Amer Sports Group (Amer, Group) CEO James Zheng reported on Tuesday, May 20 that the company began 2025 with a great performance in the first quarter, delivering sales, adjusted margins, and EPS well above expectations. In other words, it wasn’t much different from other recent quarters. The big difference to many is while other companies have cancelled or cut guidance in light of the tariff talk besieging the marketplace, Amer Sports has been busy building their models to counter the impact of the expected tariffs, enabling the company to instead raise its full-year 2025 guidance.

To be fair, Amer is far less exposed to U.S. market issues than many other active lifestyle companies and has a far larger percentage of its business coming out of Asia and China than most others that are more U.S.-centric. The fact the company is majority owned by a major Chinese retailer should not be lost in the conversation. Also, Amer had the benefit of reporting a week or two or three after other companies in the space and was able to react to last weekend’s take-aways from the U.S.-China sit-down in Switzerland that saw the U.S. slice its 145 percent tariff on China goods shipping to the U.S. down to 30 percent – at least for 90 days – while setting a base tariff rate for all other countries at 10 percent. It’s all upside for Amer if the tariffs are pushed lower if further negotiations bear fruit for the non-U.S. countries during the 90-day period.

Regardless, Wall Street liked what it heard on Tuesday and rewarded Amer Sports Group with a 19 percent increase in share price for the day, closing at $37.37 per share, just shy of triple the IPO price from January 29 last year.

“Although we are off to a great start in 2025, given macro uncertainty related to U.S. tariffs, we are operating our business with discipline and flexibility,” offered Zheng in his prepared remarks on a conference call with analysts. “[CFO] Andrew [Page] will provide a more detailed discussion of our tariff exposure, mitigation strategies, and financial impacts, but I would like to emphasize that I believe we are very well positioned to manage through a wide range of tariff scenarios given our premium brands with pricing power, secular growth trends, and relatively low U.S. revenue exposure.

“Looking near- and long-term, we believe Amer Sports is a uniquely positioned company within the global sports and outdoor space,” Zheng noted.

He said several factors give him confidence for the rest of 2025 and “well beyond”:

- Amer owns and operates a unique portfolio of premium outdoor and sports brands. Each one is empowered by technical innovation and is positioned at the pinnacle of its segment.

“Our brands have high conversion and satisfaction, but are still small players with room to grow,” he said.

- Arc’teryx is a break-out growth story with great growth and profitability for the outdoor industry driven by its disruptive DTC model and unique competitive position.

“It is still very under-penetrated globally and still has a tremendous long-term growth opportunity.”

- The company believes Salomon sneakers have unique performance and design attributes.

The brand is experiencing accelerating momentum globally, but still has small market share of the global sneaker market.

- Wilson and the Winter Sports Equipment brands have authentic heritage, premium positioning, high performance products, and leading market positions.

“These high-marketshare brands will deliver slower long-term growth in their core equipment businesses, but they still have large Softgoods potential, especially Wilson Tennis 360,” Zheng noted.

- Amer believes it has a very strong, differentiated platform in Greater China, where it continues to deliver best-in-class performance with great momentum across all three big brands.

“We continue to achieve very strong growth in China, and there are several reasons why we are doing so well there, and are also confident in our future growth in this important consumer market,” company CFO Andrew Page said, further outlining the China opportunity:

- The company’s brands compete in one of the high-quality and fastest-growing consumer segments in China: the premium sports and outdoor market. The outdoor trend in China continues to be very robust, attracting younger consumers, female consumers, and luxury

shoppers. - The company is still small, specialized brands are known for their expertise, high quality, and technical innovation, which resonates with Chinese shoppers.

- Page said most importantly, the company has a great team in China. “Our deep expertise and unique, scalable operating platform gives us a significant competitive advantage across the portfolio,” he noted.

First Quarter 2025

The company reported 2025 first-quarter revenue increased 23 percent to $1.47 billion, a year-over-year (y/y) increase of 26 percent on a constant-currency (cc) basis. The strong Group sales performance was said to be led by both Technical Apparel and Outdoor Performance, while the Ball & Racquet segment also delivered very solid growth in the quarter.

