While sales still declined, Callaway Golf Co. trimmed its net loss in the third quarter, raised its EPS guidance for the year, and reiterated its vow that it expects to post its first annual profit this year since 2008.

While sales still declined, Callaway Golf Co. trimmed its net loss in the third quarter, raised its EPS guidance for the year, and reiterated its vow that it expects to post its first annual profit this year since 2008.

Despite challenging market conditions, Callaway Golf continued its trend of improved market share, tour success and operating efficiencies, said Chip Brewer, Callaways president and CEO, on a conference call with analysts. On the strength of this performance we are raising our guidance for the year. I believe this is clear evidence that our turnaround plan is working.

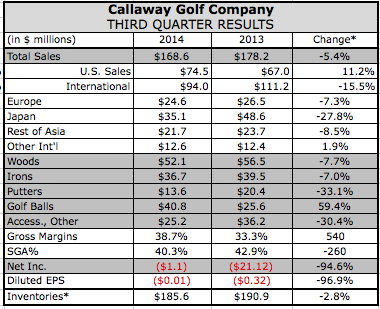

Revenues declined 5.4 percent to $168.6 million due to continued industry softness and the timing of new product launches compared to the same period last year. This decline in net sales, however, was more than offset by a 540 basis point improvement in gross margins, an $8 million improvement in operating expenses, and a $5 million improvement in other income due to positive changes in foreign currency contract values. As a result, operating income improved to a loss of $3 million compared to a loss of $17 million and its net loss was reduced to $1.1 million, or 1 cent a share, from $22.9 million, or 32 cents, a year ago.

Brewer said he considered Callaways performance so far this year significantly better than the industry overall.

In the U.S, revenue climbed 11 percent in the quarter and is now up 6 percent year-to-date. On a currency-neutral basis, Europe was down 14 percent and Japan was down 23 percent for the quarter, reflecting challenging market conditions and shift to new product launch timing. Added Brewer, All three of these large markets are showing year-to-date constant currency revenue growth and are expected to show further growth for the full year. In addition, we have had strong revenue growth this year in important mid-sized markets such as Korea and Australia.

From a product perspective, the Big Bertha V series driver launch in the quarter met its sell-through expectations and has notched five wins on major tours over the last three months. The Big Bertha Beta woods collection was launched in Japan to a good response.

Breaking out category performance in the nine month period, wood sales were $234 million, an increase of 6 percent compared to last year due to the successful launch of its Big Bertha and X2 Hot products earlier in the year as well as the recent introduction of the V series models.

Iron sales were $162 million, an increase of 9 percent due to the success of our new premium Apex Irons and Mac Daddy 2 wedges. Putter sales were $72 million, a decrease of 2 percent with no major product launches this year. Golf ball sales were $117 million, an increase of 5 percent on the success of its Speed Regime and Low Compression Super Soft lines with golf ball segment profitability particularly increasing with improved operating efficiencies.

Accessories and other sales grew 3 percent to $168 million due to an increase in sales of package sets, headwear and golf bags.

Callaways market share in the US in hard goods share through September was at 18.8 percent, up 360 basis points year-over-year. Japans market share in hard goods through September was at 14.7 percent, up 20 basis points; and the UK through August was at 18.3 percent, up 370 basis points. Callaway regained the number one position of hard goods brand in Europe for the last five consecutive months, sustained its position of number one selling American brand in Japan, and earned the number one selling fairway wood brand in the US for July, August and September. It also sustained its number one putter position worldwide.

Given an improving industry outlook for the fourth quarter, coupled with the company’s planned new product launches, the company now expects EPS for the full year in the range of 15 to 18 cents a share, up from a range of 12 to 16 cents previously. It lost 31 cents in 2013.

Sales are currently estimated to be approximately $890 million, an increase of 6 percent. The guidance assumes currency-neutral growth of 7 percent for the year and 11 percent for Q4. The company’s prior year guidance was $880 million to $900 million.

During Q4, the Big Bertha Alpha line of drivers is being launched to join its Big Bertha V series line on the woods side. It is also launching the Big Bertha line of irons and hybrids in the western markets as well as the Big Bertha Beta irons and hybrids in Japan.

Were excited about these launches and we believe this new cup-faced technology in irons is technically superior to anything in the market and should open up new growth opportunity for us in this important category going forward, said Brewer.

Looking to 2015, Callaway expects sales growth of approximately 1 percent to 2 percent on a consolidated basis, driven by constant currency revenue growth of 5 percent to 6 percent in its four channels. The guidance assumes continued market share growth and improved market conditions offset by adverse foreign exchange changes and anticipated retailer conservatism during the first half of 2015. A strategic shift in launch timing for its premium wood business will negatively impact next year’s Q1 comparison but is designed to reduce close-out volume year-over-year. While not providing EPS guidance, Callaway also expects steady improvement in its profitability in 2015.

Asked in the Q&A session about industry conditions, Brewer said the market was promotional in Q3 but in line with expectations. He expects the fourth to be a stronger quarter for the industry with overall inventory levels in better shape. Said Brewer, They were a big issue for the industry going into the year and I think the trade has made good progress working through that. Not all the way through it yet but good progress and lessening issue.

Brewer also said golf rounds played were down significantly earlier in the year, particularly in the Americas, but has since seen some improvement lately with weather improvement. He concluded, So again what were seeing is, I believe, is a return to more normalized market conditions.