Dick’s Sporting Goods reported second-quarter earnings and revenue that topped Wall Street estimates. The retailer raised its full-year EPS guidance and also increased the low end of its full-year comparable store sales guidance. Ed Stack, executive chairman, said in a statement, “The state of our industry is strong, and we remain in a great lane.”

Category: Outdoor

Sportsman’s Warehouse Adds Board Member

Sportsman’s Warehouse Holdings, Inc. appointed Nancy Walsh as an independent Class III director to its Board of Directors and a member of its Audit and Compensation Committees.

X-Vision Optics Appoints National Sales And Marketing Manager

X-Vision Optics, a Red Wing Gear Company, hired Rick Alsen as national sales and marketing manager.

Wolverine World Wide’s Debt Ratings Lowered

Moody’s Investors Service downgraded Wolverine World Wide, Inc.’s debt ratings. The downgrade reflects Wolverine’s elevated leverage compared to Moody’s original expectations and similarly rated peers and risks to the pace of deleveraging given macroeconomic, foreign currency, supply chain pressures, and the more promotional retail environment.

Revo Brands Hires Chief Revenue Officer

Revo Brands, the parent company of Real Avid and Outdoor Edge Cutlery, has hired Jody Agnew as chief revenue officer.

RV Retailer Expands Into Atlanta With Camper City Acquisition

RV Retailer, LLC announced the acquisition of Camper City with a location in Buford, GA in the greater Atlanta market.

Gregory’s Sales Expand 6.6 Percent In First Half

Gregory’s sales reached $34.9 million in the six months ended June 30, increasing 6.6 percent on a reported basis and 12.8 percent on a currency-neutral basis, according to its parent, Samsonite International.

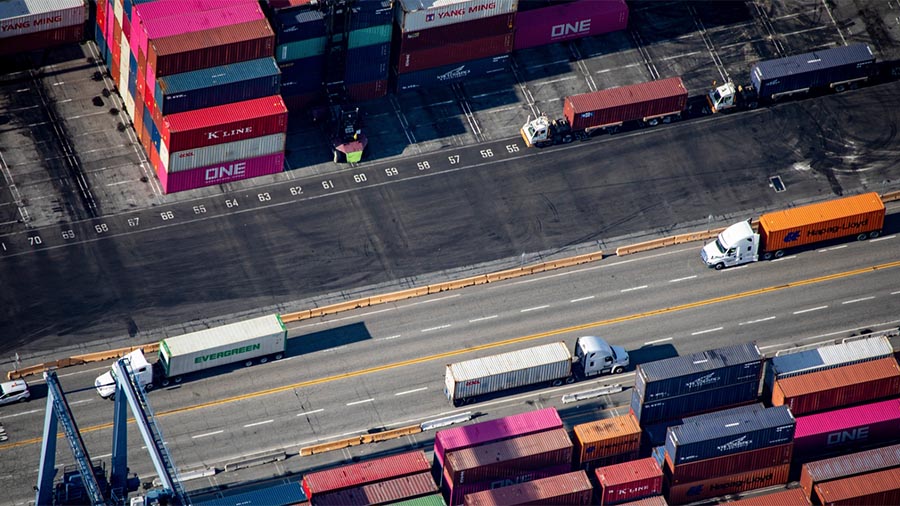

Port Of Los Angeles Breaks Another Cargo Record In July

The Port of Los Angeles processed an estimated 935,345 Twenty-Foot Equivalent Units in July, outpacing the previous record set in 2019 by 2.5 percent. The Port has set monthly records in five of seven months in 2022.

U.S. Retail Spending Shows Slight Gain In July

As calculated by the National Retail Federation, core retail sales rose in July even as overall sales reported by the U.S. Census Bureau remained flat on a monthly basis, and both calculations showed strong year-over-year gains as consumers continued to shop despite high inflation respectively, the NRF said.

Kohl’s Slashes Guidance On Planned Inventory Reduction

Kohl’s, Inc. cut its full-year forecast due to plans to increase promotional activity to reduce inventory levels. The department store chain reported second-quarter results slightly ahead of expectations but indicated a weakening economy and high inflation are weighing on sales growth.

Winnebago Approves 50 Percent Hike In Quarterly Dividend

Winnebago Industries, Inc. said its board raised its quarterly dividend by 50 percent and approved a new share repurchase authorization program.

Moody’s Affirms Newell Brands’ Debt Ratings

Moody’s Investors Service affirmed Newell Brands, Inc.’s debt ratings. The affirmation reflects Newell’s large-scale and good operating performance from sustained organic growth and operating profit margins despite the current inflationary period.

Movement Introduces New CEO

Movement Climbing, Yoga and Fitness, the operator of climbing gyms, hired Jeremy Levitt as chief executive officer.

Linus Bikes Signs New Canadian Distribution Partner

Linus announced that Noru XPLR, Inc. is now an exclusive authorized distributor of Linus Bike products for Canada.

Target’s Q2 EPS Misses Wall Street Targets

Target Corp. reported a steep decline in earnings due to planned markdowns to support the chain’s inventory reduction efforts. Total sales grew 3.3 percent due to steady traffic growth on top of unprecedented increases over the last two years. The discounter maintained its guidance for the year.