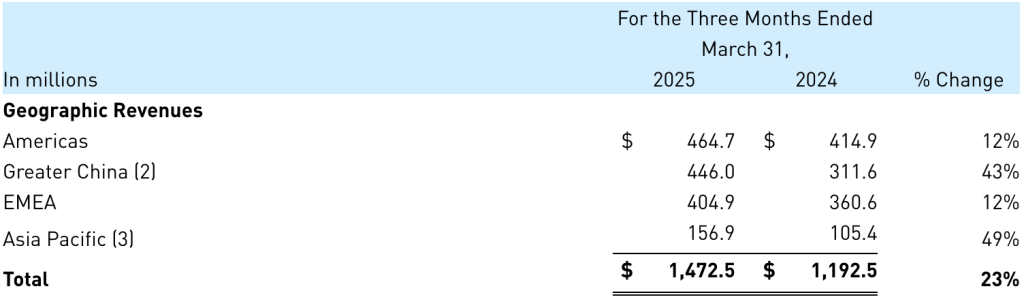

Region Revenues

Regional growth was led by Asia Pacific, which increased 49 percent y/y, followed by China, which grew 43 percent y/y. EMEA accelerated to 12 percent y/y growth, and the Americas grew 12 percent y/y in the first quarter.

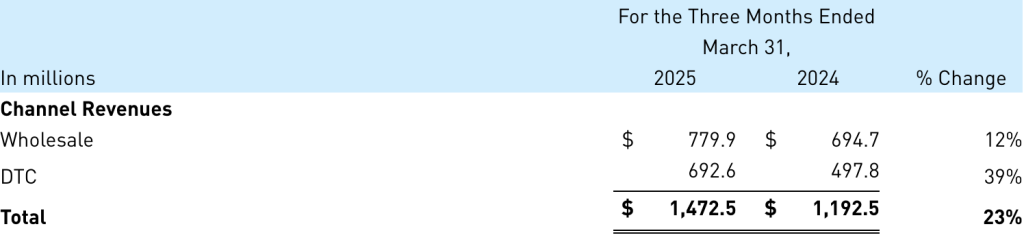

Channel Revenues

By channel, the Group continues to be led by DTC, which grew 39 percent led by Salomon footwear in Greater China and APAC. We also saw solid wholesale growth of 12 percent led by Arc’teryx.

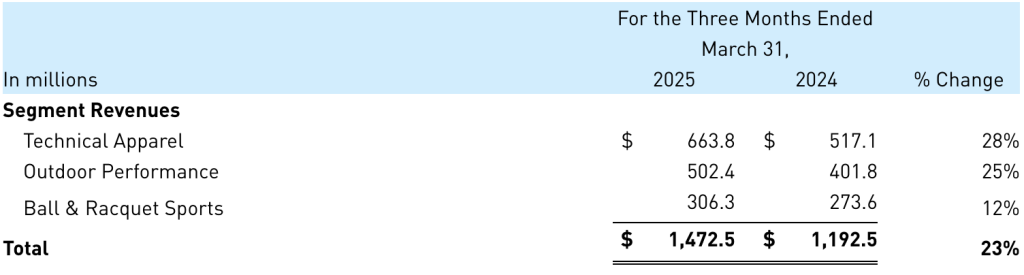

Segment Revenues

Technical Apparel, which includes the Arc’teryx and Peak Performance brands, increased 28 percent (+32 percent cc) year-over-year, generating $664 million in the first quarter. The company said strong trends at Arc’teryx continue across regions, channels and categories.

Amer said the year-over-year increase reflects an omni-comp growth of 19 percent y/y. Omni-comp growth reflects year-over-year revenue growth from owned retail stores and e-commerce sites that have been open at least 13 months.

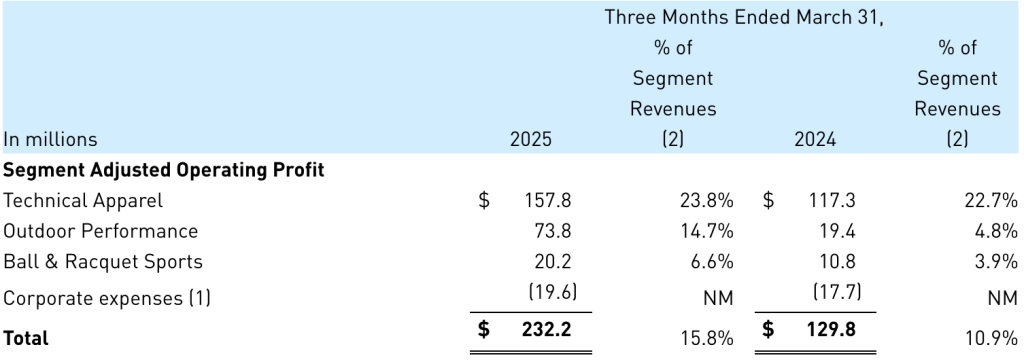

Adjusted segment operating profit increased 110 basis points y/y to 23.8 percent of segment sales in Q1 2025.

