Powered by a strong performance by both its Reebok and Adidas brands, Adidas Group's currency-neutral revenues in the fourth quarter grew 9% on a currency-neutral basis. Driving the gains was another healthy performance in North America, where currency-neutral Group sales grew 11.5% for the quarter.

Powered by a strong performance by both its Reebok and Adidas brands, Adidas Group's currency-neutral revenues in the fourth quarter grew 9% on a currency-neutral basis. Driving the gains was another healthy performance in North America, where currency-neutral Group sales grew 11.5% for the quarter.

In reporting euro terms, Adidas Group sales in the North America region sales jumped 22.4% in the quarter to €665 million ($904 mm), driven by a 13% increase for the Adidas brand and a 24% increase for Reebok.

Overall, Group revenues increased 19.2% in the fourth quarter to €2.93 billion ($3.87 bn), reflecting year-over-year appreciation of various currencies. Net earnings sunk 65.4% to €720 million ($980 mm) in the seasonally-smaller quarter due to increased marketing expenses.

In the quarter, global currency-neutral revenues for the combined

Adidas and Reebok brands in the Wholesale segment increased 7.5% with sales growth in nearly all geographies. On a wholesale basis, Adidas brand revenues increased 5% currency-neutral in Q4, driven by a 28% increase in Adidas Sport Style – the highest rate of the year. Reebok Wholesale increased 16%, also its highest rate for the year. On a reported basis, Wholesale segment sales grew 17.3% to €1.93 billion ($2.6 bn) in Q4. Gross margins for the Wholesale segment decreased 2.4 percentage points in the quarter, largely due to currency and product mix effects. Management said the decline wasn't surprising since Q4 2009 was lifted by high-margin product launches ahead of the World Cup.

Retail sales for the combined Adidas and Reebok brands increased 22.6% currency-neutral with all geographies positive. Highlights included gains of 17% in North America, 20% in Greater China, and 41% in European emerging markets. Global comps rose 15% for the quarter. By concept, all formats increased at double-digit rates with concept stores growing 19%. That helped drive retail gross margin improvements up 140 basis points to 62.1%.

Recorded sales in the retail segment surged 33.7% to €664.5 million ($903.7 mm) in the fourth quarter.

Combining Wholesale and Retail, brand Adidas sales jumped 20.0% to €2.09 billion ($2.8 bn) while growing 10% on a currency-neutral basis. Reebok advanced 25.6% to €517 million ($703 mm) and 15.3% currency-neutral.

Sales in the Other Businesses segment fell 3.2% on a currency-neutral basis in the quarter while growing 7.7% to €333.1 million on a reported euro basis.

TaylorMade-Adidas' sales declined 11.8% on a currency-neutral basis (down 0.9% to €196 million in euro terms) due to the timing of product launches and tough comparisons for the prior-year quarter, when sales were up 6%. Rockport's revenues increased 23.3% to €66 million ($90 mm) and gained 12.2% currency-neutral; Reebok-CCM Hockey's jumped 23.9% to €62 million ($84 mm) and increased 12.8% currency-neutral for the period.

Western Europe increased 3.1% currency-neutral due to improvements at Reebok as well as in running and training for the Adidas brand. Recorded sales grew 5.0% to €668 million ($909 million).

European Emerging Markets sales rose 21.5% currency-neutral, helped by an almost 40% comp in Russia. Recorded sales climbed 33.5% to €351 million ($477 mm).

Greater China grew 11.3% currency-neutral with reported sales climbing 24.7% to €280 million ($380 mm).

Other Asian Markets sales grew 7.5% currency-neutral as a result of increases in all major markets. Japan delivered double-digit gains for both Reebok and Adidas Sport Style. Recorded sales gained 3.9% to €613 million ($833.7 mm).

In Latin America, sales were up 7.6% currency-neutral due to double-digit growth at the Adidas brand. Recorded revenues climbed 20.7% to €354 million ($481 mm).

Fourth quarter gross margin improved 30 basis points to 46.5% of sales, mainly due to a larger share of higher-margin owned-retail sales and less clearance sales. Other operating expenses as a percentage of sales increased 0.5 percentage points to 47.1%, mainly due to higher sales and marketing working budget expenses. As a result, the Group's operating margin decreased 0.8 percentage points to 1.0% and operating profit declined 33.3% to €28 million ($38 mm).

