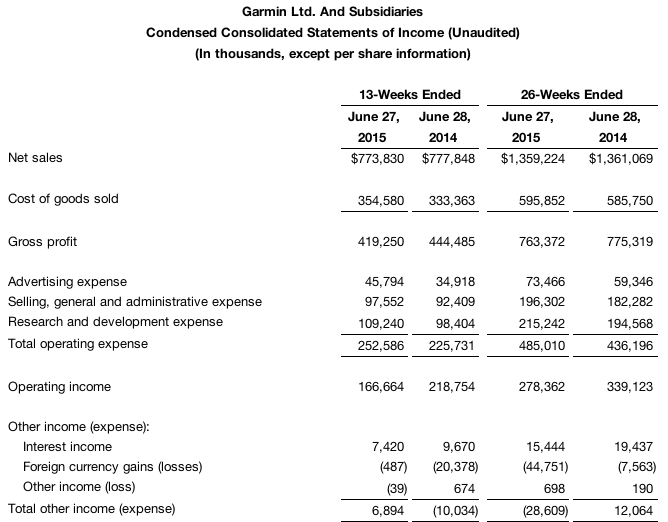

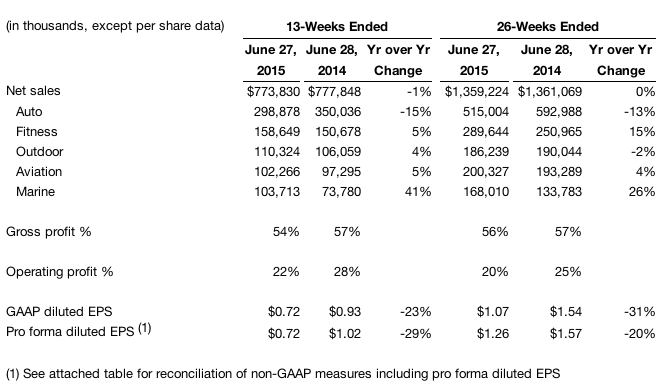

Garmin Ltd. reported sales grew 5 percent in its Fitness segment, driven by activity trackers and multisport products. Outdoor segment revenues grew 4 percent.

Summary items for the quarter include:

- Total revenue of $774 million in the second quarter of 2015 with fitness, outdoor, aviation and marine delivering 61 percent of total revenue and collectively growing 11 percent over the year ago quarter

- The relative strength of the US Dollar compared to other major currencies negatively impacted revenue by approximately $59 million, or 8 percent, in the second quarter of 2015

- Gross and operating margins were 54 percent and 22 percent, respectively, and were impacted by unfavorable currency movements and the higher mix of promotional products sold during the quarter

- Shipped over 4 million units in the quarter, an 8 percent increase over the year ago quarter

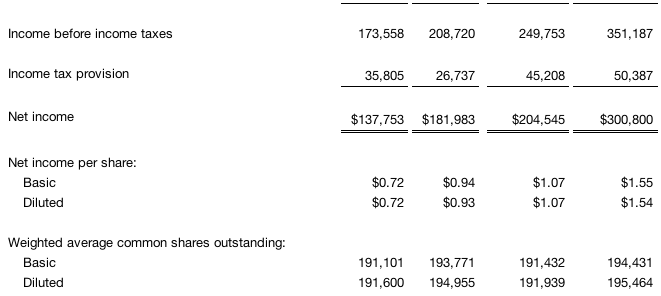

- GAAP and pro forma EPS of $0.72 for second quarter 2015

- Launched the Forerunner 225 with wrist-based heart rate monitoring, camera enabled nüvi and dēzl models, and the Edge 20/25, the world’s smallest GPS enabled bike computers

“Like many global companies, Garmin has experienced downward revenue and profit pressure due to recent unfavorable currency movements. In light of this reality, we feel positive about our first half revenue performance,” said Cliff Pemble, president and CEO, Garmin Ltd. “With our ongoing research and development efforts and exciting advertising plans, we believe that the foundation for long-term success is being established now.”

Fitness:

The fitness segment posted revenue growth of 5 percent in the quarter driven by activity trackers and multisport products. While the growth rate is below that of recent quarters, Garmin experienced significant sell-in during the second quarter of 2014 as they established retail presence in the mass-market activity tracker category.

Gross margin fell to 56 percent in the quarter, while operating margin declined to 21 percent. The gross margin decline was driven by both the unfavorable currency movements and competitive pricing dynamics in the activity tracker category. The operating margin decline reflects the significant investment in advertising and research and development to support long-term goals in the segment. The company believes these investments are appropriate and timely given the sizeable opportunity that exists in the global fitness and wellness industries.

During the quarter, Garmin introduced the Edge 520, which adds Strava segment integration and smart notifications when paired to a smart phone. Also introduced in the quarter was the Varia family of cycling products, including smart lights and radar, which are new product categories for Garmin.

