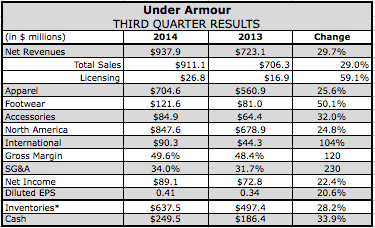

Under Armour delivered another blowout quarter with revenues jumping 29.7 percent and net income ahead 22.4 percent. The third-quarter performance again led the company to raise its targets for the year.

Under Armour delivered another blowout quarter with revenues jumping 29.7 percent and net income ahead 22.4 percent. The third-quarter performance again led the company to raise its targets for the year.

But getting much of the attention was its initial forecast for 2015, which calls for net revenues and operating income to each grow approximately 22 percent-its slowest growth rate since recession-plagued 2009. That represents a notable step down from its updated guidance for the current year that calls for gains of 30 percent in revenues and 31 percent in operating income.

Already known for its conservative guidance, UA officials stressed that the 2015 forecast was exactly in line with its long-term growth rates set at its Investor Day in June 2013 and implied that 2014 in many ways represented an extraordinary year.

Two areas initially expected to do well but significantly outperforming in 2014 have been footwear, which grew 50 percent in Q3; and international, surging 94 percent in the quarter.

On a conference call with analysts, Brad Dickerson, Under Armours CFO, noted that while international is still going to have a very healthy growth rate next year, the brand wont be entering as many new foreign markets in 2015 and comparisons will be challenged against those launches. In 2014, the international segment benefited from entering Brazil, Chile, Hong Kong, Taiwan, Australia, New Zealand and Singapore and also by transitioning its Mexico distributor in-house to a wholly-owned subsidiary.

Another positive for the current year was the cold weather that arrived in late 2013 to clear winter offerings along with supply chain enhancements last year that translates into a boost for its DTC business in the 2014 fourth quarter, as well as wholesale to a lesser degree. Continued outperformance internationally and cooperative weather could lead to an upside to the 2015 forecast, noted Dickerson.

The 2015 guidance also includes a strong but conservative projection for footwear as well as womens, which has benefited in 2014 from the attention brought to its ‘I Will What I Want campaign. Some reports pointed to the deceleration in apparel sales-rising 25.6 percent in the third quarter after climbing 35.4 percent in the second quarter-as a signal that its largest category would naturally be challenged to maintain its historic plus-20 percent growth rate as its revenue base becomes larger.

On a call, however, the even-enthusiastic CEO Kevin Plank noted how the momentum seen in footwear, womens and international will be key drivers of growth in the future. He also said the third quarter marked UAs fourth consecutive quarter of total revenue growth of 30 percent or higher, its 18th consecutive quarter with revenue growth in excess of 20 percent, and has placed Under Armour firmly on its way to hitting its $3 billion revenue goal for 2013.

This consistent outperformance speaks to the continued strength of the athletic cycle that we have significantly helped drive over the past few years, said Plank.

In the quarter, net revenues rose 29.7 percent to $937.9 million. Earnings gained 22.4 percent to $89.1 million, or 41 cents a share. Analysts on average had expected 40 cents a share on revenue of $926 million.

By category, apparel sales jumped 25.6 percent to $704.6 million, marking the 20th consecutive quarter of at least 20 percent year-over-year growth.

Dickerson said the apparel categorys recent growth has benefited from the success of platform innovations and subsequent extensions of those programs, including its two large platforms launched in 2011, Charged Cotton and Storm. ColdGear Infrared, launched last year, has likewise been expanded within apparel to areas like golf and running.

Within apparel, our men’s business was led by continued strength in golf and outdoor, said Dickerson. In women’s we saw solid gains in studio, sports bras, and outdoor. And in youth we experienced broad-based strength across both training and sports-specific categories.

Footwear revenues jumped 50.1 percent to $121.6 million. Expanded running silhouettes were the primary growth drivers, including a continued focus on more balanced price points across its sporting goods distribution while also beginning to broaden offerings across its SpeedForm platform. While off a small base, strong growth was also experienced in basketball, led by the ClutchFit Drive.

Accessories revenues increased 32.0 percent to $85.0 million primarily driven by expanded offerings in headwear, bags, and gloves.

Direct to consumer revenues advanced 35 percent for the quarter, representing approximately 26 percent of revenues. Square footage in its North America factory house channel grew 18 percent year over year. This growth reflects a total of 122 factory house stores at the end of the quarter, up 9 percent from the third quarter of 2013, as well as the upsizing of some existing locations. On the full price side, Under Armour remained at five brand house stores in North America.

E-commerce saw strong traffic gains through efforts such as the ‘I Will What I Want campaign. Its UA.com platform was updated in the quarter to optimize for mobile devices, while new local sites were launched in the UK, Germany, and France.

International revenues vaulted 94 percent to $86 million and represented 9 percent of total revenues. In Europe, strong results throughout the year have been driven by a combination of higher brand awareness and a more focused in-country strategy around its three key markets: UK, Germany, and France. In Asia Pacific. partner store openings are being accelerated throughout Greater China and Southeast Asia. Latin America is benefiting from the conversion of its Mexico distributor, as well as recent entries into Brazil and Chile.

