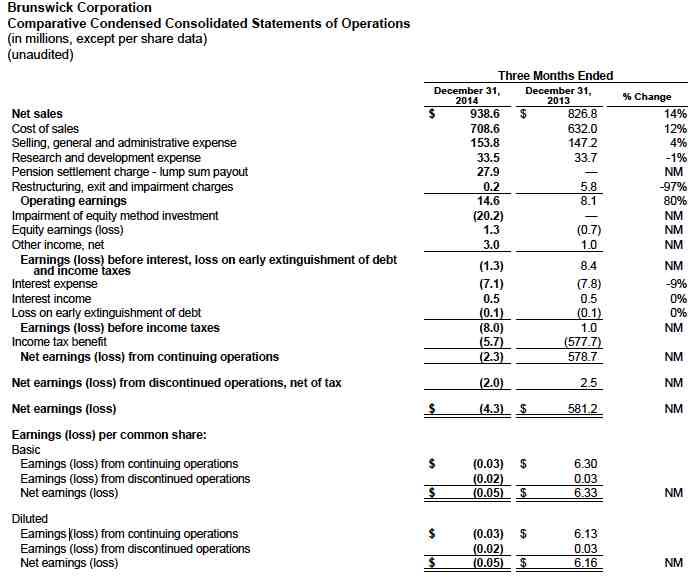

Brunswick Corporation reported fourth-quarter revenues rose 13.5 percent to $938.6 million on strong sales across all three of its segments. Sales grew 8 percent at its Fitness segment, including Life Fitness, 10 percent in its Marine Engine segment and 23 percent in Boats segment. Still, Brunswick lost $2.3 million, or 3 cents a share, in the period after special items.

“Our results in 2014 represent the fifth consecutive year of strong improvements in operating performance,” said Brunswick Chairman and Chief Executive Officer Dustan E. McCoy. “These outstanding results reflect the strong execution of our business strategy by our global workforce.

“Revenue increased by 7 percent, with U.S. and international sales up 8 percent and 4 percent, respectively. Sales growth was driven by improvements in outboard boats and engines, marine parts and accessories, fitness equipment and fiberglass sterndrive/ inboard boats, partially offset by revenue declines in sterndrive engines. Our revenue performance benefited from recent investments in growth initiatives with several new products being introduced into the marketplace. Sales growth also reflects parts and accessories acquisitions made during the year.

“Our 2014 gross margin of 27.0 percent reflects an increase of 60 basis points from the prior year and represents the highest annual level achieved since 2000. Operating expenses increased by 4 percent, due to higher research and development expense and other growth-related investments primarily associated with company-wide strategic initiatives.

“Strong improvement in adjusted operating earnings, combined with lower net interest expense and higher other income, led to a 32 percent increase in adjusted pretax earnings. This increase was offset by a higher effective tax rate, resulting in $2.42 diluted EPS, as adjusted,” McCoy concluded.

Discontinued operations

On July 17, 2014, the company announced: 1) the signing of an agreement to sell its Retail Bowling business, and 2) its intention to sell its Bowling Products business. On Sept. 18, 2014, the sale of the Retail Bowling business was completed. As a result, the historical and future results of these businesses are now reported as discontinued operations and the historical and future results of the Billiards business, which remains part of the company, are now reflected in the Fitness segment. Therefore, for all periods presented in this release, all figures and outlook statements incorporate these changes and reflect continuing operations only, unless otherwise noted.

2014 full-year results

For the year ended Dec. 31, 2014, the company reported net sales of $3,838.7 million, up from $3,599.7 million in 2013. For the year, operating earnings were $328.5 million, which included a $27.9 million pension settlement charge related to lump sum payouts and $4.2 million of restructuring, exit and impairment charges. In 2013, the company reported operating earnings of $281.8 million, which included $16.5 million of restructuring, exit and impairment charges.

For 2014, the company reported net earnings of $194.9 million, or $2.05 per diluted share, compared with net earnings of $756.8 million, or $8.07 per diluted share, for 2013. The diluted EPS for 2014 included a $0.21 per diluted share impairment charge for a marine equity method investment; $0.19 per diluted share of a pension settlement charge; $0.04 per diluted share of restructuring, exit and impairment charges and a $0.07 per diluted share benefit from special tax items. The diluted EPS for 2013 included the reversal of deferred tax valuation allowance reserves of $6.39 per diluted share; losses on early extinguishment of debt of $0.32 per diluted share; a $0.31 per diluted share charge from special tax items and restructuring, exit and impairment charges of $0.16 per diluted share.

Fourth quarter highlights:

- Net sales increased 14 percent versus fourth quarter 2013.

- Gross margin was 90 basis points higher versus prior year.

- Adjusted operating earnings increased $28.8 million from fourth quarter 2013. On a GAAP basis, operating earnings increased $6.5 million.

- Adjusted pretax earnings increased $33.5 million. On a GAAP basis, pretax earnings declined by $9.0 million.

- Diluted EPS, as adjusted, of $0.33. On a GAAP basis, diluted EPS of $(0.03).

For the fourth quarter of 2014, the company reported net sales of $938.6 million, up from $826.8 million a year earlier. For the quarter, the company reported operating earnings of $14.6 million, which included a $27.9 million pension settlement charge related to lump sum payouts and $0.2 million of restructuring, exit and impairment charges. In the fourth quarter of 2013, the company had operating earnings of $8.1 million, which included $5.8 million of restructuring, exit and impairment charges.

