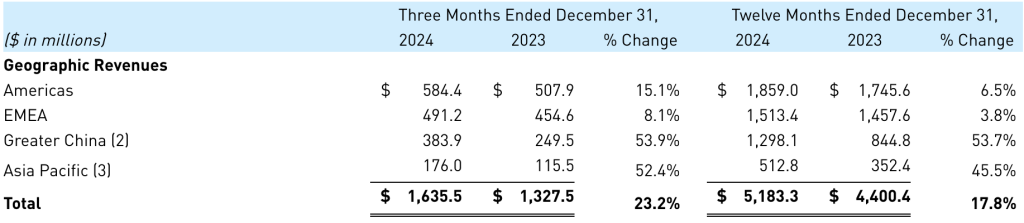

Amer Sports Inc., the parent company of the Arc’teryx, Salomon and Wilson Sports businesses, reported fourth-quarter 2024 revenue increased 23 percent to $1.64 billion. Revenue jumped 24 percent on a constant-currency (cc) basis. The company saw continued strong results in Greater China and Asia Pacific, accelerating growth in North America and EMEA.

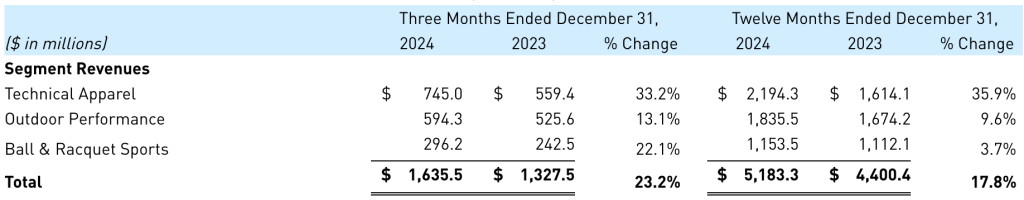

Fourth Quarter Segment Summary

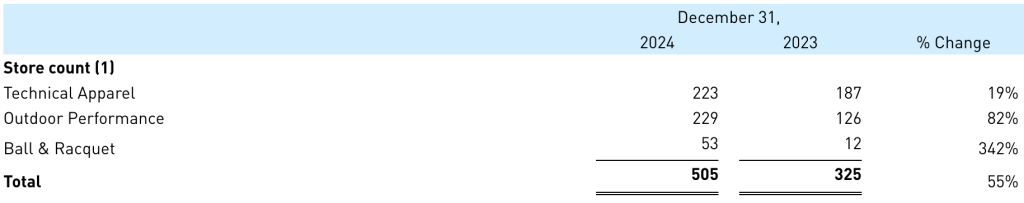

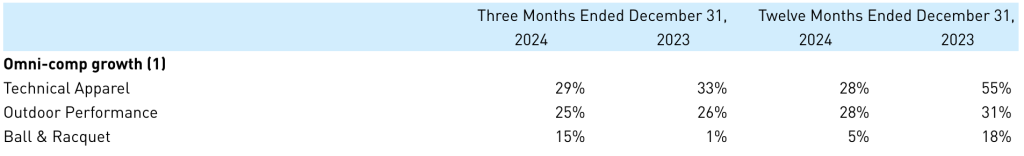

- The Technical Apparel segment, which includes the Arc’teryx and Peak Performance brands, increased 33 percent (+34 percent cc) to $745 million. The company said this reflects an omni-comp growth of 29 percent. Technical Apparel Adjusted operating margin increased 130 basis points to 24.3 percent of segment revenue.

- The Outdoor Performance segment, which includes Salomon, Atomic and Armada, increased 13 percent (+14 percent cc) to $594 million. Salomon Softgoods growth accelerated across every region. Segment Adjusted operating margin increased 190 basis points to 11.1 percent of segment revenue.

- Ball & Racquet Sports, which includes Wilson Sports, Evoshield and Louisville Slugger, increased 22 percent (+23 percent cc) to $296 million in the fourth quarter, led by Wilson Tennis 360. Segment Adjusted operating margin increased 660 basis points to negative 3.7 percent of segment revenue.

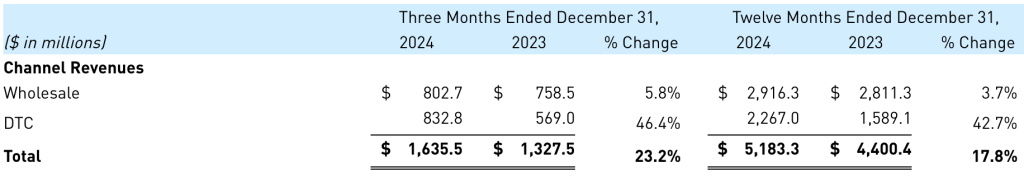

E-Commerce and Owned-Retail Breakdown

Omni-comp growth reflects year-over-year revenue growth from owned retail stores and e-commerce sites that have been open for at least 13 months.

Income Statement Summary

Gross margin increased 370 basis points to 56.1 percent of consolidated revenue. Adjusted gross margin increased 370 basis points to 56.4 percent of consolidated revenue.

Selling, general and administrative (SG&A) expenses increased 13 percent to $732 million. Adjusted SG&A expenses increased 24 percent to $708 million.

