Acushnet Holdings Corp. President and CEO David Maher reported that the parent company to the Titleist and Footjoy golf brands continued to execute its growth strategies into the second quarter and throughout the first six months of the year. Maher said the company delivered a 2 percent increase in both constant-currency (cc) net sales and Adjusted EBITDA in the second quarter, consistent with expectations for the period ended June 28.

Maher said the company’s first-half gains were driven by growth in Titleist golf balls and golf clubs but also noted that the golf club business waned in Q2. The second quarter was said to be paced by gains at Titleist golf balls and gains in the U.S. market.

“There remains strong participation and enthusiasm for the game of golf, particularly in the U.S. where rounds of play were up 2 percent year-to-date,” noted Maher on a conference call with analysts. “Rounds outside the U.S. are resilient but down slightly as several markets started slowly due to poor spring weather.”

Consolidated Sales

Consolidated net sales for the second quarter decreased 0.8 percent (+0.6 percent cc) to $683.9 million, primarily driven by a 5.3 percent cc increase in sales of Titleist golf balls, partially offset by a 4.1 percent cc decline in sales volume of Titleist golf clubs in the quarter.

Brand and Category Highlights

Titleist golf balls net sales increased 4.2 percent (+5.3 percent cc) to $247.5 million primarily due to higher sales volumes of Pro V1 and Pro V1x and the latest generation AVX golf balls launched in the first quarter of 2024.

Titleist golf clubs saw a 5.6 percent decrease in net sales (-4.1 percent cc) to $177.5 million as higher sales volumes of the latest generation T-Series irons and recently launched SM10 wedges and Phantom putters were said to be more than offset by lower sales volumes of drivers, fairways, hybrids and Super Select putters, which were all in their second model year.

“While clubs in the first half were up 5 percent over last year, a more relevant comp is against two years ago, given our extended product life cycles,” offered Maher. “Compared to the first half of 2022, Titleist Club sales increased 22 percent, with growth coming from wedges, putters, and irons.”

Titleist golf gear posted a 1.4 percent decrease in net sales (+0.1 percent cc) to $68.9 million as increased sales volumes in travel product categories and higher average selling prices across all product categories were offset by lower sales volumes in golf bags.

FootJoy golf wear saw a 0.6 percent decrease in net sales (+0.7 percent cc) to $157.2 million in the quarter. The constant-currency increase was primarily due to higher net sales in apparel, partially offset by lower net sales in footwear.

Regional Highlights

On a geographic basis, higher net sales in the United States were largely driven by an 8.5 percent increase in Titleist golf balls and 4.8 percent growth in FootJoy golf wear, primarily due to higher sales volumes of Pro V1 and Pro V1x and its latest generation AVX golf balls and higher average selling prices in apparel and higher net sales in footwear. These increases were partially offset by a 9.0 percent decrease in Titleist golf clubs as higher sales volumes of its latest generation T-Series irons and its recently launched SM10 wedges and Phantom putters were more than offset by lower sales volumes of drivers, fairways, hybrids, and Super Select putters, which were all in their second model year.

Net sales in regions outside the United States decreased 4.4 percent (-1.0 percent cc), primarily due to lower net sales in Rest of World partially offset by increases in Japan, EMEA and Korea. In Rest of World, net sales decreased was primarily due to lower net sales in FootJoy golf wear, primarily footwear.

“First-half rounds of play in Korea and Japan are projected to be up 2 percent and down 1 percent, respectively, as both markets made up ground in Q2 after slow weather-related starts in Q1,” Maher noted.

Maher said the company is pleased with its golf ball and club momentum across Asia but the region continues to work through excess footwear and apparel inventories, which has negatively impacted results in these regions.

“As we said on our last call, we expect Korea’s premium apparel market will remain soft for the near term as the market corrects following a period of accelerated growth, which brought in many new competitors and a significant amount of inventory in recent years,” the CEO noted. “And while we are comfortable that footwear inventories have normalized in the U.S. market, we are still seeing elevated channel inventory levels in Europe and Asia.”

Income Statement Highlights

The second quarter gross margin of 54.4 percent was up 90 basis points versus the prior-year quarter.

SG&A expense of $246 million in the quarter increased $4 million, or 2 percent, from 2023, mainly due to increased IT-related expenses and higher distribution expenses in the U.S.

Interest expense was $14 million in the quarter, up $3 million due to an increase in borrowings.

The effective tax rate in Q2 was 23.2 percent, up from 21.8 percent last year. This increase was primarily due to a shift in the company’s jurisdictional earnings mix.

