Topgolf Callaway Brands Corp. reported fourth quarter net revenue increased 3.0 percent year-over-year to $924.4 million, primarily driven by increases in Golf Equipment.

On a GAAP basis, loss from operations increased $1,428.2 million to $1,460.8 million primarily due to a non-cash $1,452.0 million impairment of the Topgolf goodwill and intangible assets.

On a non-GAAP basis, income from operations increased $27.2 million to $18.5 million, driven by a $24.4 million increase in total segment operating income, reflecting improvements in all three operating segments and led by the Golf Equipment segment which delivered the largest improvement.

Adjusted EBITDA of $101.4 million increased 45.3 percent vs. the prior year driven by increased profitability in the Topgolf and Golf Equipment segments.

“We are pleased with our strong finish to the year with fourth quarter revenue, adjusted EBITDA and adjusted free cash flow exceeding expectations,” commented Chip Brewer, president and CEO, Topgolf Callaway Brands Corp. “These results reflect continued strength in our Golf Equipment business, including our leading market share position in golf clubs and record market share in golf balls in 2024, as well as continued strong operating performance at TravisMathew and the successful reorganization at Jack Wolfskin. In addition, Topgolf had a strong finish to the year with same venue sales, venue margins and adjusted free cash flow all outpacing expectations.”

Fourth Quarter Segment Summary

(All comparisons to prior periods are calculated on a year-over-year basis, unless otherwise noted)

Topgolf

Topgolf segment revenue remained flat at $439.0 million in the fourth quarter, with a decline in same-venue sales offset by revenue from new venues. Same venue sales were down 8 percent, slightly better than expectations due to improving traffic trends.

Segment operating income increased $3.8 million, or 16.5 percent, to $26.9 million and Adjusted EBITDA increased $10.3 million, or 14.1 percent, to $83.5 million, reportedly driven primarily by revenue from additional venues, and record Q4 venue-level margins.

Topgolf opened two new venues in Q4 2024, compared to nine venues in Q4 2023.

Golf Equipment

Golf Equipment revenue increased $25.4 million to $224.8 million in the fourth quarter, reportedly driven by increased revenue in both golf clubs and golf balls due to the continued success of the clubs business and Chrome family of balls as well as the successful launch of the new Ai-One Square 2 Square Odyssey putters during the period.

The typical seasonal segment operating loss in Q4 improved by $17.2 million to a loss of $2.7 million, driven by increased sales volume and improved gross margins.

Active Lifestyle

Fourth quarter revenue increased $1.9 million or 0.7 percent to $260.6 million, driven by TravisMathew.

Operating income increased $3.4 million, said to be primarily driven by the increased revenue as well as cost savings initiatives at Jack Wolfskin resulting from the recent right-sizing of that business.

“We are pleased with our strong finish to the year with fourth quarter revenue, adjusted EBITDA and adjusted free cash flow exceeding expectations,” commented Chip Brewer, president and CEO, Topgolf Callaway Brands Corp. “These results reflect continued strength in our Golf Equipment business, including our leading market share position in golf clubs and record market share in golf balls in 2024, as well as continued strong operating performance at TravisMathew and the successful reorganization at Jack Wolfskin. In addition, Topgolf had a strong finish to the year with same venue sales, venue margins and adjusted free cash flow all outpacing expectations.”

Full Year Summary

For the full year, net revenue dipped 1.1 percent year-over-year to $4,239.3 million, said to be primarily due to decreases in the Korea business and the Jack Wolfskin Europe business as a result of soft market conditions in those markets.

On a GAAP basis, loss from operations was $1,257.2 million in 2024, compared to income from operations of $237.7 million in 2023. This decrease was said to be primarily attributable to the non-cash $1,452.0 million impairment of Topgolf goodwill and intangible assets.

On a non-GAAP basis, income from operations decreased $33.3 million to $255.9 million primarily due to a decrease in Active Lifestyle segment operating income, partially offset by an increase in Topgolf operating income.

Adjusted EBITDA decreased 1.5 percent to $587.7 million as a result of the decrease in the Active Lifestyle segment operating income, partially offset by the increase in Topgolf Adjusted EBITDA.

