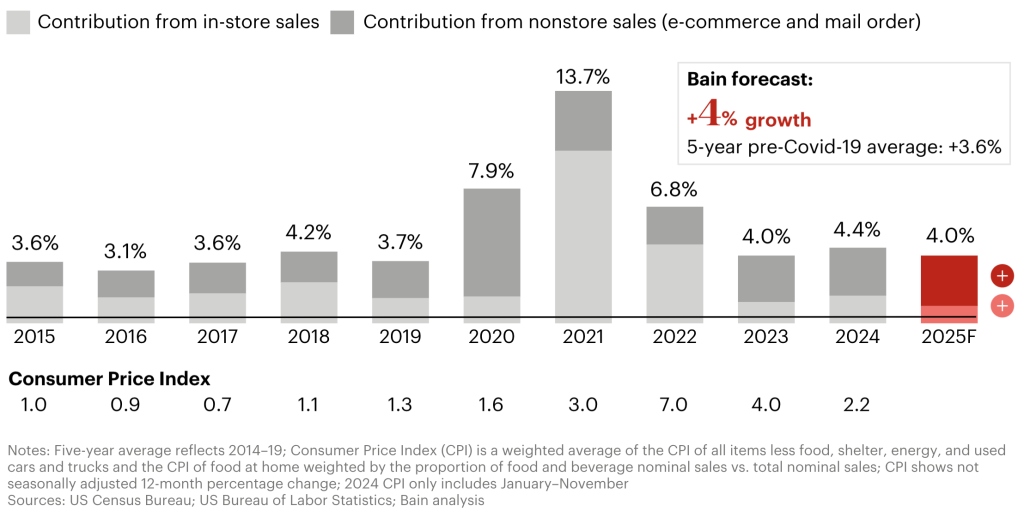

The 2024 retail fiscal year has yet to close; however, Bain & Company (Bain) has forecasted 4 percent year-over-year growth for the 2025 fiscal year. The firm sees total U.S. retail sales amounting to $5.2 trillion in 2025, driven by a 10 percent surge in e-commerce and 2 percent brick & mortar, or in-store, growth.

“While headwinds remain, opportunities such as potential interest rate cuts, tax incentives and momentum from a strong 2024 holiday season suggests that 2025 may be a year in which innovative moves can set the stage for lasting success,” Bain said in its 2025 forecast report. “The retailers that win a disproportionate share of this growth will proactively seize opportunities rather than simply react to challenges,” Bain continued in the report’s introduction. Artificial intelligence can help, but adopting it simply to check a box won’t be enough. Bain explores how the real power lies in harnessing AI for the strategies that matter most and five resolutions retailers should keep top of mind in 2025.”

Bain suggests in the report that retailers face a pivotal moment in 2025.

“The challenges of shifting consumer behaviors and demands, economic volatility, regulatory changes, and trade complexities persist, reshaping the retail game. Successful businesses will go beyond the familiar, tapping into cutting-edge technologies, reimagining loyalty programs and fortifying supply chains against an unpredictable global backdrop,” the firm wrote in the report.

Bain’s outlook for 2025 is seen as a stronger-than-expected view by some, given a stagnant consumer outlook, tempering inflation, negative year-over-year employment trends, diminishing consumer savings, rising credit card delinquencies, elevated non-discretionary costs, and potential trade disruptions, as well as the potential disruptions caused by a new U.S. Administration and the recent AI revelations from China that has disrupted the U.S. technology sector.

Year-over-Year Nominal U.S. Retail Sales Growth

(Figure 1)

Bain said the retailers that win a disproportionate share of this growth will proactively seize opportunities rather than simply react to challenges. “Artificial intelligence can help, but adopting it simply to check a box won’t be enough. The real power lies in harnessing AI for the strategies that matter most,” the firm said in the report.

Bain outlined its Top 5 resolutions that successful retailers will focus on in 2025 and beyond. SGB is outlining a few of those resolutions for the report here and readers can find the full report and other resources here.

Top 5 for 2025

- Earn your spot atop consumers’ shopping lists

- Win hearts to win wallets

- Modernize your supply chain for resilience

- Reimagine cost efficiency with tech and AI

- Turbocharge beyond-trade profits

Top 2 Explained

1. Earn Your Spot Atop Consumers’ Shopping Lists

Scale players like Walmart and Amazon, with their endless assortments, along with Costco, have become the go-to for many shoppers, accounting for 57 percent of retail growth over the last three quarters and 17 percent of total US retail sales in 2024—a 6-percentage-point increase from 2014. Competing directly with these giants is harder than ever. But by crafting a unique value proposition, retailers can carve out a winning position alongside them and capture significant rewards.

A clear and compelling value proposition starts with the fundamentals, be it fast shipping, consistent quality, or reliable digital experiences. Miss here, and irrelevance is almost inevitable. But to truly stand out, retailers must go further. Success hinges on being best in class in at least one (if not two or three) attributes that matter most to your target customers and are tailored to their specific need or occasion. Leaning into these priorities allows retailers to break through traditional trade-offs and expand the value frontier, delivering experiences that surprise, delight, and differentiate.

Consider how Costco earned its leading position by pairing two rare attributes—low prices and high quality—with an innovative system that limits assortment and optimizes efficiency. The retailer has created a value proposition that’s both differentiated and defensible.

