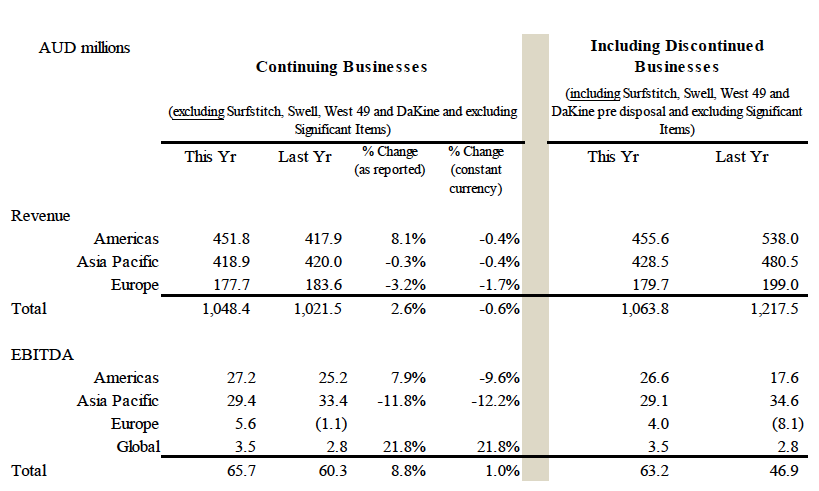

Billabong International Ltd. reported of a net profit of Australian $4.2 million in its year ended June 30 compared to a AUS$233.7 million loss for the previous corresponding period. Global revenue reached AUS$1.05 billion up 2.6 percent.

Highlights:

- Turnaround accelerating with Net Profit After Tax, including significant items and discontinued businesses (NPAT), for the year ending June 30, 2015 of $4.2 million compared to a $233.7 million loss for the previous corresponding period.

- Excluding significant items and discontinued businesses, EBITDA for the period was $65.7 million, up 8.8 percent. Global revenue of $1.05 billion was up 2.6 percent .

- Brand Billabong grew sales 13.1 percent in the U.S. wholesale market on a currency-neutral basis (c-n). RVCA currency-neutral sales grew 12.6 percent globally.

- Europe EBITDA reached $5.6 million, an increase of $7.0 million in currency-neutral terms with Element growing currency-neutral sales in its largest wholesale market by 5.6 percent.

- Asia Pacific EBITDA of $29.4 million down $4.1 million in currency-neutral terms due to retail results and the impact of exchange rates on input prices.

- Key projects to drive earnings improvement have progressed to implementation.

“Two years into our turnaround, Billabong is back to full-year profit and back to doing what it does best – building great global brands,” said Billabong CEO Neil Fiske. “Growth has returned in the key U.S. market and Europe is again profitable. Challenges remain but this result confirms our confidence in the resilience of our brands and provides the conviction to see through the complex changes we’re undertaking globally to deliver sustained, long-term profitable growth.”

The Group returned to full-year EBITDA growth for the first time since 2008 with the first full-year profit since 2011.

“For the full-year, brand Billabong saw strong growth in the U.S. wholesale market, with sales up 13.1 percent and accelerating in the second half,” said Fiske. “RVCA sales were up 15.3 percent over the last six months in the same channel and is surging globally. Element continues its growth in its largest market of Europe and the forward order book in the U.S. indicates the brand is on the way back. Retail around the globe was mixed as we continue to refine the fleet in advance of our omnichannel roll out, through exiting underperforming stores, consolidating multi-brand banners and investing in new and refurbished mono-brand stores.”

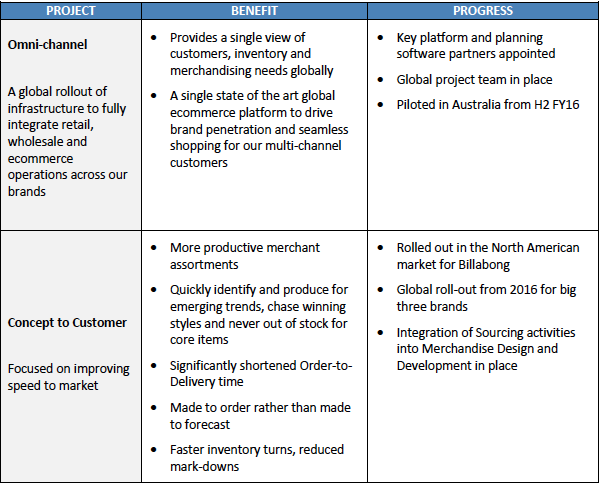

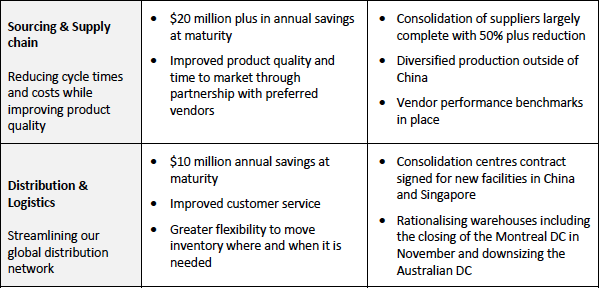

Fiske also provided an update on four major turnaround projects: Omnichannel, Concept to Customer, Sourcing and Supply Chain and Logistics and Distribution.

