Big 5 Sporting Goods Corp. reported earnings rose 4.0 percent in the second quarter on a 1.7 percent comp-store gain. Results were in line with previous guidance.

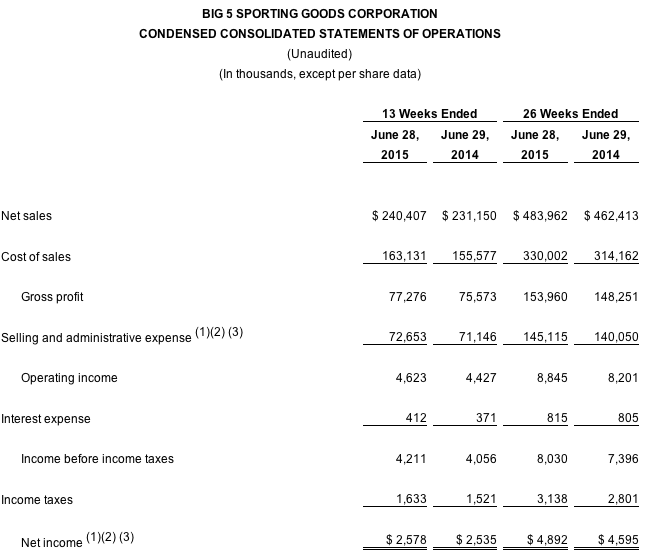

For the fiscal 2015 second quarter, net sales increased to $240.4 million from net sales of $231.2 million for the second quarter of fiscal 2014. Same store sales increased 1.7 percent for the second quarter of fiscal 2015.

Gross profit for the fiscal 2015 second quarter was $77.3 million, compared to $75.6 million in the second quarter of the prior year. The company's gross profit margin was 32.1 percent in the fiscal 2015 second quarter versus 32.7 percent in the second quarter of the prior year, reflecting a decrease in merchandise margins of 17 basis points and an increase in distribution and store occupancy costs as a percentage of net sales.

Selling and administrative expense as a percentage of net sales was 30.2 percent in the fiscal 2015 second quarter, versus 30.8 percent in the second quarter of last year. The company leveraged selling and administrative costs for the quarter despite a $1.6 million increase in overall selling and administrative expense from the prior year. The overall increase was due primarily to higher employee labor expense reflecting an increased store count, as well as expenses of $1.1 million related to the company's publicly-disclosed proxy contest which was settled prior to its annual meeting of stockholders, partially offset by a decrease in advertising expense.

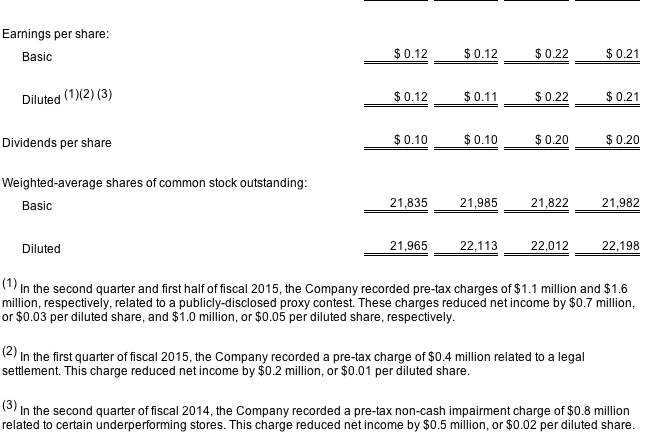

Net income for the second quarter of fiscal 2015 was $2.6 million, or 12 cents per diluted share, including $0.03 per diluted share of charges for expenses associated with the company's proxy contest, compared to net income for the second quarter of fiscal 2014 of $2.5 million, or 11 cents per diluted share, including a non-cash impairment charge of $0.02 per diluted share.

In reporting first-quarter results, the company said it expected same store sales to increase in the low to mid-single-digit range, while earnings per diluted share were expected in the range of 12 to 17 cents a share, excluding costs incurred related to a publicly-disclosed proxy contest.

For the 26-week period ended June 28, 2015, net sales increased to $484.0 million from net sales of $462.4 million in the comparable period last year. Same store sales increased 2.8 percent in the first 26 weeks of fiscal 2015 versus the comparable period last year. Net income was $4.9 million, or $0.22 per diluted share, including $0.06 per diluted share of charges for a legal settlement and expenses associated with the company's proxy contest, for the first 26 weeks of fiscal 2015, compared to net income of $4.6 million, or $0.21 per diluted share, including $0.02 per diluted share of non-cash impairment charges, for the first half of fiscal 2014.

“We are pleased to deliver improved sales and earnings growth for the second quarter,” said Steven G. Miller, the company's chairman, president and CEO. “Despite cycling against the soccer-related business generated by last year's men's World Cup, and facing the ongoing economic and recreational impact of the well-publicized drought in our core California markets, we were able to generate same store sales increases in each of our major product categories of apparel, footwear and hardgoods during the period. While these headwinds have continued to impact our third quarter, we remain encouraged by the strength we are experiencing across a number of product categories. We believe we have a strong promotional plan in place to generate positive same store sales for the period.”

Quarterly Cash Dividend

The company's board of directors have declared a quarterly cash dividend of $0.10 per share, which will be paid on September 15, 2015 to stockholders of record as of September 1, 2015.

Share Repurchases

In the second quarter of fiscal 2015, the company repurchased 20,200 shares of its common stock for a total expenditure of $0.3 million. For the year-to-date period through June 28, 2015, the company repurchased 96,273 shares of its common stock for a total expenditure of $1.2 million. As of June 28, 2015, the company had $5.9 million available for future share repurchases under its $20.0 million share repurchase program.

Guidance

For the fiscal 2015 third quarter, the company expects same store sales to increase in the low single-digit range and earnings per diluted share to be in the range of $0.28 to $0.34.

Store Openings

During the second quarter of fiscal 2015, the company opened three new stores and closed one store, ending the quarter with 439 stores in operation. During the fiscal 2015 third quarter, the company currently anticipates opening one new store and closing one. For the fiscal 2015 full year, the company currently anticipates opening approximately eight to ten new stores and closing approximately six stores.