With cost of living ranking as global consumers’ top concern, delivering on value has never been more urgent. Bain research shows that retailers with strong value perception consistently outperform peers on financial metrics (see Figure 2).

Retailers with Better Value Perception Among Consumers Outperform Across Financial Metrics

(Figure 2)

Bain said product and pricing are at the core of the systems that make these value propositions tangible:

Assortments. In our experience, balanced assortments that cater to customer preferences can boost sales by 2 percent to 5 percent. Private brands are becoming an especially powerful tool, adding value through exclusivity. Bain research shows high-performing private brands can boost grocer share of wallet by 12 percentage points.

Pricing and promotions. Strong value perception doesn’t always mean chasing the lowest price. Retailers with a competitive advantage build structured pricing architectures that align with their customer and product strategies, balancing margin growth and market share. Personalized promotions tailored to individual preferences can further enhance value perception and influence buying behavior—ultimately improving ROI.

Winning retailers like Trader Joe’s use these merchandising elements to show a deep understanding of what customers value most. The grocer’s curated assortments, innovative private brand products, and resonant brand identity inspire exceptional loyalty. Trader Joe’s proves that value creation is about more than just price; it’s about building a differentiated proposition that keeps customers coming back.

2. Win Hearts to Win Wallets

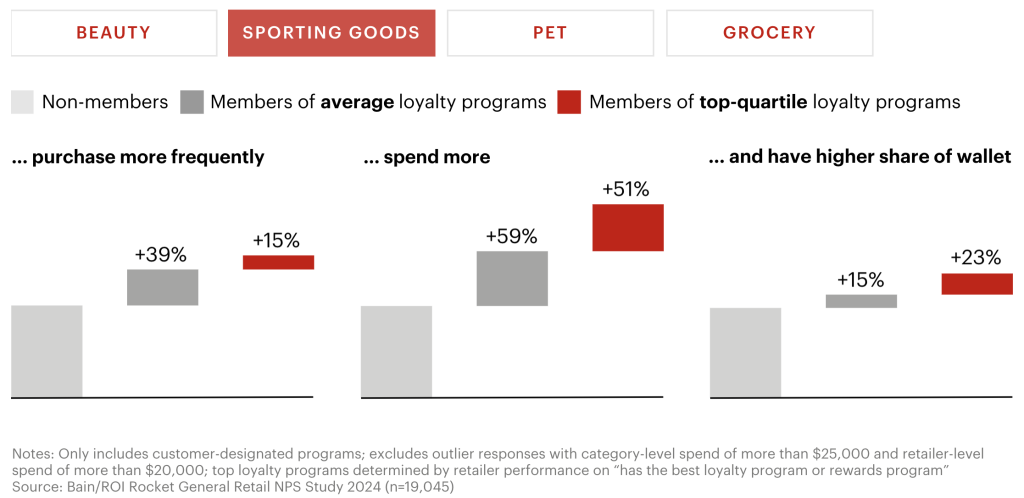

Loyalty isn’t bought, it’s earned. The best programs have evolved from nice-to-have perks into strategic assets. The payoff? Loyalty program members purchase more frequently, spend more, and have a higher share of wallet than others (see Figure 3). SGB Media focused on Bain’s assessment of the sporting goods retail business here, which includes the outdoor sector.

Across Retail Categories, Fostering Loyal Customers Pays Off

(Figure 3)

Members of top-quartile loyalty programs that…

But simply having a loyalty program isn’t enough. Over one-third of U.S. online adults don’t regularly participate in most of the loyalty programs they join and frequently forget to use the programs they belong to.

The most effective programs move beyond mere discounts and bonus points to earn genuine, lasting loyalty. It isn’t just about financial incentives. It’s about creating an emotional connection through tailored experiences, exclusive benefits, and a sense of belonging that consumers can’t find elsewhere. By leveraging rich customer data and cutting-edge tools, including AI, retailers can design relevant, personalized journeys that transform one-time buyers into passionate lifetime advocates.

Sephora’s Beauty Insider program exemplifies emotion-driven loyalty. Combining transaction data with information such as details about a shopper’s unique complexion and brand preferences from tools like Shade Finder and the AR-powered Virtual Artist, Sephora personalizes recommendations and homepages for loyalty members. Sephora also uses these insights to elevate in-store experiences, including offering access to early sales and exclusive events. As a result, Beauty Insiders report making 58 percent more purchases annually and spending more than twice as much as non-members. They also command a 63 percent higher share of wallet, per our annual study with ROI Rocket.

To read more and dig into all of Bain’s recommendations for 2025, go here.

The Common Thread

A common thread ties Bains Top 5 resolutions together. Data.

“Having quality data—and the ability to harness it effectively—is the only way to succeed at these strategic imperatives,” the firm said. “It’s well worth the investment: Retailers with strong data strategies have outpaced their peers, achieving twice the revenue growth and four times the profitability growth from 2020 to 2023.”

By unlocking the ability to reshape loyalty, refine supply chains, advance technology, and fuel beyond-trade growth, proactive, data-savvy retailers will not just survive in these changing times. They will thrive.

Image courtesy Adobe Stock; Data, analysis, graphics courtesy Bain & Company