“Focused on better serving our brands, these four projects are moving from planning to implementation and execution. They are multi-phased global projects that will progressively drive earnings over the next several years and significantly improve the way all our customers interact with our brands,” said Fiske.

NPAT was $4.2 million compared to a loss of $233.7 million for the pcp.

EBITDA from continuing businesses of $65.7 million up from $60.3 million in the pcp. For the second six months of the year EBITDA of $22.9 million was up 49 percent from $15.3 million in the pcp.

Global revenue from continuing businesses of $1.05 billion for the full-year was up 2.6 percent on the pcp.

Regional overview:

The Americas EBITDA was $27.2 million for the year, with the second half EBITDA up 17.5 percent (cc) fueled by second half revenue growth from Billabong and RVCA in the key U.S. wholesale market.

Overall retail sales were down slightly on the back of store closures, with a 3.7 percent decline in brick-and-mortar comparable (comp) sales offset by a 35 percent (cc) growth in e-commerce revenue.

Reported at the interim results, the prior year earnings include a wholesale contribution from the West 49 business prior to its sale in February 2014. It was noted in the half year statement that the second half result in 2015 would be largely cycling the West 49 business on a comparable basis. Accordingly, whilst the first half effect remains, there is only minimal impact of the West 49 transaction in the second half comparison for this Americas result.

European EBITDA of $5.6 million compares to a loss of $1.4 million (cc) for the pcp, despite a 1.7 percent (cc) drop in overall revenue for the year.

The restructuring that has driven the improvement in Europe’s earnings after more than five years of decline has continued. The focus on better quality channels and sales continues to drive gross margin (up 650 bps for the year) and, despite a planned contraction in wholesale sales, the region has achieved retail sales growth of 2.9 percent on a comp store basis. These results have been achieved despite operational challenges with the Paris distribution facility.

Asia Pacific revenue was $418.9 million compared to $420.5 million (cc) for the pcp.

The region represents the Group’s largest retail footprint and will be the first market to adopt the new omnichannel platform. In advance of the roll out, the store fleet is being rationalized with the closure of 20 underperforming stores and consolidation of multi-brand stores in Australia under the Surf Dive ‘n’ Ski banner. At the same time, the Group opened 17 stores 12 Billabong, four Tigerlily and one multi-brand which have positively

contributed to the overall retail performance for the region.

Retail comp store sales for the year were down 3.2 percent across Asia Pacific which drove a $4.1 million (cc) reduction in overall EBITDA for the region. Despite the impact of a stronger U.S. dollar on input prices, overall gross margin was maintained.

Turnaround update:

The Group today provided an update on four major projects driving the turnaround.

“These projects are aligned with our seven-part turnaround strategy and are interlinked in ensuring that we quickly get the right product to the right markets in tune with what our customers want,” said Fiske.

“They are not only about driving a better brand experience for our followers but also providing operational savings that can be invested in marketing and growing those brands…To date we have identified $30 million in potential annual profit improvement from our global sourcing and logistics initiatives. We will begin to see benefits in FY16, however the lead times in the business mean the benefits will take several years to be fully realized.”

Details of the four major projects of Omnichannel, Concept to Customer, Sourcing and Supply Chain and Logistics and Distribution are set out in the table below.

“Our vision is simple strong global brands operating on global platforms. These four projects are critical for the long-term success of our brands. While this remains a complex, challenging turnaround in an uncertain economic environment, on balance more things are working for us than against us,” said Fiske.

2016 trading to date

Since the end of the financial year in the wholesale channel, the Group continues to see growth in forward order books around the globe consistent with the view that the big three brands are making progress. In retail, trading has been more mixed. In North America, the early part of back to school saw a slow start, not just for the Group, but for the sector as a whole. Europe, on the other hand, has been above expectations. The trend in Asia Pacific has been improving since year-end with trading broadly in line with the prior year.

The group results note a number of risk factors including the impact of currency on input prices and debt, and further disruption from the operational issues with the Paris distribution facility. However, the group does expect the benefits of supply chain and other initiatives to begin in the second half of FY16.

Company Secretary resignation

Joanna Brand resigned from the office of company secretary effective from 27 August 2015 as Tracey Wood has returned from maternity leave and will resume her role as international general counsel and company secretary.