Although American consumers have remained resilient throughout 2023, the pressures of inflation, higher interest rates, high credit-card debt, and other factors such as student loans coming due will moderate spending across the board this holiday season, according to a forecast from AlixPartners. The consulting firm is projecting just a 3.0 to 6.0 percent increase in sales over last year, lower than last year’s 6.6 percent growth.

The firm also released its annual AlixPartners Holiday Outlook Survey of more than 1,000 American consumers. It found that 26 percent of consumers plan on spending less this holiday season than last year’s, and that spending reductions are significantly more prominent with lower-income households—as 38 percent of households with incomes under $45K said they plan to spend less.

“Once again, we are going to see the Dickens classic — A Tale of Two Cities,” said Bryan Eshelman, Americas leader of the retail practice at AlixPartners. “Higher-income consumers may not be in the best of times, but we see them sustaining their spending through the holidays. However, most other consumers, including lower-income ones, will make retailers feel like this holiday is the worst of times. There is a solution, though. This year’s retail winners will be those that are ‘value-right.’ By that we mean those retailers that offer value in categories where consumers are targeting cutbacks.”

According to the survey, consumers will target savings opportunities in three key ways:

- Trading Down: 33 percent will trade down to more affordable brands and retailer private labels.

- Less Self-Gifting: 24 percent will reduce spending on gifts for themselves.

- Lots of Deal-Hunting: 38 percent of consumers will buy half or more of their gifts on sale.

AlixPartners said it expects consumers to trade down from brand names across categories, making it crucial for retailers to meet shifting preferences.

“Retailers need to think outside of the box when it comes to their traditional target audience, understanding that consumers are spending with more discretion—often tied to their individual perceived value,” said Andrew Webb, a partner in the retail practice at AlixPartners.

However, some categories are going to feel the burn more than others, according to the survey. Its results show that the home furnishings category (where the planned spending reduction is 15 percent vs. last year), jewelry and watches (also minus 15 percent), and accessories (-13 percent) will see the most drastic reductions. Sales reductions in these categories is likely to outpace inflation — leading to a reduction in overall unit sales compared to last year. In other categories, such as footwear (-3 percent), toys (-5 percent), and apparel (-6 percent), retailers will likely feel less of a pinch.

Given the savings imperative this holiday season, more than 70 percent of survey respondents said they will be researching products and prices online prior to purchase — by reading product reviews, doing price checks across retailers, and researching gifting ideas through influencers, news sources, and blogs.

“Therefore,” said Adam Pressman, a partner and managing director at AlixPartners, “it is crucial to reach and influence customers via their preferred digital and physical channels during their sales journey, making the most out of every consumer interaction. While this may seem daunting to many retailers, they need to identify and prioritize key use-cases and sales journeys, and keep in mind that when exposed to the right content and products from a brand about one-third (32 percent) of consumers, according to our survey, will immediately convert.

“Retailers will also have more time this year to fine-tune promotional strategies,” continued Pressman. “Only 38 percent of consumers in our survey said they intend to start their holiday shopping before Halloween this year, down from 46 percent in our 2022 survey and 53 percent in our 2021 survey. But while retailers are making progress with personalization efforts, there is much work left to be done — 65 percent of consumers said they see little-to-no improvement in companies being able to provide relevant product recommendations.”

Recent advances in AI capabilities could offer a solution. Survey results indicate that consumers are most favorable to AI enhancements that improve product recommendations (with only 15 percent saying they are against such enhancements), provide personalized offers (25 percent against), and streamline service with virtual assistance (26 percent against).

“With the fight for sales picking up, retailers need to solidify their approach now to ensure they are well-positioned for this holiday season,” said Amol Shah, a partner and managing director at AlixPartners.

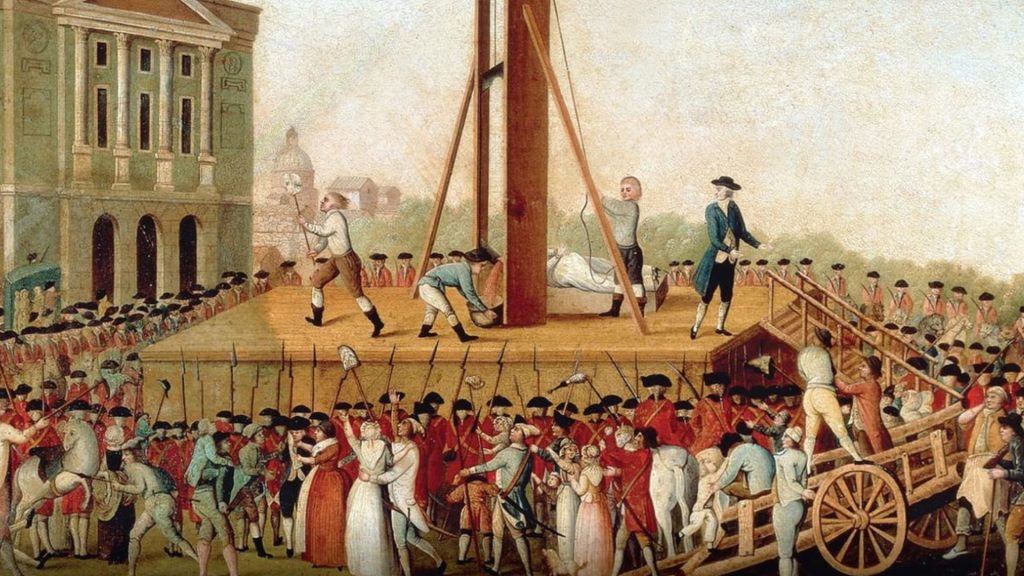

Photo courtesy of Let’s Talk Literature