For the fourth quarter of 2014, Brunswick reported a net loss of $2.3 million, or $(0.03) per diluted share, compared with net earnings of $578.7 million, or $6.13 per diluted share, for the fourth quarter of 2013. The diluted EPS for the fourth quarter of 2014 included a $0.22 per diluted share impairment charge for a marine equity method investment; $0.19 per diluted share of a pension settlement charge and a $0.05 per diluted share benefit from special tax items. The diluted EPS for the fourth quarter of 2013 included the reversal of deferred tax valuation allowance reserves of $6.35 per diluted share; a $0.22 per diluted share charge from special tax items; $0.06 per diluted share of restructuring, exit and impairment charges and losses on early extinguishment of debt of $0.01 per diluted share.

Review of cash flow and balance sheet

Cash and marketable securities totaled $635.9 million at the end of 2014, up $266.7 million from year-end 2013 levels. This increase mainly reflects net proceeds received from the sale of the Retail Bowling business completed in the third quarter of 2014 (reported in discontinued operations). In addition, net cash provided by operating activities of $235.3 million, less cash used for investing and financing activities of $300.6 million, also affected cash and marketable securities balances. Investing and financing activities during 2014 included $41.5 million for acquisitions, $41.7 million of dividends and $20.0 million of common stock repurchases.

Marine Engine Segment

The Marine Engine segment, consisting of the Mercury Marine Group, including the marine parts and accessories businesses, reported net sales of $465.0 million in the fourth quarter of 2014, up 10 percent from $423.5 million in the fourth quarter of 2013. International sales, which represented 39 percent of total segment sales in the quarter, increased by 8 percent. For the quarter, the Marine Engine segment reported operating earnings of $31.6 million. This compares with operating earnings of $18.1 million in the fourth quarter of 2013.

Sales increases in the quarter were led by the segment’s parts and accessories and outboard engine businesses. Higher sales, along with benefits from new products and continued favorable warranty experience, contributed to the increase in operating earnings in the fourth quarter of 2014.

Boat Segment

The Boat segment is comprised of the Brunswick Boat Group, and includes 14 boat brands. The Boat segment reported net sales of $294.3 million for the fourth quarter of 2014, an increase of 23 percent compared with $239.7 million in the fourth quarter of 2013. International sales, which represented 33 percent of total segment sales in the quarter, increased by one percent compared to the prior year period. For the fourth quarter of 2014, the Boat segment reported an operating loss of $4.1 million, including restructuring charges of $0.2 million. This compares with an operating loss of $21.9 million in the fourth quarter of 2013, including restructuring charges of $5.8 million.

The increase in sales reflected strong growth in fiberglass sterndrive/inboard boats and continued growth in outboard boats. The reduction in the segment’s operating loss was a result of higher sales and lower restructuring charges.

Fitness Segment

The Fitness segment is comprised of the Life Fitness Division, which designs, manufactures, and sells Life Fitness and Hammer Strength fitness equipment. Fitness segment sales in the fourth quarter of 2014 totaled $235.0 million, up 8 percent from $217.2 million in the fourth quarter of 2013. International sales, which represented 47 percent of total segment sales in the quarter, increased by 10 percent. For the quarter, the Fitness segment reported operating earnings of $40.8 million. This compares with operating earnings of $36.6 million in the fourth quarter of 2013.

The increase in sales reflected growth to U.S. health clubs, hospitality, education and local and federal government customers, as well as net gains in international markets. The increase in operating earnings in the fourth quarter of 2014, when compared with the same period of 2013, reflects the benefit from higher sales, partially offset by investments in growth initiatives.

2015 outlook

“Our outlook and financial targets for 2015 are generally consistent with our three-year strategic plan,” McCoy said. “Pursuant to the strategy to grow in moderate economic conditions, all of our businesses have been investing heavily in growth for several quarters. Our recent results reflect the success of our strategy and we are well- positioned to continue to generate sales and earnings growth in 2015 and beyond.

“We expect our businesses' top-line performance will continue to benefit from several recent product introductions, along with increases in production rates and capacity. Market acceptance of these products has been excellent, and as a result, our plan reflects revenue growth rates in 2015 to be in the range of 6 percent to 8 percent.

“Although category and regional strengths and weaknesses exist in the marine and fitness markets, the demonstrated resiliency of both marine participation and the overall commercial fitness market, combined with the continued successful execution of our growth strategy, give us the confidence that we can achieve the financial targets outlined in our 2016 plan, absent any additional significant changes in global macroeconomic conditions.

“Against the backdrop of our revenue targets, our 2015 plan reflects a slight improvement in gross margin levels and solid gains in operating margins. While we plan to continue to benefit from volume leverage and modest positive product mix factors, our sales and earnings growth will be affected by foreign exchange headwinds, both from a translation and competitive risk basis. In addition, earnings will be affected by: the absence of 2014 favorable warranty related adjustments; costs associated with production expansions and new product integration and ramp-ups; and continued increases in investments to support our strategic objectives. Operating expenses are estimated to increase in 2015; however, on a percentage of sales basis, are expected to be at slightly lower levels than 2014.

“Our guidance for 2015 reflects adjusted pretax earnings growth of 15 percent to 20 percent and diluted EPS, as adjusted, is estimated to be in the range of $2.70 to $2.85. Finally, for the full year, we expect to generate positive free cash flow in the range of $150 million to $170 million,” McCoy concluded.