor, and we are positioned to capitalize on this added interest through new colors and materials and new collections, like the Fundamentals,” said Martinez. “This product is perfect for consumers looking for versatile, go-anywhere footwear and will encompass everything from canvas casual styles to boots for men and women.”

Sanuk’s sales decreased 7.9 percent to $20.5 million. Lower wholesale sales and international distributor sales were partially offset by an increase in domestic e-commerce sales and sales contributions from store openings.

Martinez said Sanuk is entering spring with “good brand momentum following a solid season at retail last year,” with additional shelf space and more in-store marketing for 2015. Martinez added, “The early read is that women's sandals are off to a strong start, led by the yoga sling and the yoga mat.”

Internationally, Sanuk was recently introduced to Australia, Brazil, and Japan – “three markets that we believe are ideal for the brand and its line of lifestyle footwear, rooted in the surf culture,” said Martinez.

In its Other Brands segment (Hoka, Ahnu, Tsubo and Mozo), sales jumped 96.5 percent to $14.6 million. The increase was primarily attributable to a $7.2 million increase in sales for Hoka.

Martinez said Hoka capped off a year of “rapid growth” with multiple awards at the Outdoor Retail Winter Market.

“That said, we believe that this is just the beginning,” added Martinez. “Right now the quality of the product line is bigger than the brand. We've gotten good traction in the specialty running channel, where we focused our initial distribution expansion efforts.”

In February, Hoka will be rolling out to select doors within mainstream sporting goods retailers, such as Sports Authority, Hibbett Sports, and Finish Line. Added Martinez, “The priority will be on growing brand awareness to drive demand across all channels and take advantage of the unique position that Hoka occupies in the running industry.”

Regarding Ahnu, Martinez said its new YogaSport collection, coming with increased participation in yoga, “is incredibly timely and will be received very well by the yoga consumer.”

Martinez said Deckers had recently made a decision to seek other strategic alternatives for Tsubo and Mozo to “allow us to focus more of our resources on the growth of Ugg and the other brands.” It has not yet made a final decision on the next steps for Tsubo and Mozo.

Sales for the retail business increased 8.3 percent to $192.7 million, driven by 29 new stores since Dec. 31, 2013, partially offset by a same store sales decrease of 7.2 percent. E-commerce sales jumped 25.2 percent to $146.9 million, driven primarily by Ugg.

Inventories at Dec. 31 increased 12.7 percent. Ugg inventory increased 6.5 percent, Teva decreased 25.0 percent, Sanuk leapt 83.0 percent, and Other Brands' inventory jumped 110.1 percent.

For its fourth quarter ended Mar. 31, the company still expects revenues to increase approximately 10 percent. However, it now expects to show a loss of 8 cents per share, down from previous guidance of earnings of 15 cents, driven mostly by gross margin pressure from foreign currency exchange rates.

For its full fiscal year, it now expects revenues to climb 13.5 percent, down from its previous guidance of 15 percent. EPS is projected to come in at approximately $4.58, an increase of 12.6 percent year-over-year. It previously projected gains of approximately 15.8 percent. Operating margin is expected to land at approximately 12.5 percent compared to previous guidance of approximately 13 percent.

Ugg’s sales are expected to grow 11 percent for the full year, down from 14 percent previously. Both Sanuk and Teva are expected to expand low double digits. Its Other Brand segment is expected to deliver sales of $83 million, up from its previous guidance of $82 million and compared to $48.6 million the prior year.