The Beachbody Company, Inc. (BODi) Co-Founder and CEO Carl Daikeler said first quarter results marked the first full quarter in the company’s new business model, and was pleased to have exceeded expectations.

“We continue to generate higher margin revenue streams, with first quarter gross margins at their highest level in five years,” he said. “We have made significant progress in broadening our go-to-market strategy, opening new channels of distribution that were not previously available to us. This multi-channel opportunity will allow us to reach more of our addressable market while leveraging our cost structure.”

“In addition, we are thrilled to announce a new lending agreement with Tiger Finance for a $25 million, 3-year committed loan facility that we executed on May 13, 2025. This financing allowed us to retire $17.3 million of outstanding debt on May 13, 2025, while also adding approximately $5 million of capital to our balance sheet. We are excited about our new partner, Tiger Finance, and their conviction with the BODi business plan over the next three years.

“While we are pleased with our first quarter results, 2025 will be a transition year for the company, and it will take time for our strategic initiatives to take hold. However, with our new business model in place, I am very excited about the opportunities to optimize our top-line potential, positioning us for long-term success.”

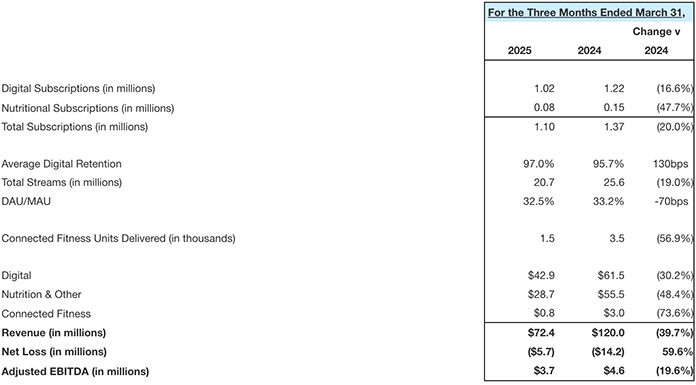

First Quarter 2025 Results

- Total revenue was $72.4 million compared to $120.0 million in the prior year period.

- Digital revenue was $42.9 million compared to $61.5 million in the prior year period, and digital subscriptions totaled 1.02 million in the first quarter.

- Nutrition and Other revenue was $28.7 million compared to $55.5 million in the prior year period, and nutritional subscriptions totaled 0.08 million in the first quarter.

- Connected Fitness revenue was $0.8 million compared to $3.0 million in the prior year period, and approximately 1,500 bikes were delivered in the first quarter.

- Total operating expenses were $55.2 million compared to $92.1 million in the prior year period.

- Operating loss improved by $7.1 million to $3.7 million compared to an operating loss of $10.8 million in the prior year period.

- Net loss was $5.7 million compared to a net loss of $14.2 million in the prior year period.

- Adjusted EBITDA was $3.7 million compared to $4.6 million in the prior year period.

- Cash provided by operating activities for the three months ended March 31, 2025 was $2.3 million compared to cash provided by operating activities of $9.1 million in the prior year period, and cash used in investing activities was $0.7 million compared to cash provided by investing activities of $3.9 million in the prior year period. Free cash flow was $1.6 million compared to $7.4 million in the prior year period.

New Lending Agreement

BODi announced a $35.0 million, 3-year loan facility on May 14, which includes a $10.0 million uncommitted accordion. The company borrowed $25.0 million on May 13, 2025 and used the proceeds to fully retire the $17.3 million of outstanding debt with Blue Torch Capital as of the repayment date of May 13, 2025, ahead of the February 2026 maturity date of that loan, and provided the company approximately $5 million in additional capital on the balance sheet.

Key Operational and Business Metrics

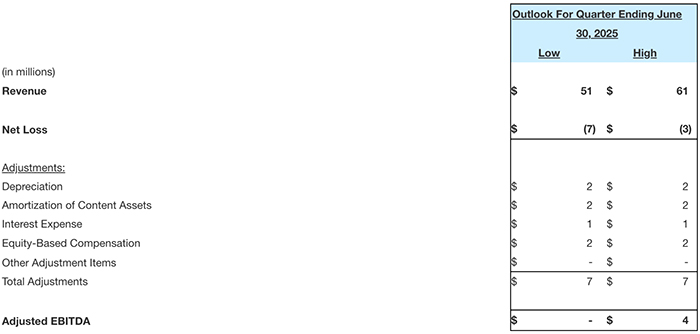

Outlook for The Second Quarter of 2025

Known initially as Beachbody, BODi, founded in 1999, is a home fitness and nutrition company. Brands in its portfolio include P90X, Insanity, 21-Day Fix, plus the nutrition supplement, Shakeology.

Image courtesy BODi/P90X