Topgolf Callaway Brands Corp., parent of the Callaway Golf, Topgolf, Travis Mathew, Odyssey, Ogio, Jack Wolfskin brands realized net revenue of $1.16 billion in the second quarter ended June 30, representing a decrease of 1.9 percent year-over-year. The decline was reportedly due to a decrease in Golf Equipment sales and lower sales in the Active Lifestyle segment, partially offset by an increase in the Topgolf segment, driven by revenue from additional venues. But the Q2 report also uncovered trouble in Topgolf business that has management questioning its viability going forward.

“Despite macro headwinds including the cumulative impact of negative FX trends, persistently high inflation and recent softer-than-expected traffic to our Topgolf venues, I am incredibly proud of our team’s ability to drive market share gains in our products business as well as the continued strengthening of the digital capabilities and fundamental venue profitability at Topgolf,” commented Chip Brewer, president and CEO, Topgolf Callaway Brands. “TravisMathew continues to gain market share and grow its highly profitable direct to consumer business with 10 stores opening this year. Jack Wolfskin successfully rightsized its operations to focus on key markets in Central Europe and China. And our Golf Equipment results remain strong, especially in the U.S. market, where our club market share continues to lead the industry and our ball share continues to grow. The successful rebranding and redesign of our premium Chrome Tour family of balls highlights our excellence in R&D and commitment to innovation.

So Much for the Shiny Object

Did we mention that the shine must be off the Topgolf shiny object? It now looks like the company, after rebranding to put Topgolf first, changing a ticker symbol to “MODG” to represent its focus on “Modern Golf” from the former iconic “ELY” ticker symbol that was a nod to company founder Ely Callaway, will be doing a strategic review of the Topgolf business that soared to new heights during the pandemic and has since fallen back to earth with struggling same-venue profitability and sales increases that are reliant of new venues.

“As we look forward, we remain convinced that Topgolf is a high-quality business with significant future opportunity. It is transforming the game of golf, and we believe it will deliver substantial growth and financial returns over time. At the same time, we have been disappointed in our stock performance for some time, as well as the more recent same-venue sales performance,” Brewer advised. “As a result, we are in the process of conducting a full strategic review of Topgolf. This review includes the assessment of organic strategies to return Topgolf to profitable same-venue sales growth, as well as inorganic alternatives, including a potential spin [off] of Topgolf. Our strategic review of Topgolf is being conducted with the help of outside advisors and is focused on maximizing long-term shareholder value. We are active in this work at present and expect to complete our strategic review of Topgolf expeditiously. We will report back on this when the work is complete.”

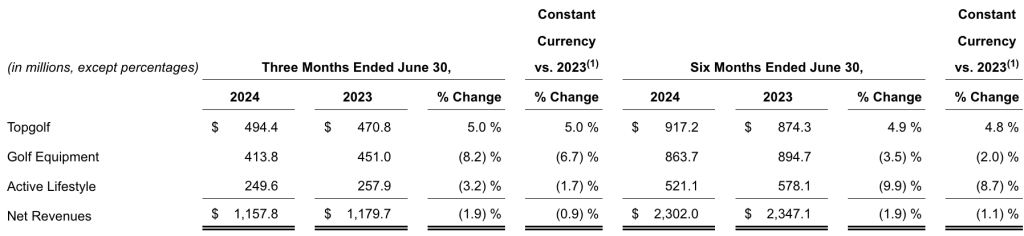

Segment Review

Golf Equipment segment revenue decreased $37.2 million or 8.2 percent to $413.8 million, in line with expectations. The decline was said to be primarily due to the lapping effect of last year’s Big Bertha woods and irons launch, as well as changes in foreign exchange rates. The company said it maintained its #1 U.S. model market share in Driver, Fairway Woods and Irons with Ai Smoke clubs and continued to drive market share gains in golf ball driven by the new Chrome Tour family of golf balls.

Topgolf segment revenue increased 5.0 percent year-over-year to $494.4 million, driven primarily by new venues. Same-venue sales decline of 8 percent were below expectations, reportedly driven by softer-than-expected traffic as the business navigates the current cyclical macro challenges.

Active Lifestyle segment revenue decreased 3.2 percent to $249.6 million resulting primarily from previously expected lower wholesale revenue at Jack Wolfskin.

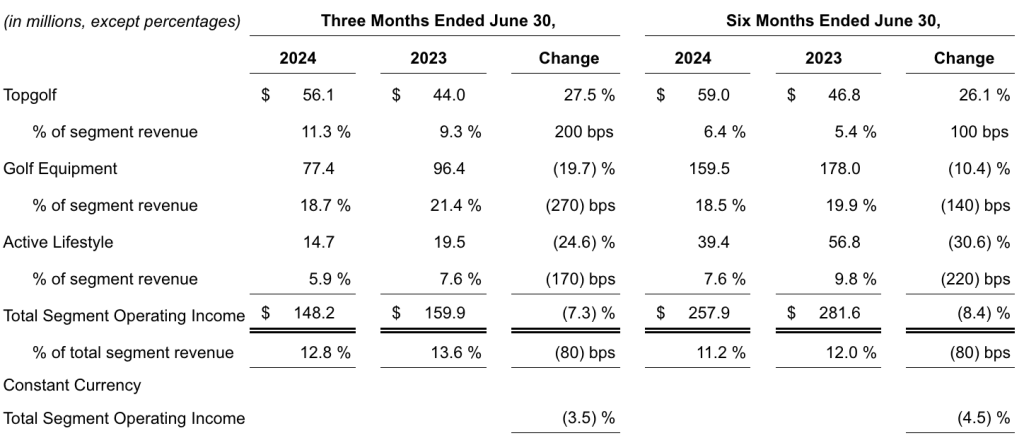

Consolidated Income from operations decreased 11.2 percent on a GAAP basis to $103.0 million in Q2, and experienced a decline of 4.6 percent to $121.8 million on a non-GAAP basis, said to be primarily due to unfavorable changes in foreign currency.