Outdoor:

The outdoor segment posted revenue growth of 4 percent in the quarter, accelerating as forecasted, as supply constraints eased. Gross and operating margins within the segment were largely consistent with the prior year at 61 percent and 34 percent, respectively. While gross margin was comparable to the prior year, it is below historical levels. In the second quarter of 2015, unfavorable currency movements created downward pressure, while the second quarter of 2014 was negatively impacted by inventory reserves. During the quarter, Germin upgraded its best-selling eTrex series of outdoor handhelds, including the addition of affordably priced touchscreen models and our Rino two-way radios, allowing for a communication range of up to 20 miles.

Aviation:

The aviation segment posted revenue growth of 5 percent in the second quarter of 2015 driven by solid aftermarket results. The gross margin in aviation remains strong at 73 percent, while operating margin declined slightly year-over year to 27 percent due to growth in research and development to support future revenue opportunities.

Aviation is largely unaffected by unfavorable currency movements as most revenues and costs are denominated in U.S. Dollars. Overall industry trends continue to be difficult with the General Aviation Manufacturers’ Association reporting a first quarter decrease in new aircraft sales of 15 percent. Thus, Garmin saw growth rates slow in the first half of the year and is reducing full year revenue guidance to 5 percent growth. While this is not ideal, stronger market share positions Garmin well if the industry experiences near term weakness.

The company remains excited about the recent certification of the Cessna Latitude and numerous other certifications that will take place over the next few years, which will drive an improved long-term position in this highly profitable segment.

Marine:

The marine segment posted revenue growth of 41 percent in the quarter as the response to new products was strong. Garmin also continued to benefit from its third quarter 2014 acquisition of Fusion Electronics.

Gross margin declined year-over-year to 56 percent in the quarter as the effects of unfavorable currency movements and the mix of lower margin Fusion products were largely offset by a higher mix of new products with less discounting and higher margin profiles. Even with the currency driven gross margin pressure, operating income grew 35 percent in the segment. Given the positive results in the first half of the year, Garmin is raising full year revenue growth guidance for the marine segment to 15 percent.

Auto:

The auto segment posted a revenue decline of 15 percent as PND sales continued to decline and the contribution of amortization of previously deferred revenue fell as expected. Gross and operating margins in the quarter were 44 percent and 15 percent, respectively. The gross margin decline resulted from unfavorable currency movements and a reduced contribution from deferred revenue. The industry volume trends have been consistent with our expectations and pricing continues to be stable on a constant currency basis. The recently introduced nüviCam and dēzlCam, including a built-in dash cam and advanced alerts like forward collision and lane departure awareness, have been positively reviewed by many in the media and early indications are that these are also being well-received by consumers.

Additional Financial Information:

Total operating expenses in the quarter were $253 million, a 12 percent increase from the prior year. Research and development investment increased 11 percent with growth primarily focused on aviation and active lifestyle products in fitness and outdoor. Advertising increased 31 percent driven primarily by our wearables advertising campaign and continued growth in point-of-sale presence with key retailers. Selling, general and administrative expense increased by 6 percent driven largely by legal related expenses, product support and information technology costs.

The effective tax rate in the second quarter of 2015 was 20.6 percent compared to 12.8 percent in the prior year, negatively impacting earnings per share by $0.07. The increase in effective tax rate resulted from the reduced income projection for 2015, which negatively impacts geographic income mix, and a $4 million reduction in favorable tax reserves released on a year-over-year basis.

Garmin continued to return cash to shareholders with its quarterly dividend of approximately $92 million and share repurchase activity, which totaled $41 million in the second quarter. The company has $243 million remaining in the share repurchase program authorized through December 31, 2016, and expects to actively purchase throughout the remainder of the year as market conditions warrant. Garmin ended the quarter with cash and marketable securities of over $2.4 billion following the payment of $183 million of tax liability associated with its inter-company restructuring announced in third quarter of 2014.

2015 Guidance:

The global currency situation is expected to continue to create downward pressure on revenue growth and profitability for the remainder of the year. In addition, Garmin expects to incur higher advertising costs in the back half of 2015, in order to further solidify its position in key markets. As pre-announced, Garmin updated guidance to reflect these factors. They continue to anticipate revenues of approximately $2.9 billion, which is unchanged from previous guidance despite the approximately $160 million of currency driven impact that is now built into the forecast. Due to unfavorable currency movements and competitive pricing dynamics in fitness, the company now expects gross margin in the range of 54-55 percent with additional advertising resulting in an expected operating margin of 20-21 percent. The expected effective tax rate increases to 18-19 percent due to lower operating income and geographic income mix. The result of these changes is expected pro forma EPS of approximately $2.65.