Operating profit increased 224 percent to $194 million in Q4. Adjusted operating profit increased 63 percent to $223 million. Operating margin increased 730 basis points to 11.8 percent of consolidated revenue. Adjusted operating margin increased 330 basis points to 13.6 percent of consolidated revenue.

Net income increased 117 percent to $15 million, or 3 cents per diluted share. Adjusted net income increased 388 percent to $90 million, or 17 cents per diluted share.

“Fourth quarter was a great finish to a historic year for Amer Sports Group, with strong performance across all segments and geographies,” offered company CEO James Zheng. “Led by Arc’teryx, our unique portfolio of premium technical brands continues to create white space and take market share with long growth runways still ahead. Given the strong sports and outdoor trend globally and our still under-penetrated brands, I am confident that our talented management team is well positioned to deliver strong results in 2025 and beyond.”

Fiscal 2024 Summary

For the fiscal year 2024, compared to fiscal year 2023, revenue increased 18 percent (+19 percent cc) to $5.18 billion.

- Revenues by segment:

- Technical Apparel increased 36 percent (+38 percent cc) to $2.19 billion. This reflects an omni-comp growth of 28 percent.

- Outdoor Performance increased to $1.84 billion, which represents 10 percent growth on both a reported and constant-currency basis.

- Ball & Racquet Sports revenue increased to $1.15 billion, which represents 4 percent growth on both a reported and a constant currency basis.

- Gross margin increased 290 basis points to 55.4 percent. Adjusted gross margin increased 290 basis points to 55.7 percent.

- Selling, general and administrative expenses increased 21 percent to $2,430 million. Adjusted selling, general and administrative expenses increased 23 percent to $2,341 million.

- Operating profit increased 56 percent to $471 million. Adjusted operating profit increased 33 percent to $577 million, including $24 million of government subsidies received in 2024 compared to $4 million received in 2023.

- Operating margin increased 220 basis points to 9.1 percent. Adjusted operating margin increased 130 basis points to 11.1 percent.

- Adjusted operating margin by segment:

- Technical Apparel increased 150 basis points to 21.0 percent.

- Outdoor Performance increased 40 basis points to 9.4 percent.

- Ball & Racquet Sports decreased 70 basis points to 2.1 percent.

- Net income/(loss)increased 135 percent to $73 million, or 14 cents per diluted share. Adjusted net income increased 329 percent to $236 million, or 47 cents per diluted share.

Balance Sheet Summary

Year-over-year inventories increased 11 percent to $1,223 million. Net debt 3 was $591 million, and cash and cash equivalents totaled $345 million at year end.

Outlook

“With over 20 percent revenue growth, healthy margin expansion, significant free cash flow generation, and the transformation of our capital structure, the fourth quarter of 2024 marked a financial turning point in Amer Sports’ journey,” company CFO Andrew Page commented. “Although foreign currency exchange headwinds will weigh slightly on our 2025 financial results, continued strong momentum from our highest-margin Arc’teryx franchise and accelerating momentum in Salomon footwear, plus strong and stable positions from our market-leading Hardgoods franchises, gives me confidence that Amer Sports is well positioned to deliver another year of strong and profitable growth in 2025.”

Full-Year 2025 Outlook

Amer Sports is providing the following guidance for the year ending December 31, 2025. All guidance figures reference adjusted amounts.

- Reported revenue growth: 13 percent to 15 percent, which assumes a 250 basis point drag from unfavorable Fx impact at current exchange rates.

- Gross margin: 56.5 percent to 57.0 percent of revenue

- Operating margin: 11.5 percent to 12.0 percent of revenue

- D&A: approximately $350 million, including approximately $180 million of ROU depreciation

- CapEx: approximately $300 million

- Net finance cost: approximately $120 million

- Effective tax rate: approximately 33 percent

- Fully diluted share count: approximately 560 million

- Fully diluted EPS: 64 cents to 69 cents per share

Segment Outlook for 2025

- Technical Apparel (Arc’teryx): Revenue growth of approximately 20 percent. Segment operating margin approximately 21 percent

- Outdoor Performance (Salomon): Revenue growth of low-double-digits. Segment operating margin approximately 9.5 percent

- Ball & Racquet (Wilson Sports): Revenue growth of low- to mid-single-digits. Segment operating margin 3 percent to 4 percent

First Quarter 2025

Amer Sports is providing the following guidance for the first quarter ending March 31, 2025. Aall guidance figures reference adjusted amounts.

- Reported revenue growth: 14 percent to 16 percent, which assumes a 300 basis point drag from unfavorable Fx impact at current exchange rates

- Gross margin: 56.5 percent to 57.0 percent of revenue

- Operating margin: 11.0 percent to 11.5 percent of revenue

- Net finance cost: approximately $30 million

- Effective tax rate: approximately 33 percent

- Fully diluted share count: approximately 560 million

- Fully diluted EPS: 14 cents to 15 cents per diluted share

Other than revenue, Amer Sports only provides guidance on a non-IFRS basis. The company does not provide a reconciliation of forward-looking non-IFRS measures to the most directly comparable IFRS Accounting Standards measures due to the difficulty in forecasting and quantifying specific amounts necessary for such reconciliations without unreasonable efforts.

Image courtesy Amer Sports/Arc’teryx