- Golf Equipment segment operating income decreased $19.0 million, primarily due to lower revenue, higher air freight costs and changes in foreign exchange rates, partially offset by management of operating expenses.

- Topgolf segment operating income increased $12.1 million, or 27.5 percent, to $56.1 million year-over-year.

- Active Lifestyle segment operating income decreased $4.8 million due to the decrease in revenue previously mentioned.

Income Statement Summary

Second quarter net income of $62 million, non-GAAP net income of $83 million, and Adjusted EBITDA of $206 million were all said to be ahead of expectations.

Net income decreased 47.1 percent on a GAAP basis to $62.1 million in the quarter, or an increase of 9.9 percent to $83.1 million on a non-GAAP basis compared to Q2 last year. The decrease in net income on a GAAP basis was said to be primarily attributable to a decrease in income tax benefit, the decrease in operating income previously mentioned, and higher interest expense related to new venues. On a non-GAAP basis, the increase in net income was reportedly due to a decline in income tax expense as well as lower interest expense as a result of our debt refinancing.

Adjusted EBITDA of $205.6 million was approximately flat (-0.3 percent) compared to the prior-year quarter, exceeding the high-end of the company’s Q2 2024 guidance range, driven by reduced costs and strong operational efficiencies.

Topgolf segment Adjusted EBITDA increased $17.4 million, or 18.9 percent, to $109.5 million primarily due to increased revenue from new venues and strong operating efficiencies.

Balance Sheet and Cash Management

Inventory decreased $192.7 million year-over-year to $647.1 million at quarter-end, with declines across all three segments.

The company made a $50 million discretionary payment against the outstanding principal of its term loan debt at the end of May.

First half cash provided by operations improved by $173 million compared to prior year.

Available liquidity, which is comprised of cash on hand plus availability under the Company’s credit facilities, increased $136 million compared to June 30, 2023.

Outlook

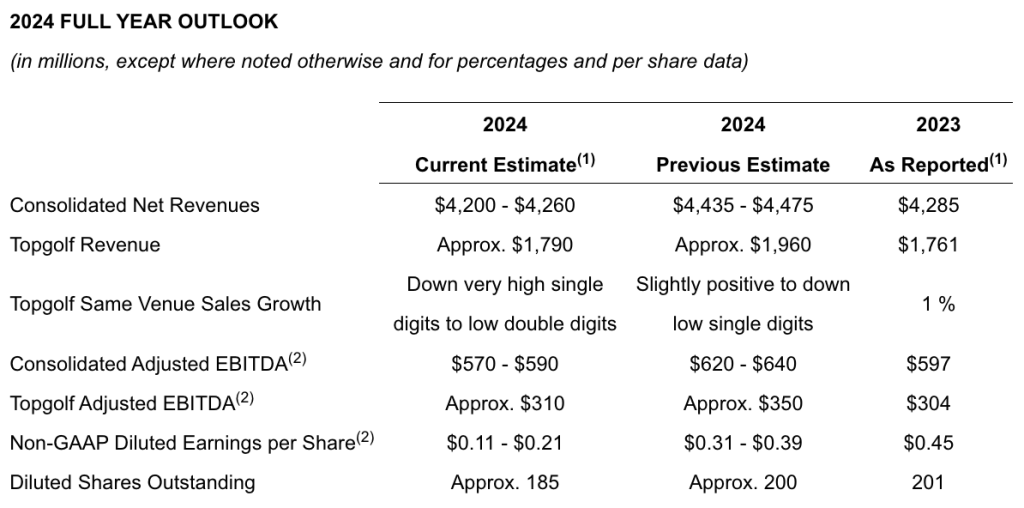

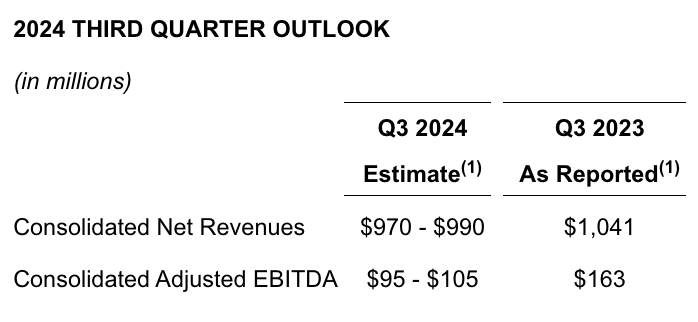

Revenue and Adjusted EBITDA outlook lowered to a range of $4,200 – $4,260 million and $570 – $590 million, respectively.

Image courtesy Topgolf