Balance Sheet Summary

- Cash flow from operating activities was $382.0 million, and Adjusted Free Cash Flow was $203.1 million, driven by operating efficiencies at Topgolf, improved working capital in the Core business and lower capital expenditures.

- Inventory decreased $37.1 million year-over-year to $757.3 million at year-end, driven by decreases in the Active Lifestyle segment primarily resulting from recent right-sizing initiatives at Jack Wolfskin.

- Available liquidity, which is comprised of cash on hand and availability under the company’s credit facilities, increased $54.3 million to $796.9 million compared to December 31, 2023.

“Looking forward to 2025, improving same venue sales at Topgolf is a top priority for us and we are actively implementing initiatives to address same venue sales,” Brewer continued. “We also remain focused on executing our strategic initiatives, bringing exciting new products and programs to market, and driving continued operating efficiencies.

Brewer said the company is navigating some short-term headwinds, which are impacting this year’s outlook, including foreign currency exchange rates and year-over-year cost pressures.

“Given the strength of our brands and their market positions, our operational capabilities, and our financial position, we are confident we will work through these short-term headwinds and return to growth. And, as we execute on our strategy, we believe we will be able to deliver significant shareholder value,” he concluded.

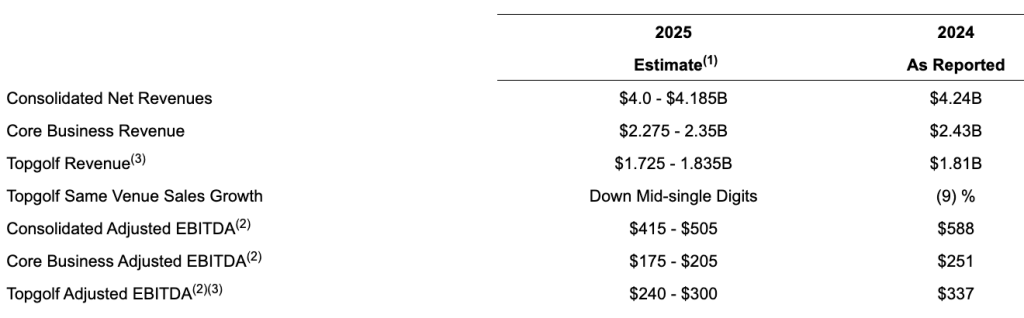

The company’s 2025 outlook assumes a consumer environment similar to 2024 and headwinds of approximately $105 million in revenue and approximately $120 million in Adjusted EBITDA compared to 2024.

The revenue headwinds include approximately $60 million in the Core business from unfavorable changes in foreign currency exchange rates, and approximately $45 million in total headwinds from the sale of the Topgolf World Golf Tour (WGT) mobile gaming business in 2024, a transition to a retail calendar for reporting purposes in 2025 which will cause Topgolf to lose three reporting days of financial results in 2025, as well as one less day due to 2024’s leap year. Excluding those headwinds, the organic revenue would be approximately the same in 2025 as in 2024.

The Adjusted EBITDA outlook includes approximately $75 million in headwinds in the Core business relating primarily to the estimated impact of changes in foreign currency and an expected increase in tariffs, but also a reset of incentive compensation that was not paid out in 2024.

Topgolf’s outlook includes approximately $45 million in Adjusted EBITDA headwinds related to 2025 calendar changes, the sale of WGT, the incurrence of public company standalone costs, as well as the impact of the reset of incentive compensation. Excluding these headwinds, Total company organic Adjusted EBITDA would be down slightly year-over-year at the mid-point, including approximately 6% organic growth in Core business EBITDA.

Expected Topgolf separation costs:

- The company continues to expect approximately $50 million in one-time separation costs.

- The guidance below includes an estimated incremental $15 million in operating expense at Topgolf for standalone public company costs in 2025.

The company’s 2025 full year outlook is as follows:

(in millions, except where noted otherwise and for percentages)

Image courtesy Topgolf Callaway Brands Corp.