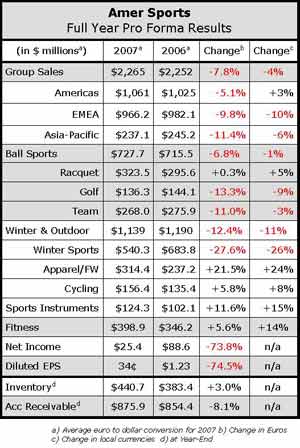

Amer Sports ended a tough year with a tough fourth quarter  as the dismal winter season last year left retailers overstocked on inventory and unprepared to make any re-orders this year. That weakness compounded soft results in the

as the dismal winter season last year left retailers overstocked on inventory and unprepared to make any re-orders this year. That weakness compounded soft results in the

To that end, the company has reorganized, reverting back to a category-centric business model, rather than the brand focus it had been running under. The most noticeable change here is the moving of the Atomic business into the Winter & Outdoor division with Salomon.

The company reported a 15% decrease in fourth quarter sales to 497.1 million ($720.0 mm) from 581.6 million ($750.0 mm) for the year-ago period. EBIT amounted to 53.7 million ($77.8 mm) before non-recurring expenses to the amount of 42.7 million ($61.9 mm) resulting from the reorganization of the Winter Sports equipment business were recorded for the period. Earnings per share were 0.02 (3 cents) or 0.47 (68 cents) excluding the non-recurring items.

For the fourth quarter, sales for the Winter & Outdoor division decreased 21.2%, or a decrease of 20% in local currencies, to 304.9 million ($441.6 mm) from 387.1 million ($499.2 mm) in the year-ago quarter. The sharp downturn in sales was derived from a 32.2% decrease in Winter Sports sales to 188.7 million ($273.3 mm) from 278.5 million ($359.1 mm) last year. Without the benefit of currency translation, sales decreased 31% for Winter Sports. The company reported that despite good snow conditions towards the end of the year, the volume of re-orders in Q4 remained low.

The Winter Sports decline more than offset gains in the Apparel and Footwear business, the Cycling business and the Sports Instruments business. Apparel and Footwear sales increased 14.4% to 60.2 million ($87.2 mm) as the Salomon brand continues to expand its presence in softgoods. The company said that sales of trail running shoes grew the fastest, though a small base likely had an effect here. In local currencies, Apparel and Footwear sales grew 14%. Cycling, or Mavic, sales increased 1.7% in euro terms to 30.4 million ($44.0 mm), or 4% in currency-neutral terms, while the Sports Instruments, or Suunto business, saw sales increase 11.0% to 25.3 million ($36.6 mm) or grew 14% without the effect of currency change.

The divisions EBIT for the fourth quarter dropped 37.5% to 35.2 million ($51.0 mm), or decreased 38% currency-neutral, while decreasing 55.7% for the full year to 20.9 million ($28.6 mm). EBIT decreased 57% for the full year in local currency terms. The decline was caused by a considerable softening of the demand in the Winter Sports equipment market.

For the year, EMEA accounted for 65% of Winter & Outdoor division sales, the

Amer said it expects sales and EBIT for the division to improve for 2008 with significant improvement in profitability expected for 2009 due to the companys efforts to integrate the Salomon business, especially the snow sports hardgoods businesses that overlap with Atomic. As a result, the manufacturing of skis is being moved from

The Wilson brand, which Amer is now calling its Ball Sports division, saw net sales decrease 4.0% for the fourth quarter to 107.0 million ($155.0 mm) from 111.5 million ($143.8 mm), but increased 4% in local currency terms. Sales growth in Racquet Sports was more than offset by declines in Team Sports and Golf.

Racquet Sports net sales continued to perform well, increasing 11% currency-neutral, or 5.3% in euro terms to 44.1 million ($63.9 mm) as tennis racket sales grew 8% in local currency terms, led by the [K] Factor product.

Team Sports net sales, which failed to reach objectives, Amer reported, increased 1% in local currency terms, but declined 9.2% in euro terms to 47.4 million ($68.7 mm) as a result of “softened demand for baseball products.”

Golf's net sales decreased 6% in local currency terms or 10.9% in euro terms to 15.5 million ($22.5 mm). In order to ensure the profitability of its golf business,

In Japan, Kasco Inc. began to distribute and license Wilson Golf products as of January 1, 2008. These reorganization measures are expected to provide annual savings of approximately $5 million. In total, approximately 100 staff positions were reduced as a result of the reorganization measures.

For the fourth quarter, the divisions EBIT jumped 53.8% to 8.0 million ($11.6 mm) or 5.2 million ($6.7 mm), while growing 58% in currency-neutral terms. EBIT for the full year decreased 5% in local currency terms or 12% in euro terms to 48.2 million ($66.1 mm). The decrease in EBIT was due to Team Sports sales falling short of expectations.

The

Sales are expected grow slightly and profitability is estimated to improve for 2008. The company expects the favorable development of Racquet Sports to continue, while the sales and volume of the Team Sports is expected to grow slightly. Golf will be in the black in 2008.

For the fourth quarter, Fitness division, or Precor, sales increased 2.7% to 85.2 million ($123.4 mm) from 83.0 million ($107.0 mm) in the year-ago quarter. In local currency terms, the divisions net sales grew 13% for the quarter. The company reported that sales grew faster than the market in

EBIT for Q4 increased 13% currency-neutral or 2.4% in euro terms to 13.0 million ($18.8 mm), while growing 6.9%, or 17% in local currency terms, to 37.2 million ($51.0 mm) for the full year. The company attributed the EBIT growth to investments in product development and continued improvements in production technology.

The

Precor is expected to continue to grow faster than the fitness market in 2008.

For 2008, company-wide net sales are expected to increase approximately 5% in local currencies. EBIT is estimated to amount to 100 million to 130 million, with earnings per share coming in at 0.75 to 1.00. These estimates are based on a dollar-euro exchange rate of $1.47.

>>>Makes you wonder how much of the baseball softness is related to Dicks Sporting Goods now specializing in three-striped bats and what The Sports Authority having Tommy Armour will do to Wilson Golf…