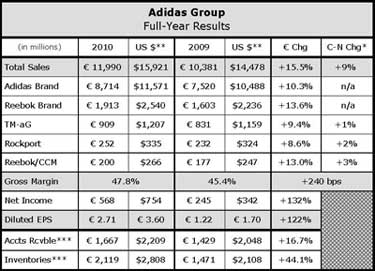

The quarter capped off a rebound year in which currency-neutral sales grew 9% to €11.99 billion ($15.9 bn) and net income vaulted 132% to €568 million ($754 mm), leading to diluted earnings per share of €2.71, the top end of guidance provided in November. Gross margins improved 240 basis points, reaching 47.8% of sales due to lower sourcing costs, fewer clearance sales, and growth in its higher-margin Retail segment.

For the full year, total Adidas Group sales in the North America region grew 18.8% to €2.81 billion ($3.7 bn) and was up 11.7% currency-neutral. North America sales grew 14% at brand Adidas in 2010, led by double-digit sell-through in five key lines representing its lightweight push. Reebok's sales in the region grew 22% for the year, led by toning and ZigTech.

Full year Wholesale segment sales were up 8% currency-neutral, or basis to up 14.2% on a reported basis to €8.18 billion ($10.9 bn) . For the Adidas brand, currency-neutral sales for Sports Performance (€5.10 billion) were up 2%, driven by double-digit increases in football and outdoor and high-single-digit growth in running. Sales for Sport Style (€1.56 billion) increased 21% currency-neutral with particularly strong momentum in Adidas Originals and NEO. For Reebok, Wholesale sales (€1.51 billion) increased to 12% currency-neutral with significant growth in the running and walking. Wholesale gross margin declined 30 basis points for the full year. A less favorable regional mix offset lower input costs, less clearance sales and a higher Reebok gross margin, which increased 240 basis points.

Retail segment sales grew 18% currency-neutral in the year, driven by an 11% comparable store sales increase. Comps in concepts stores grew 14%. European emerging markets, Greater China, and Latin America all grew at rates above 30% while North America saw 14% growth. Gross margin for the Retail segment increased 320 basis points to 61.8%, mainly due to a higher proportion of concept store sales, the improved margin at Reebok, as well as the appreciation of the Russian ruble. The retail segment's performance contributed more than half of the entire Group's profitability improvement in 2010, as segmented operating margin increased 5.3 percentage points to 18.9%.

Adidas brand sales including Retail and Wholesale increased 9% currency-neutral to €8.64 billion ($11.5 bn) in 2010.

On a conference call with analysts, company Chairman and CEO Herbert Hainer called the football (soccer) category the “obvious catalyst” for the Adidas brand, aided by the success of the adiZero F50 and its sponsorship of the World Cup. Adidas football sales last year reached a record €1.5 billion ($2.0 bn). The Adidas brand also underwent a “rebound” year in basketball, generating its “highest sales in the category for years.” Running was up 8% in 2010, driven by double-digit gains for its adiZero, Supernova and Response models. Japan was particularly strong, with running sales ahead over 20%. Training grew 21% in the year, capped by a 40% gain in the fourth quarter. Adidas' MiCoach training device was also a success, with its accompanying App now downloaded over 1 million times. Adidas' Sports Style sales grew 23.0% to a record €2.2 billion ($2.9bn) helped by collaborations such as one with American designer Jeremy Scott, the response to its Star Wars Cantina marketing campaign, and the expansion of the NEO collection.

“Adidas North America reported another strong quarter, significantly exceeding our targets,” said Patrik Nilsson, president of Adidas America Inc., in a statement e-mailed to Sports Executive Weekly. “This success was led by the momentum we are seeing in our key initiatives such as our lightweight adiZero and Originals products, which have resonated well with our core consumers. An additional bright spot for the quarter was our impressive push in basketball driven by Derrick Rose and Dwight Howard in the Fast Don’t Lie Campaign which generated our highest sell-throughs in the category in many years.”

* * * * *

Reebok brand's full year net sales – including Wholesale and Retail grew 12.2% currency-neutral and moved up 19.3% on a recorded basis to €1.91 billion ($2.5 bn).

“EasyTone has been a magnificent hit with global consumers and customers, supported by exciting campaigns and fitness testimonials such as Helena Christiansen and Kelly Brook, [and] we ended the year on the top spot in toning category,” said Hainer. “Let me assure you this category is definitely not a fad.”