Gross margins expanded 120 basis points to 49.6 percent. Higher US import duties from the year-ago period were anniversaried, contributing approximately 90 basis points for the quarter. A favorable sales mix during the period, primarily driven by a more profitable product mix across its factory house channel, contributed approximately 70 basis points in margin. That helped offset 40 basis points decline in margin due to the shift in footwear liquidations into the third quarter previously highlighted on its second-quarter call.

SG&A expenses increased 230 basis points to 34 percent, reflecting higher year-over-year sports marketing sponsorships, higher variable costs tied to the growth in North America DTC business, and higher product innovation costs, including its connected fitness efforts as well as higher personnel costs in footwear and international.

On the call, Plank spent much of his time discussing how UA planned to grow well beyond its North American apparel business, highlighting how footwear and international together added nearly $200 million in sales and 35 percent of its growth year-to-date.

To support international growth, Chris Bate, formerly managing director EMEA at Wolverine World Wide/PLG and footwear business director at Nike Europe, has been recruited to lead Europe. Erick Haskell, formerly managing director, India at Adidas and former COO, Greater China for Adidas, has been hired to lead China.

Seeing some stability and expected to surpass $100 million in revenue for the first time this year, Matt Shearer, who had been running EMEA and Canada, will return to North America full time to focus on Canada. Kevin Eskridge, who had been guiding UAs expansion into China after originally helping drive its outdoor business in the U.S., will transition back to Baltimore where he can then influence our global perspective.

Plank said the homegrown talent helped establish the culture of the brand in those regions but the new hires will bring on-the-ground expertise to expand those regions.

Said Plank, What Ive learned in building Under Armour is that there is no substitution for grade A people, and that bringing fresh yet experienced talent into the Under Armour brand is what will continue to drive our growth.

Footwear marked its third consecutive quarter of 30 percent plus revenue growth and revenues are set to surpass $400 million this year. Plank said footwear will be less than 15 percent of the business in 2014 and that UA still sees the category eventually becoming larger than apparel.

In running footwear, UA plans to significantly broaden its successful SpeedForm platform this year, including introducing this spring the $130 SpeedForm Gemini with Charge cushioning, and SpeedForm Vent at $100 that features a material in the upper that was originally developed for its apparel line. Said Plank, We are taking the SpeedForm technology developed for a single shoe into a broader platform that will enable us to reach a broader range of consumers and gain share on the shoe wall as well.

Basketball is seeing double-digit sell-throughs, driven by the $130 ClutchFit Drive Stephen Curry wore during the FIBA Basketball World Cup. ClutchFit technology will gain more exposure across its sponsored college teams such as Notre Dame, St. John’s and Maryland as well as its most recent endorser signing, Emmanuel Mudiay, who left high school to play in the Chinese Basketball Association this season.

Plank also noted that the Highlight Cleat for football wound up selling almost 50 percent more this year at a retail price $20 higher than last year.

Under Armours women’s business, which is over $500 million currently, is still less than half the size of UAs men’s business, and we still believe it should be as big or bigger than our men’s category, according to Plank.

‘I Will What I Want has become a game-changing campaign, with strong responses to the ballerinas Misty Copeland initial commercial and a later one starring supermodel Gisele Bundchen. The two executions have generated over 13 million views across YouTube and Under Armour sites. Its also gained attention internationally in Bundchens home country of Brazil as well as from Copelands appearance in Paris. The campaign also drove tremendous traffic to its e-commerce site, primarily with women, 70 percent of which were new consumers to Under Armour. More than 350,000 have downloaded the brand new ‘I Will What I Want app, UAs first effort into bringing the MapMyFitness technology into its brand communications.

Plank concluded that the overall response to the campaign positions us extremely well as we continue to build out the product and distribution to expand our reach from the female athlete to the athletic female.

To support its North American wholesale business, Under Armour is introducing the Armour base layer this spring, a more focused training assortment, and expanding its lifestyle offerings. A focus will also be on improving speed to market and its merchandising efforts to enable its larger wholesale partners to present distinct points of view on Under Armour within all their doors.

MapMyFitness has expanded to more than 30 million users from 20 million at the time of the workout apps December 2013 acquisition. With additional languages and product enhancements, the goal is to have over 100 million users in the next several years. Said Plank, What’s truly compelling to us is what that platform provides in terms of helping our users proactively manage their own health and fitness. We understand the opportunity is massive.

Looking ahead, Under Armour now expects 2014 revenues of approximately $3.03 billion, representing growth of 30 percent, and 2014 operating income of approximately $348 million, representing growth of 31 percent. It had previously expected revenue gains of 28 to 29 percent; and operating income gains of 29 to 30 percent.

Regarding 2015, Under Armour said it expects international, DTC, and footwear businesses to again outpace the growth rate of its overall business. Gross margin gains are expected to be relatively consistent with 2014, balanced with SG&A investments to support growth opportunities, including international, retail, and connected fitness. On top of a normalized capital expenditures growth rate, UA plans to invest approximately $90 million more to build a new Southeast distribution center in the U.S. and expand its headquarters in Baltimore.