Net income attributable to Acushnet Holdings Corp. decreased 4.4 percent year-over-year to $71.4 million, primarily due to an increase in interest expense.

Adjusted EBITDA was $131.0 million, down 0.8 percent year-over-year. Adjusted EBITDA margin was 19.2 percent for the second quarter versus 19.2 percent for the prior year period.

Balance Sheet Highlights

Company CFO Sean Sullivan told participants on the call that the company’s balance sheet and cash flow positions remain very strong, allowing it to execute its capital allocation strategy with ongoing investments in the business and return of capital to shareholders being the highest priorities.

Sullivan said the net leverage ratio at the end of Q2 using average trailing net debt was 1.9x.

“Our inventory position has significantly improved, having declined 22% from the fourth quarter of 2023 and 10% from the first quarter of 2024 with decreases across all our product segments. When comparing to last year’s second quarter, inventories were down 14 percent,” Sullivan noted.

“We are comfortable with our inventory position given the current state of demand and expect inventories to increase in the back half of 2024 in support of second-half product introductions in the 2025 Pro V1 launch,” he explained.

First half cash flow from operations decreased from the first half of 2023 primarily due to a decrease in net income and deferred income tax expense, offset by a change in working capital.

“Capital expenditures were $22 million in the first half of 2024,” Sullivan said. Based on project timing, we now expect full-year 2024 CapEx spend to be approximately $80 million rather than $85 million.”

Cash Dividend and Share Repurchase

“Through June, we returned roughly $101 million to shareholders with $73 million in share repurchases and $28 million in cash dividends,” the CFO said. Acushnet’s Board of Directors declared a quarterly cash dividend of $0.215 per share of common stock. The dividend will be payable on September 20, 2024 to shareholders of record on September 6, 2024. The number of shares outstanding as of July 31, 2024 was 61,813,629.

During the quarter, the company repurchased 587,520 shares of its common stock on the open market at an average price of $63.83 for an aggregate of $37.5 million. As a result, on July 10, 2024, the company repurchased 587,520 shares of its common stock from Magnus Holdings Co., Ltd. (Magnus), a wholly-owned subsidiary of Fila Holdings Corp., for an aggregate of $37.5 million in satisfaction of its previously disclosed obligation. On June 14, 2024, the company entered into a new agreement with Magnus to purchase from the company an equal amount of its common stock as it purchases on the open market over the period of time from July 1, 2024 through December 31, 2024, up to an aggregate of $62.5 million, at the same weighted average per share price.

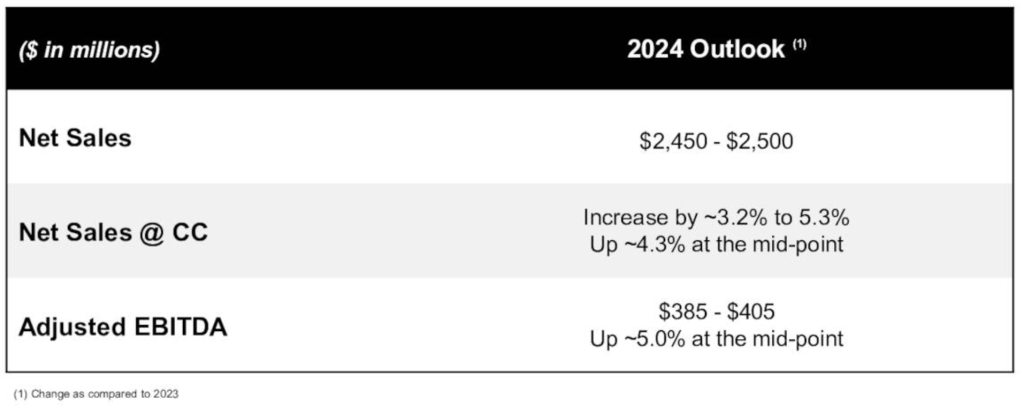

2024 Outlook

The company reaffirmed its full-year 2024 outlook and expects full-year consolidated net sales to be approximately $2,450 million to $2,500 million and Adjusted EBITDA to be roughly $385 million to $405 million. Consolidated net sales are expected to increase from 3.2 percent to 5.3 percent on a constant-currency basis.

“As we look ahead to the second half of the year, we are excited to launch new Titleist GT drivers and fairway metals, which are already seeing success across the global professional tours, and new products from FootJoy and KJUS for the fall and winter seasons,” Maher commented.

Image courtesy Titleist, data tables courtesy Acushnet