He also said ZigTech was supported by the company's largest ever online prelaunch campaign, “and the commercial result has been phenomenal” with Reebok ranking among the top three selling footwear brands during the Christmas period in the U.S. He also noted that Reebok saw a 4 percentage point improvement in gross margin to 35.9% of sales for 2010. “While we still have a way to go here, with the great product pipeline and the sales confidence that is really firing up in Canton today, I believe 2011 will be another bright year for the Reebok brand,” said Hainer.

* * * * *

In the company's Other Businesses segment, revenues increased 9.7% in 2010 to €1.42 billion ($1.89 bn) with currency-neutral revenues inching up 1.6%. TaylorMade's sales increased 0.9% currency-neutral came in “a tough golf market which declined at a mid single-digit rate,” said Hainer. He added, “In doing so, TaylorMade Adidas Golf became the global leader in the golf industry.”

Excluding the effects from the non-recurrence of prior-year sales relating to its discontinued Ashworth license, currency-neutral sales for TaylorMade increased 5%. Hainer said marketing programs such as the Unstoppable 8 demo tour helped TaylorMade become the number one selling iron brand in the U.S. during November and December and its lead in January was extended to the mid-20s. The successful launches of the R9 Super Tri Driver and Rescue 09 added 1 point of market share to TaylorMade's lead in the metal woods category. TM-aG’s share in balls grew almost 2 points, supported by the high visibility of the Penta TP across major tours.

Sales at Rockport and Reebok-CCM Hockey increased 1.9% (€252 million) and 2.9% (€200 million) for the year, respectively. Gross margin of Other Businesses increased 4.2 percentage points to 43.5% in 2010, mainly due to a solid gross margin improvement at TaylorMade. In addition, fewer clearance sales led to significant improvement in Rockport's gross margins.

* * * * *

At year end, Group inventories were up 34% currency neutral to €2.12 billion ($2.9 bn), but the increase in inventories compared to 2009 reflects a normalization of levels compared to 12 months ago as well as expectations for growth in the coming quarters. Management also indicated that aging is “very good, particularly in Retail, where the portion of current-season product has increased by 4 percentage points.”

Looking ahead, Adidas expects sales for 2011 to rise at a “mid- to high-single-digit rate,” slightly up from its previous guidance calling for a mid-single digit percentage gain. The positive impacts of the Group’s high exposure to fast-growing emerging markets, the further expansion of Retail as well as continued momentum at the Reebok brand are expected to more than offset the absence of sales related to the World Cup.

Wholesale sales are expected to increase at a mid-single-digit rate on a currency neutral basis, led by growth in Greater China and North America. Retail sales will increase at the low-double-digit rate while Other Businesses are projected to see a mid-single-digit rate.

The Adidas brand is expected to be helped by the March launch of its largest-ever global advertising campaign, as well as by major product launches planned in running and football. Basketball and Sports Style are also being targeted for aggressive growth. Hainer said the brand “has never been stronger in its 61-year history.”

At Reebok, toning is expected to grow globally this year with the brand having moved aggressively to reduce production to avoid any “unnecessary discounting” for Reebok toning models in the marketplace. Reebok plans to further evolve its toning platform once inventories are normalized.

“We believe in the toning category and what it stands for, as do our consumers,” said Hainer. “This is confirmed by the fact that they are still buying more units than this time a year ago.”

Also expected to support the toning category is a Tone While You Lift campaign that kicked off last week with new endorser, Hollywood actress Eva Mendes.

Toning apparel has also gotten off to a good start, with some key accounts selling out completely in the first two weeks.

Also driving Reebok's growth is projected to be the continued expansion of ZigTech and the launch of a RealFlex technology platform focusing on natural movement. Hainer also reported that Reebok Classics, which now represents less than 20% of the brand's business, has partnered with Grammy winner Swizz Beatz to design a line of shoes as part of a revival of the collection.

Gross margins are expected to remain largely unchanged in 2011 in the range from 47.5% to 48% compared to the 47.8% in 2010. Growth in emerging markets, an increasing portion of Retail sales, and further gross margin improvements at Reebok are expected to be matched by increasing cost pressures. But Hainer said his company's brands are well positioned to handle price inflation.

“When it comes to pricing power, I have every confidence in our brands,” said Hainer. “Even in the midst of the worst global recession in living memory, we have seen that consumers will pay a premium for exciting new products from brands renowned for quality, innovation, and service. We have those brands and we have these products.”