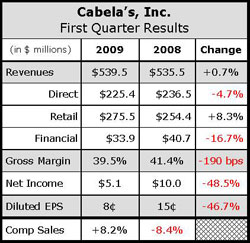

Mirroring a pervasive market trend that has emerged as a common thread for nearly all outdoor retailers, Cabelas Inc. reported first quarter revenues were driven by notable strength from strong firearms and ammunition sales. However, despite any improvement the retailer may have seen in its top line, bad debt expenses at Worlds Foremost Bank, the companys finance unit, crippled net income for the quarter, cutting net profits 48.5% from the first quarter of 2008.

Bad debt expenses counted $14.7 million for company, while a $1.7 million pre-tax charge related to severance and fixed asset write downs drove profits down further.

In a conference call with analysts, new company President and CEO Tommy Millner maintained that “charge offs continue to be a challenge,” but stressed that the company doesnt expect increased charge-offs to impact earnings guidance because CAB is adjusting pricing to “mitigate the financial impact of increased bad debts.”

Revenues for the Financial Services segment fell 16.7% to $33.9 million from $40.7 million in Q1 last year, while managed credit card loans increased 14.1% and active accounts grew 10.7% compared to the year-ago period. Management said the company would continue to adjust credit card pricing to adhere to market levels and is managing credit limits on customers it believes are at risk for future charge offs. Recently, Cabelas increased liquidity at the Worlds Foremost Bank by $425 million by issuing a securitization, which will provide the company with a permanent source of liquidity for the next three years.

Management said they expect charge offs for the full year to be between 5.1% and 5.5%, up from the range of 4.5% and 4.6% the company originally predicted.

The companys Retail segment posted strong results, increasing 8.3% to $275.5 million from $254.4 million on comps that were up 8.2% from the first quarter of 2008. Average ticket prices increased 5.4% (despite the fact that management said customers had adopted a more “budget-conscious” mentality) while transactions increased 2.7%.

Revenues for the companys Direct segment decreased 4.7% to $225.3 million in the year-ago period. Traffic to Cabelas.com increased about 25%, according to management.

Management added that they have seen traffic and sales increase as first-time gun owners make their first firearms purchases. Likewise, the company has seen an uptick in add-on sales related to guns. Millner estimated new customers gains generated from firearm sales is in the “low-double-digits.”

SG&A as a percentage of sales declined 30 basis points to 37.2% from 37.5% a year ago. The company implemented several cost cutting measures in the first quarter, including a 13% cut in direct marketing costs, a 0.5% cut in labor cost from the retail segment and a 0.6% cut in distribution, general corporate overhead and merchandising costs.

Inventory levels decreased 7.6% to $574.0 million from $620.9 million a year ago, an improvement management said will continue as the company continues efforts to tighten inventories. Total debt was reduced by $151 million, leaving the company with $475 million in debt as compared with $636 million a year ago.

Regarding outlook, management said it now expects same store sales and revenue to remain flat for the year. Previously, comps and revenues were expected to decline slightly. As mentioned, charge offs in the financial services segment is expected to be in the range of 5.1% and 5.5%, more than the original estimate of between 4.5% and 4.6%.