Outdoor Performance, which includes the Salomon and Atomic brands, posted an increase of 25 percent (+29 percent cc) year-over-year to reach $502 million in the quarter. The company said Salomon Footwear brand momentum accelerating globally and Winter Sports Equipment had a solid finish to Winter season.

Adjusted segment operating profit increased 990 basis points y/y to 14.7 percent of segment sales in Q1.

Go here for more detailed Salomon metrics and data and CEO/CFO commentary.

Ball & Racquet Sports, which includes Wilson Sports, grew 12 percent (+13 percent cc) to $306 million in the first quarter, compared to the prior-year Q1 period. Amer said the Ball & Racquet segment delivered healthy sales and profitability led by Wilson Tennis 360.

Adjusted segment operating profit increased 270 basis points y/y to 6.6 percent of segment sales.

Profitability & Expense Summary

Adjusted gross margin increased 330 basis points to 58.0 percent of net sales in Q1, said to be primarily driven by favorable channel, geographic, and product mix, as well as by lower discounts compared to the prior-year quarter. Reported gross margin increased 350 basis points to 57.8 percent of net sales.

“Going forward, we expect our highest gross margin franchise Arc’teryx, to continue to be the biggest underlying driver of our ongoing gross margin expansion,” Page added.

Adjusted selling, general and administrative (SG&A) expenses as a percentage of revenues leveraged by 160 basis points and represented 42.6 percent of revenues in the first quarter. Adjusted SG&A expenses increased 19 percent to $627 million. Reported SG&A expenses increased 18 percent y/y to $642 million.

Page said the Technical Apparel and Outdoor Performance segments each achieved SG&A leverage on “very strong growth,” which was partially offset by slight deleverage at Ball & Racquet due to ongoing investments in Tennis 360 and DTC growth.

“Driven by both gross margin expansion and SG&A leverage, we generated a 490 basis point increase in our adjusted operating margin from 10.9 percent last year to 15.8 percent in Q1,” Page reported. Company reported operating profit increased 97 percent to $214 million in Q1.

Operating margin increased 540 basis points y/y to 14.5 percent of net sales. Adjusted operating margin increased 490 basis points to 15.8 percent in Q1.

Adjusted corporate expenses were $19 million, up from $17 million in Q1 of last year. D&A was $78 million which includes $36 million of ROU depreciation.

Adjusted net finance cost in the quarter was $17 million, comprised of $22 million of interest expense, partially offset by $5 million of Fx gains and other items related to the weakening U.S. dollar.

In the quarter, adjusted income tax expense was $64 million, which equates to an adjusted effective tax rate of 30 percent.

“Better than expected,” Page said. “Primarily due to our over-delivery on operating income.”

Adjusted net income in Q1 was $148 million, compared to $50 million in the prior-year Q1 period. Adjusted diluted earnings per share was 27 cents in Q1, compared to adjusted diluted earnings per share of 11 cents in Q1 last year.

Balance Sheet Summary

- Cash and cash equivalents totaled $422 million at quarter end.

- Inventories increased 15 percent y/y to $1.27 billion at quarter end.

- Net debt was $515 million at quarter end. Net debt is the principal value of borrowings from financial institutions, including the revolving credit facility and other borrowings, less cash and cash equivalents.

The Improved Outlook Despite High Tariffs Scenario

Given the upside in the first quarter and the company’s continued operating and financial momentum — and despite higher tariffs — CFO Page announced that Amer Sports Group was raising its full year revenue and EPS expectations.

He said there are several factors that give him confidence that the company is well positioned to manage through a variety of tariff scenarios, both near- and long-term.

The updated guidance assumes the current 30 percent tariff on goods arriving to the U.S. from China and 10 percent tariff on goods coming in from Rest-of-World will stay in place for the remainder of 2025.

“Given the mitigation strategies we already have underway, we expect the impact to our P&L from higher tariffs to be negligible this year,” Page noted. “Our updated guidance implies slower growth in 2H than 1H. However, as we’ve said before, should strong trends continue and better-than-anticipated demand materialize, we believe we will be well positioned to deliver financial performance ahead of these expectations.”

