Canada Goose Holdings, Inc.’s fiscal second-quarter revenue decreased 5 percent to CN$267.8 million in the period ended September 29, a 6 percent year-over-year decline on a constant-currency basis.

Canada Goose reports in Canadian dollars (CN$) unless otherwise indicated.

DTC revenue decreased 5 percent to CN$103.9 million, or 6 percent on a constant-currency basis, with DTC comparable sales declining 13 percent, partially offset by sales from newer stores.

Wholesale revenue decreased 15 percent to CN$137.3 million, or 17 percent on a constant-currency basis, reportedly due to a planned lower order book. The company said it continues to elevate its presence within the Wholesale channel by right-sizing its inventory position and building strong relationships with brand-aligned partners.

Other revenue increased CN$16.9 million to CN$26.6 million, said to be primarily due to clearing slow-moving and discontinued inventory as part of the company’s inventory exit strategy and contribution of incremental revenue from its knitwear facility acquired in third quarter of fiscal 2024.

Income Statement Summary

Gross profit decreased 9 percent to CN$164.1 million. The gross margin for the quarter was 61.3 percent of revenue, compared to 63.9 percent in the second quarter of fiscal 2024. The decline is primarily due to a higher proportion of non-heavyweight-down revenue within the product mix.

Selling, general and administrative (SG&A) expenses were CN$162.5 million in fiscal Q2, compared to CN$177.2 million in the prior-year fiscal Q2 period. The reduction in SG&A was said to be primarily due to the non-recurrence of costs relating to the company’s Transformation Program, a shift in timing of marketing spend to align with the launch of the first capsule from Haider Ackermann and continued efficiencies from workforce reductions in the prior year, partially offset by an increase in expenses related to the expansion of the company’s global retail network.

Operating Income was CN$1.6 million in the quarter, compared to CN$2.3 million in the prior-year fiscal Q2 period.

Adjusted EBIT was CN$2.5 million, compared to CN$15.6 million in the prior-year fiscal Q2 period. The decrease in adjusted EBIT is reportedly due to the decline in gross profit in the quarter compared to the Q2 period in fiscal 2024 and the expansion of the company’s global retail network,. Lower corporate SG&A expense and a shift in the timing of marketing spend versus the same period last year partially offset the decrease.

Net income attributable to shareholders was CN$5.4 million, or 6 cents per diluted share, compared with a net income attributable to shareholders of CN$3.9 million, or 4 cents per diluted share, in the prior-year fiscal Q2 period.

Adjusted net income attributable to shareholders was CN$5.2 million, or 5 cents per diluted share, compared with an adjusted net income attributed to shareholders of CN$16.2 million, or 16 cents per diluted share, in the prior-year fiscal Q2 period.

Balance Sheet Summary

Inventory of CN$473.4 million for the second quarter ended September 29, 2024, was down 9 percent year-over-year due to a combination of sales through the company’s DTC, Wholesale and Other channels and a temporary reduction in production levels.

The company ended the second quarter of fiscal 2025 with net debt of CN$826.4 million, compared with CN$851.9m at the end of the second quarter of fiscal 2024. This net debt position includes borrowings on the company’s revolving facility, which is seasonally typical while it builds inventory in preparation for its peak selling season.

“Our second quarter performance reflected steady progress across our operating priorities, as we navigated an increasingly challenging macro environment that affected consumer sentiment,” said Chairman and CEO Dani Reiss. “We remain focused on delivering an outstanding customer experience in our DTC channel and increasing desirability for our versatile collection through focused marketing and improved distribution. We believe we are well-positioned for the upcoming holiday season and are excited to bring the first capsule collection from our Creative Director, Haider Ackermann, to market at the end of November. We are confident that our plan will improve our overall business performance as we continue to build a strong foundation for sustainable, long-term profitable growth.”

Other highlights from the fiscal second quarter:

- Continued to expand its presence in key markets, opening two new stand-alone stores and converting two temporary stores to permanent, bringing the total permanent store count to 72 at the end of the second quarter of fiscal 2025;

- GOOS also opened a newly renovated store in Tokyo’s Ginza district. The store features its signature cold room and VIP space;

- Launched a live shopping channel on the Chinese platform Douyin, enabling the company to engage in brand marketing and grow awareness with a large audience in a key market.

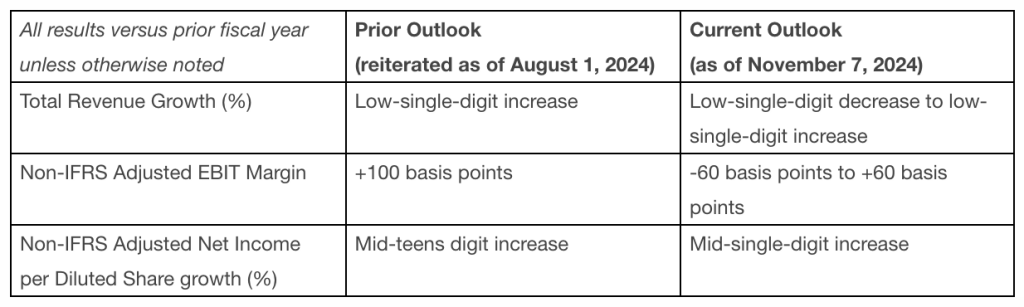

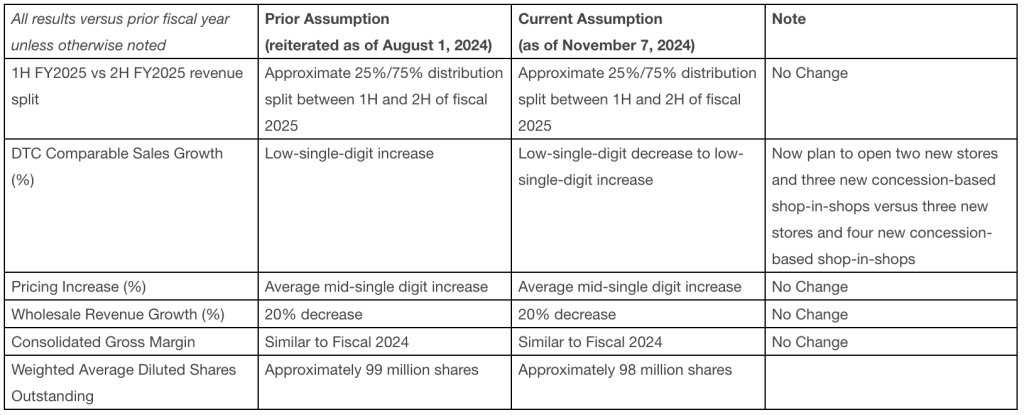

Fiscal 2025 Outlook

Canada Goose is updating the fiscal 2025 guidance issued with fourth quarter and fiscal 2024 results published on May 16, 2024, to the following:

The company’s revised outlook reflects the increased pressure on global luxury consumer spending and incremental planned marketing spend compared to our initial outlook, as well as a more focused and strategic product assortment, along with the following assumptions: