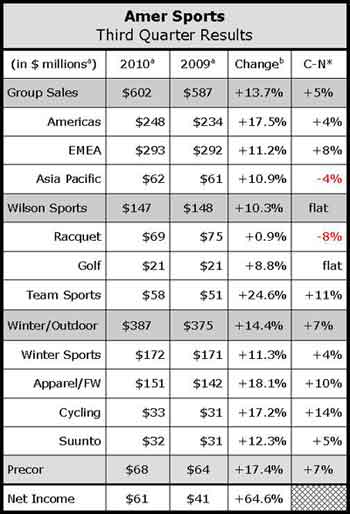

Amer Sports Corp. became a much more profitable company in the third-quarter, as the parent of Salomon, Atomic, Wilson, Precor and Suunto expanded its gross margins by 310 basis points on a 5% increase in currency-neutral sales. When measured in local currency to exclude the impact of exchange rates, total net sales for the quarter rose 5% to €466.9 million ($602 mm).

On a geographic basis, currency-neutral sales grew 8% in Europe, Middle East and Africa (EMEA), where the Winter and Outdoor business is largest and 4% in the Americas, where the team business is largest. Currency-neutral sales declined 4% in Asia, which represents 9% to 14% of sales across the company three major segments.

Company-wide, inventory and work in progress rose 14% to €354.8 million while selling, marketing and administrative expenses rose by 17.7% to €143.8 million, or 30.8% of revenues, up from 29.7% a year earlier.

Gross profit margin increased 310 basis points to 44.8% of revenues due largely to higher pricing, including “tight control of rebates” and a “favorable outcome” to negotiations with vendors, said company President and CEO Heikki Takala. These helped offset unfavorable exchange rates and rising labor costs in Asia.

Earnings before interest and taxes (EBIT) reached €55.8 million ($72 mm), up 37.1% from €40.7 million ($58 mm) in the year earlier quarter. EBIT as a percentage of net sales rose 210 basis points to 12.0%. That translated to earnings per share of €0.38 (49 cents), up from €0.29 (41 cents).

The company confirmed its earlier guidance that net sales would grow 13% to €1.7 billion in 2010. Executives also dialed in their EBIT forecast to 6.0% growth for the year. Head winds in China, where Amer Sports sources most of its footwear and apparel, make predicting EBIT for 2011 more difficult.

“Gross margin does face pressures and we are not immune,” Takala said. “We see that as a constant, consistent theme from peer companies and many companies who do sourcing in the Far East, China.”

In early September, Amer Sport announced a five-pronged strategy to drive profitable growth by shifting to centralized R&D, product-line management, sourcing and manufacturing across its footwear and apparel brands. The company appointed a president for its apparel business in early October and has appointed its regional general managers to an executive board to improve go-to-market execution at the local level.

In the Winter and Outdoor business, sales rose 7% currency-neutral to €300.3 million ($388 mm), or 64% of total net sales for the company. The growth was driven by sales increases of 10% in Apparel and Footwear (Salomon and Arc’teryx) and 14% in Cycling (Mavic). When measured in local currencies, sales rose 6% to €84.7 million ($109 mm) in the Americas and 10% to €189.7 million ($245 mm) in EMEA, but fell 3% in the Asia Pacific.

EBIT for the group improved 32% currency-neutral to €58.2 million ($75 mm) thanks to higher gross margins and higher sales volume. On a local currency basis, operating expenses increased by €9.4 million ($12 mm) mainly driven by increased sales and distribution expenses.

Drilling down further, net sales of Winter Sports Equipment grew 4% in local currency terms to €133.1 million ($172 mm).

Apparel and Footwear net sales rose 10% to €117.3 million ($151 mm). Executives said the order book for the Apparel & Footwear Fall/Winter season is strong. Cycling's net sales totaled €25.2 million ($33 mm), up 14% in local currencies due to a shift in pre-season deliveries to OEMs, who began delivering 2011 bicycle models much earlier than normal. Sports Instruments net sales rose 5% to €24.7 million ($32 mm) as sales of outdoor products remained strong.

In the company’s Ball Sports (Wilson Sports) business, which derives nearly 65% of its sales from the Americas, net sales were flat in local currency terms at €114.0 million ($147 mm) as growth in Team Sports in the U.S. was offset by a decline in Racquet Sports sales worldwide and Golf sales came in flat. Currency-neutral sales in the Ball Sports group increased by 4% in the Americas, while declining 7% in both the EMEA and Asia Pacific regions, due mainly to the soft tennis market.

In U.S. dollar terms, Wilson Sports sales dipped 0.5% for the third quarter.

EBIT improved by 45.8% to €3.5 million ($4.5 mm), however, due mostly to higher gross margins, which executives attributed to less price discounting. Operating expenses increased by €1.8 million ($2.3 mm).

Team Sports sales, which accounted for 39.1% of Wilson Sports sales in the quarter, rose 12.5% in U.S. dollar terms to $57.5 million, while Racquet Sports sales declined 8.9% to $68.8 million and Golf sales came dipped 1.8% to $20.8 million.

In Team Sports, net sales growth was driven by a 13% currency-neutral increase in the Americas, which accounted for 94% of total sales. Solid growth was achieved across all major product categories.

Sales at the more global Racquet Sports business, by contrast, fell 8% in the Americas, 10% in EMEA and 7% in Asia when measured in currency-neutral terms.

Executives said independent research indicated industry-wide sell-in for the North American tennis market was off 12%, but that they were not clear on why tennis sales declined worldwide. They said third party research indicates Amer Sports retained its market share.

Takala indicated that one potential driver to the global tennis decline was an “extremely warm summer.”

In Amer Sports third major segment, Fitness (Precor), net sales totaled €52.6 million ($68 mm), up 7% in local currencies. In local currency terms, sales came in flat in the Americas, which account for two-thirds of fitness sales. Sales in EMEA, which account for a quarter of fitness sales, increased by 27%, while Asia Pacific sales grew by 7%.

In U.S. dollar terms, Precor sales rose 6.0% to $67.9 million in the third quarter.

EBIT in the Precor Fitness business increased by €4.2 million ($5.4 mm); swinging to a positive €2.8 million ($3.6 mm). Operating expenses were down by €1.0 million ($1.3 mm).

Fitness sales to clubs and institutions were up in all regions, but sales of premium consumer equipment for home use continued to be sluggish. Takala said that while commercial sales have stabilized in recent quarters and the fitness business appears to have hit bottom, it’s still not clear whether or by how much it will grow in coming quarters.