Looking beyond 2025, he said the company is confident in its ability to offset the vast majority of higher import tariffs under a wide range of scenarios through pricing, vendor renegotiation, and supply chain maneuvers.

“Since the ultimate tariff outcome is still unknown, we thought it would be helpful to frame our U.S. sourcing exposure,” Page revealed.

“First, we have low exposure to the U.S. — only 26 percent of revenues — and we enjoy meaningful exposure to high-end consumers,” he explained. “Also, the high functional nature of our products creates personal engagement and a strong value equation for consumers. Thirdly, we believe the brands in our portfolio have significant untapped pricing power. The vast majority of our growth the last several years has come from more units, and not higher pricing. Lastly, our clean balance sheet and strong cash flow dynamics give us the financial flexibility to weather macro challenges as they arise.”

Page said sourcing from China to the U.S. was approximately eight points of the 26 percent slice of the revenue pie. Vietnam was also eight, Rest of Asia was six, Europe was three, and Rest of World, one point.

Looking at brand exposure, the CFO said “slightly more than half” of the tariff exposure is in the Ball & Racquet (Wilson) segment, around 30 percent in Technical Apparel (Arc’teryx), and the remainder in Outdoor Performance (Salomon).

“All three segments, including Ball & Racquet, are already implementing and executing measures to offset higher tariffs,” Page noted. “Retailers understand the landscape, and price increases are being accepted and implemented for 2H on those product categories most affected.”

Page had an interesting insight into the Amer Sports business:

“Even if the higher tariffs had remained in effect for the rest of the year, or if they do return – i.e. China at 145 percent and Rest-of-World at the higher rates from before the 90-day pause – we were only anticipating a 5-cent impact from tariffs to full year 2025 EPS after mitigation, or approximately 100 basis points annualized. And over time, we believe we would be able to mitigate the majority of even the higher tariff rates,” he explained.

Full-Year 2025 Outlook

For the full year 2025 guide, Page said to consider the following:

Reported Revenue Growth to range from 15 percent to 17 percent (versus 13 percent to 15 percent previously). Page said they are now assuming a 150 basis-point drag on revenue from unfavorable FX impact at current exchange rates, compared to the 250 basis-point drag incorporated in the company’s prior guidance.

Gross Margin: 56.5 percent to 57 percent (no change)

Operating Margin: 11.5 percent to 12 percent (no change)

Net Finance Cost: approximately $120 million

Effective Tax Rate: 30 percent to 32 percent

Fully Diluted Share Count: approximately 560 million

Fully diluted EPS: 67 cents to 72 cents per share (versus prior 64 cents to 69 cents range)

D&A: roughly $350 million, including approximately $180 million of ROU depreciation

CapEx: approximately $300 million, , primarily to support new store expansion, ERP optimization, and distribution and logistics investments.

Segment Guide

“We are raising our Technical Apparel revenue growth guidance from approximately 20 percent to 20 – 22 percent, Outdoor Performance from low-double digits to now mid teens percent, and Ball & Racquet from low- to mid-single digit previously to mid-single-digits currently,” Page said.

For the segments, Page said they continue to expect an adjusted operating margin of approximately 21 percent for Technical Apparel, approximately 9.5 percent for Outdoor Performance, and 3 percent to 4 percent for the Ball & Racquet segment.

Second Quarter 2025 Outlook

Amer Sports provided guidance for the second quarter ending June 30, 2025 (all guidance figures reference adjusted amounts). Guidance assumes U.S. tariffs on imports from China remain at 30 percent and Rest-of-World at 10 percent for the remainder of the year.

- Reported revenue growth: 16 percent to 18 percent

- Gross margin: 57 percent to 58 percent

- Operating margin: 3 percent to 4 percent

- Net finance cost: $25 million to 30 million;

- Effective tax rate: 30 percent to 32 percent;

- Fully diluted share count: approximately 560 million

- Fully diluted EPS: $0.00 to 2 cents per share

Image courtesy Salomon

See below for additional SGB Executive coverage of details for each brand and segment:

EXEC: Arc’teryx Still King at Amer Sports But Growth Trend Moderates

EXEC: Salomon Footwear Continues to Boost the Brand and Parent Amer Sports

EXEC: Wilson Ball & Racquet Segment Continues DD Growth for Amer Sports