The TJX Cos. Inc. on Wednesday announced net sales for the fiscal fourth quarter ended February 1 increased 10 percent to $12.2 billion, beating estimates by $370 million. Consolidated comparable store sales increased 6 percent over a 6 percent increase last year driven by improved customer traffic.

Net income for the fourth quarter was $985 million. Diluted earnings per share were 81 cents, a 19 percent increase versus the prior year’s 68 cents and ahead of analyst targets by 4 cents.

For the 52-week fiscal year ending February 1, 2020, net sales were $41.7 billion, a 7 percent increase over the same period last year. Consolidated comparable store sales increased 4 percent over a 6 percent increase last year. Net income was $3.3 billion, and diluted earnings per share were $2.67, a 10 percent increase versus $2.43 in the prior year. Fiscal 2020 diluted earnings per share increased 9 percent over the prior year’s adjusted $2.45, which excluded a $.02 pension settlement charge.

CEO And President Comments

Ernie Herrman, Chief Executive Officer and President of The TJX Companies, Inc., stated, “We are extremely pleased with our strong fourth-quarter results, as both sales and earnings per share significantly exceeded our expectations. Fourth-quarter consolidated comparable store sales increased a very strong 6 percent, over a 6 percent increase last year. We saw strength across the company, with each major division delivering comp sales growth of 4 percent or higher, all over strong increases last year and all primarily driven by customer traffic. Our exciting brands and gift-giving assortments at great values, supported by our marketing, attracted customers around the globe during the holiday season and beyond. Fourth-quarter earnings per share of $.81 were also well above our guidance.”

Herrman continued, “As to the full-year, we also delivered strong results. Consolidated comparable store sales were up 4 percent over a 6 percent increase last year, marking our 24th consecutive year of comp sales growth. We are also very proud to well surpass $40 billion in annual sales, a tremendous milestone for our company. Full-year earnings per share also exceeded our guidance. I want to recognize the terrific efforts of our Associates throughout the year who bring our business to life every day for consumers and the support of our customers, vendors, communities, and shareholders. Looking ahead to 2020, the year is off to a solid start and our global organization remains focused on bringing great values to shoppers every day. We see plentiful opportunities for TJX in today’s retail landscape and are confident we will continue to capture market share. We look forward to many more successful years ahead and continued growth around the world!”

Shareholder Distributions

During the fourth quarter, the company returned a total of $631 million to shareholders. The company repurchased a total of $355 million of TJX stock, retiring 5.9 million shares, and paid $276 million in shareholder dividends. In Fiscal 2020, the company returned a total of $2.6 billion to shareholders. The company repurchased a total of $1.5 billion of TJX stock, retiring 27.1 million shares, and paid $1.1 billion in shareholder dividends.

With the company’s continued strong cash flow, TJX announced today that it intends to increase the regular quarterly dividend on its common stock to be declared in March 2020 and payable in June 2020 to $.26 per share, subject to the approval of the company’s Board of Directors. This would represent a 13 percent increase in the current per share dividend and mark the 24th consecutive year that the company has raised the dividend.

The company is also announcing today its plan to repurchase approximately $1.75 to $2.25 billion of TJX stock during the fiscal year ending January 30, 2021. With $1.7 billion remaining at Fiscal 2020 year-end under the company’s existing stock repurchase programs, the company’s Board of Directors approved a new stock repurchase program that authorizes the repurchase of up to an additional $1.5 billion of TJX common stock from time to time. The new authorization represents approximately 2 percent of the company’s outstanding shares at current prices. The new stock repurchase program marks the 21st program approved by the Board since 1997. Under the company’s repurchase plans, share repurchases may be made from time-to-time in the market or private transactions and may include derivative transactions. The repurchase program announced today has no time limit and may be suspended or discontinued at any time.

Herrman commented, “Our business continues to generate large amounts of cash and deliver strong financial returns. In 2020, we plan to continue investing to support the growth of TJX while continuing our long history of distributing cash to our shareholders. Our capital spending plans include investing in new stores, store remodels and our supply chain, and infrastructure. At the same time, we’re planning a strong increase in our regular quarterly dividend and a continuation of our significant buyback program. These actions demonstrate our confidence in our ability to continue delivering strong, profitable sales and cash flow that enables us to both fund our continued growth and return value to our shareholders.”

