S&P Global Ratings revised its debt rating outlook on Canada Goose Holdings Inc. to positive from stable. S&P said Canada Goose’s operating performance for fiscal 2021 was healthier than its previous expectation because of stronger consumer demand and better recovery post easing of restrictions.

As a result, the company exited fiscal 2021, ended March 31, 2021, with a debt-to-EBITDA, S&P Global Ratings’ adjusted, ratio of 2.8x, which is significantly stronger than S&P’s previous expectation of the high 4.0x area for fiscal 2021. S&P expects the company will maintain leverage below 3x in fiscal 2022.

S&P said, “The positive outlook indicates the possibility we could raise the ratings in the next few quarters as the company continues to execute on its direct-to-consumer strategy. The positive outlook also incorporates the company’s significantly improved debt-to-EBITDA ratio as a result of better-than-expected operating performance.”

S&P also affirmed its ‘B+’ issuer credit rating on the company and its ‘BB’ issue-level rating on Canada Goose’s senior secured term loan.

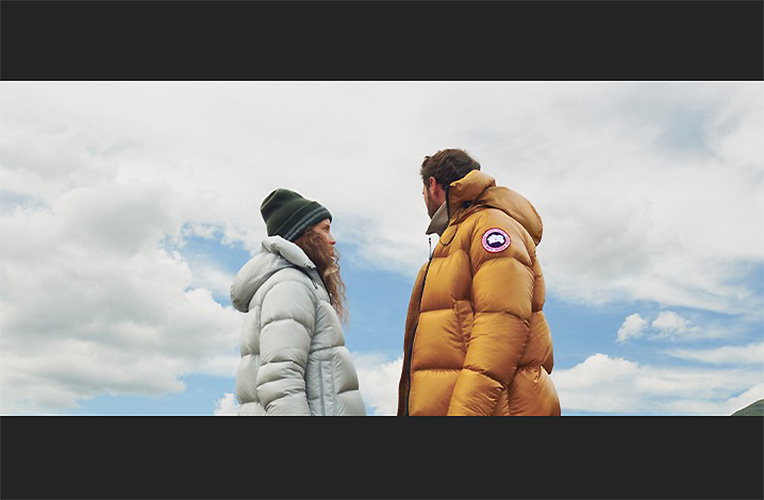

Photo courtesy Canada Goose