The outdoor specialty business in the five-week fiscal month of December, as in November, outpaced the retail market as a whole and mirrored trends seen in the luxury market.

According to retail point-of-sale data compiled by SportScanInfo for OIA VantagePoint, sales of outdoor products grew by 4.8% to nearly $2.1 billion in the five-week retail fiscal month of December, pushing outdoor product sales for the 11-month fiscal year-to-date period sales to over $10.1 billion. However, the outdoor specialty channels posted a 7.3% increase for the month, with the independent specialty channel growing 7.8% to $439.7 million for the month and more than $2.1 billion for the year-to-date period.

Analysts point to upper-end consumers that continued to spend based on better feelings about their “wealth effect” – represented by a stronger 401(k) and other investment gains – for the continued energy in these specialty businesses while lower- to middle-income consumers tended to spend early in the season driven by the heavy promotional cadence at the end of November.

Economists suggest that consumers continued to scour the aisles for bargain-bin prices while holding off entirely on big purchases like electronics and other high price-point items. Likewise, many retailers pointed to a post-Christmas snowstorm than blanketed much of the Eastern seaboard, curtailing customer traffic for “week-after” promotions and dampening overall sales.

Economists suggest that consumers continued to scour the aisles for bargain-bin prices while holding off entirely on big purchases like electronics and other high price-point items. Likewise, many retailers pointed to a post-Christmas snowstorm than blanketed much of the Eastern seaboard, curtailing customer traffic for “week-after” promotions and dampening overall sales.Internet sales continued to post explosive growth through December as both pure-plays and multi-channel retailers pushed deadline dates further into the month, with many shipping goods all the way up to Christmas Eve. According to online research firm comScore, retail e-commerce spending for the November-December holiday season reached $32.6 billion, marking a 12% increase over the year-ago period and representing an all-time record for the season. The Internet was also the biggest gainer in outdoor product sales for the month, although growth moderated a bit from the nearly 30% November gain.

In the outdoor products business, OIA VantagePoint reports that sales for the Internet channel jumped 24.4% for the month to nearly $331 million.

Internet Channel Continues to Take Retail Share…

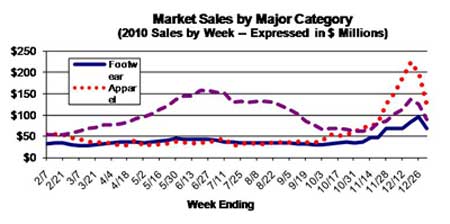

Outdoor apparel and outdoor footwear both posted their biggest weeks of the year during fiscal December (see chart below), peaking the weekend before the Christmas holiday. Outdoor hardgoods also posted another peak for the year, but it fell short of the early summer surge from paddlesports.

The combined outdoor specialty channels of distribution, which includes both independent outdoor specialty and outdoor chain specialty, saw footwear sales growth percentage outpace the retail market as a whole, with sales up 10.2% to $96.5 million in the sector in the five-week fiscal month of December versus just a 1% increase to $382.9 million in the broader market . Still, the growth rate for outdoor footwear in the outdoor specialty channels and the overall market in general fell far short of the November trends as consumers started to focus more on the holiday buying season for others versus the weather-driven surge in personal purchases seen in November. December also had tougher comps against a year-ago period that had more seasonal weather patterns.

Sales growth for outdoor apparel moderated a bit from the double-digit gains seen in November, but key categories like outdoor outerwear and outdoor activewear & sportswear continued to post double-digit growth for the month. While sales were up 9.1% to $1.1 billion in fiscal December in the channels tracked by SportScanInfo for OIA VantagePoint, sales were up more than 27% in the Internet trade channel in December, helped by a 2% increase in ASPs and a 26% increase in outdoor outerwear sales. Outdoor chain specialty ASPs rose the most in outdoor outerwear, gaining 3.5% to $133.05 per unit sold at retail.

ASPs at Independent outdoor specialty were $2/unit higher.

Sales of outdoor hardgoods actually slipped 0.4% in fiscal December to $567.4 million, due entirely to a strong double-digit decrease in the sporting goods channel. Sales of outdoor hardgoods product were up 4.2% to nearly $182 million in the combined outdoor specialty channels.

From a trade channel perspective, the Internet gained more ground in outdoor hardgoods than in the softgoods categories, reaching nearly 19% of outdoor hardgoods sales for the month of December. The channel’s share of the overall outdoor hardgoods business was up 280 basis points to 18.8% of total category sales – the highest share percentage seen all year for the channel. sporting goods retail was the most impacted by the shift, falling below 20% of total market sales for outdoor hardgoods.

Sales of outdoor hardgoods actually slipped 0.4% in fiscal December to $567.4 million, due entirely to a strong double-digit decrease in the sporting goods channel. Sales of outdoor hardgoods product were up 4.2% to nearly $182 million in the combined outdoor specialty channels.

From a trade channel perspective, the Internet gained more ground in outdoor hardgoods than in the softgoods categories, reaching nearly 19% of outdoor hardgoods sales for the month of December. The channel’s share of the overall outdoor hardgoods business was up 280 basis points to 18.8% of total category sales – the highest share percentage seen all year for the channel. sporting goods retail was the most impacted by the shift, falling below 20% of total market sales for outdoor hardgoods.

For more details on weekly outdoor product sales, look for the OIA VantagePoint December Trend Report distributed to Outdoor Industry Association members or contact The SportsOneSource Group for more details about OIA VantagePoint at 704.987.3450.