Caleres, the parent company of Famous Footwear and the Naturalizer, Vionic, Allen Edmonds, Blowfish Malibu, and Sam Edelman brands, missed Wall Street’s revenue expectations in Q4, with sales falling 8.3 percent and GAAP EPS of 15 cents per share came in 68.7 percent below analysts’ consensus estimates.

“Our fourth quarter earnings were at the high end of our most recent guidance. We gained market share in women’s fashion footwear, our Lead Brands outperformed, and we grew our sneaker penetration. Famous Footwear’s business softened in the quarter, but we maximized key selling periods. We invested to support our long-term growth while continuing to evolve our supply chain and further mitigate the impact of additional tariffs,” said Jay Schmidt, president and chief executive officer.

“While 2024 overall was disappointing relative to our initial expectations, we made meaningful progress in advancing our strategic priorities and positioning our brands for sustainable growth. We also returned $75 million to shareholders in the form of dividends and share repurchases.

“As we look forward to 2025 and the macroeconomic environment with persistent inflation and newer tariffs, we believe it is prudent to take a conservative view for the year. Despite this posture, I am optimistic about what we have in store for 2025. Our Lead Brands remain strong and are collectively gaining market share, and we have expanded our customer reach with greater focus on the significant opportunity we see in contemporary,” said Schmidt. “The hard work of our talented teams and the impact of new leadership across several areas of our business, along with strategic brand partnerships and the planned acquisition of Stuart Weitzman, position us well to drive significant value in 2025 and beyond,” continued Schmidt.

Fourth Quarter 2024 Results

(13 weeks ended February 1, 2025, compared to 14 weeks ended February 3, 2024)

- Net sales: $639.2 million, down 8.3 percent year-over-year, with net sales excluding the impact of the 53rd week down 4.0 percent.

- Famous Footwear segment: Net sales decreased 9.6 percent, with comparable sales down 2.9 percent.

- Brand Portfolio segment: Net sales decreased 7.2 percent.

- Direct-to-consumer sales represented about 73 percent of total net sales.

- .Gross profit of $275.1 million, with gross margin at 43.0 percent, down 80 basis points year-over-year

- Famous Footwear segment gross margin of 42.5 percent, down 40 basis points.

- Brand Portfolio segment gross margin of 41.6 percent, down 100 basis points.

- SG&A expenses of 40.9 percent of net sales, up 180 basis points compared to the prior year, reflecting expense deleverage due to the decline in sales.

- Net earnings of $4.9 million, or earnings per diluted share of 15 cents, compared to net earnings of $55.8 million, or earnings per diluted share of $1.57 in the fourth quarter of 2023. Adjusted net earnings were $11.1 million, or adjusted earnings per diluted share of 33 cents, compared to adjusted net earnings of $30.8 million, or adjusted earnings per diluted share of 86 cents, in the fourth quarter of 2023.

Fiscal Year 2024 Results

(52 weeks ended February 1, 2025, compared to 53 weeks ended February 3, 2024)

- Net sales: $2.72 billion, down 3.4 percent from 2023.

- Famous Footwear segment: Net sales declined 3.3 percent.

- Brand Portfolio segment: Net sales declined 3.5 percent.

- Direct-to-consumer sales: Represented about 72 percent of total net sales

- Gross profit: $1.22 billion with a gross margin of 44.9 percent, up 10 basis points to 2023.

- Famous Footwear segment gross margin: 44.1 percent, down 60 basis points to 2023.

- Brand Portfolio segment gross margin: 43.7 percent, up 80 basis points to 2023.

- SG&A expenses: 39.1 percent of net sales, up 140 basis points compared to the prior year, reflecting inflationary factors and strategic investments.

- Net earnings: $107.3 million, down $64.1 million from 2023, and adjusted net earnings of $114.6 million, down $34.7 million from 2023

- Earnings per diluted share of $3.09 as compared with earnings per diluted share of $4.80 in 2023, and adjusted earnings per diluted share of $3.30 versus $4.18 in 2023.

- EBITDA: $206.7 million, or 7.6 percent of sales, and adjusted EBITDA of $216.6 million or 8.0 percent of sales.

- Inventory: Up 4.5 percent compared to 2023.

- Borrowings: Under the asset-based revolving credit facility, borrowings were $219.5 million at the end of the period.

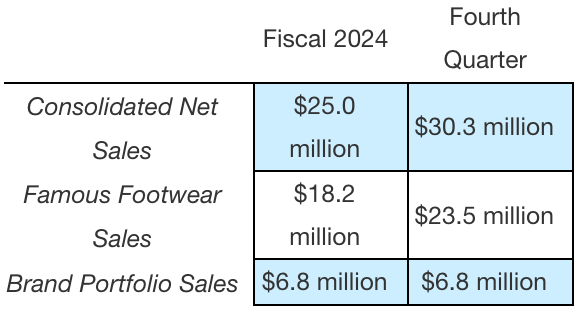

Fiscal 2024 and Fourth Quarter Negative Impact from 53rd Week

Capital Allocation Update

During fiscal 2024, Caleres continued to invest in value-driving growth opportunities while at the same time returning $74.7 million in cash to shareholders through dividends and share repurchases.

Subsequent to quarter end, the company announced plans to acquire Stuart Weitzman for $105 million, subject to customary adjustments. The company expects the transaction to close in the summer of 2025, and Caleres will fund the acquisition through the company’s revolving credit agreement. Caleres will continue to consider business performance and market conditions as it evaluates all opportunities for free cash flow.

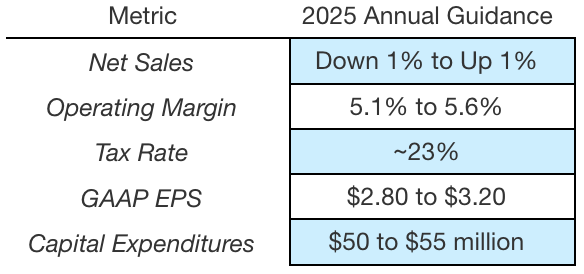

Fiscal 2025 Outlook

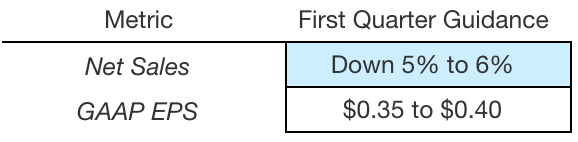

First Quarter 2025 Outlook

Image and Data courtesy Stuart Weitzman/Caleres, Inc.