Boot Barn Holdings, Inc. reported that net sales decreased 20.5 percent to $147.8 million in the first fiscal quarter ended June 27. Same-store sales decreased 14.9 percent, comprised of a 27.1 percent decrease in retail store same-store sales and a 51.9 percent increase in e-commerce sales. The decrease in retail store sales was primarily a result of decreased traffic in Boot Barn stores that resulted from customers staying at home in response to the COVID-19 crisis and temporary store closures.

Gross profit was $40.2 million, or 27.2 percent of net sales, compared to $62.2 million, or 33.5 percent of net sales, in the prior-year period. Gross profit decreased primarily due to decreased sales resulting from COVID-19. The decrease in gross profit rate of 630 basis points was driven by 430 basis points of deleveraging in buying and occupancy costs and a 200-basis point decline in merchandise margin rate. The deleverage in buying and occupancy costs was primarily a result of lower sales volume. Merchandise margin declined 200 basis points primarily as a result of outsized growth in the e-commerce channel as a percent of sales. Of the 200-basis point decline in merchandise margin, 160 basis points are attributable to the increased sales penetration of the lower merchandise margin e-commerce business and 30 basis points is related to a write-down of discontinued inventory at the recently acquired G&L Clothing work-only store.

Selling, general and administrative expenses were $38.4 million, or 26.0 percent of net sales compared to $46.1 million, or 24.8 percent of net sales, in the prior-year period. The decrease in selling, general and administrative expenses was primarily a result of lower store payroll, reduced marketing expenses and lower overhead. Selling, general and administrative expenses as a percentage of sales, increased by 120 basis points as a result of deleveraging from lower sales.

Income from operations decreased 88.8 percent to $1.8 million, or 1.2 percent of net sales, compared to $16.1 million, or 8.6 percent of net sales, in the prior-year period. This decline in income from operations is a result of the negative impact on sales, gross margin, selling, and general and administrative expenses due to COVID-19.

The net loss for the 13-week period was $0.5 million, or a loss of 2 cents per diluted share, compared to net income of $9.7 million, or 33 cents per diluted share, in the prior-year period. Net income per diluted share in the prior-year period includes a penny per share benefit due to income tax accounting for share-based compensation.

The company opened 5 new stores during the quarter.

Cash and cash equivalents increased to $83.1 million at quarter-end.

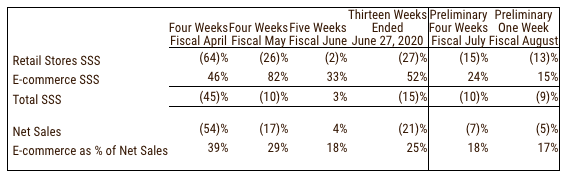

Company CEO Jim Conroy commented, “I am proud of how our organization has navigated through the difficulties created by COVID-19. We quickly adapted our operations to meet the current needs of our customers in stores and online while taking a number of precautionary measures. During our first fiscal quarter, we drove a sequential increase in same-store sales each month, improving from negative 45 percent growth in April to positive 3 percent growth in June. We also enacted operating expense reduction measures to help minimize the impact on our bottom line from the temporary slowdown in sales. Despite our lower sales volume, we were able to reduce our average comp-store inventory by 3 percent versus last year, which is a significant improvement from our year-end position. Selling through our inventory at a healthy margin allowed us to increase cash and reduce vendor accounts payable while maintaining our year-end debt levels. The significant reduction in inventory compared with the fiscal 2020 year-end balance, fueled a strong gain in operating cash flow compared to the prior-year period.”

Conroy continued, “As our second fiscal quarter got underway, we continued to see a strong correlation between our customer’s shopping behavior and the number of positive COVID-19 test results in their communities. While July got off to a slow start due to the resurgence in cases, same-store sales in our retail stores sequentially improved from mid-July through the first week of fiscal August as sentiment improved. With the exception of temporary store closures due to COVID-19, we are fortunate to have all of our stores open and believe we are well-positioned to reengage in growth when customer confidence and in-store shopping returns. We have the leading brand in our industry, an extremely loyal customer base, expanded omnichannel capabilities and a strong cash position. This combination should enable us to weather these unprecedented times and emerge even stronger post-COVID-19.”

Current Business

The following table includes same-store sales, net sales and e-commerce as a percentage of net sales for the periods indicated below:

Fiscal Year 2021 Outlook

The COVID-19 continues to adversely affect the company’s results. Due to the ongoing uncertainty created by the virus, the company is not providing its second quarter and fiscal year 2021 guidance at this time.

Photo courtesy Boot Barn