Sales By Business Segment

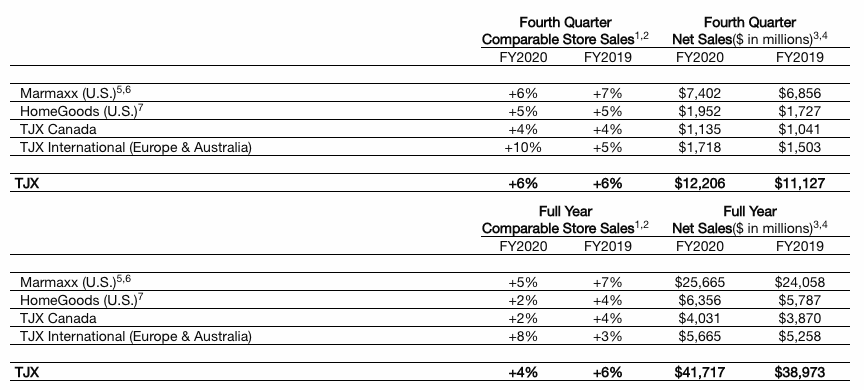

The company’s comparable-store sales and net sales by division, in the fourth quarter and full year, were as follows:

Margins

For the fourth quarter of Fiscal 2020, the company’s consolidated pretax profit margin was 10.9 percent versus 10.6 percent in the prior year.

Gross profit margin for the fourth quarter of Fiscal 2020 was 28.4 percent, a 0.6 percentage point increase versus the prior year. The company’s merchandise margin was up significantly. Selling, general and administrative (SG&A) costs as a percent of sales for the fourth quarter were 17.5 percent, a 0.3 percentage point increase versus the prior year.

For the full year Fiscal 2020, the company’s consolidated pretax profit margin was 10.6 percent. This was a 0.1 percentage point decrease versus the prior year’s 10.7 percent and a 0.2 percentage point decrease versus the prior year’s adjusted 10.8 percent, which excluded a negative 0.1 percentage point impact from a pension settlement charge.

Gross profit margin for the full year Fiscal 2020 was 28.5 percent, a 0.1 percentage point decrease versus the prior year. Selling, general and administrative (SG&A) costs as a percent of sales for the full-year were 17.9 percent, a 0.1 percentage point increase versus the prior year.

Inventory

Total inventories as of February 1, 2020, were $4.9 billion, compared with $4.6 billion at the end of the prior fiscal year. Consolidated inventories on a per-store basis as of February 1, 2020, including the distribution centers, but excluding inventory in transit, the company’s e-commerce sites, and Sierra stores, were up 4 percent on a reported and constant-currency basis. The company enters the new fiscal year in an excellent inventory position and is well-positioned to continue shipping fresh, spring merchandise to its stores and take advantage of the fantastic buying opportunities it sees in the marketplace.

Full-Year And First Quarter Fiscal 2021 Outlook

For the 52-week fiscal year ending January 30, 2021, the company expects diluted earnings per share to be in the range of $2.77 to $2.83. This would represent a 4 percent to 6 percent increase over the prior year’s $2.67. This EPS outlook is based upon estimated comparable store sales growth of 2 percent to 3 percent on both a consolidated basis and at Marmaxx.

For the first quarter of Fiscal 2021, the company expects diluted earnings per share to be in the range of $.59 to $.60 versus earnings per share of $.57 in the prior year. This EPS outlook is based upon estimated comparable store sales growth of 2 percent to 3 percent on both a consolidated basis and at Marmaxx.

The company’s earnings guidance for the first quarter and full-year Fiscal 2021 assumes that currency exchange rates will remain unchanged from the levels at the beginning of the first quarter.

Stores By Concept

During the fiscal year ended February 1, 2020, the company increased its store count by 223 stores to a total of 4,529 stores. The company increased square footage by 4 percent over the same period last year.

Logo courtesy TJX Cos.