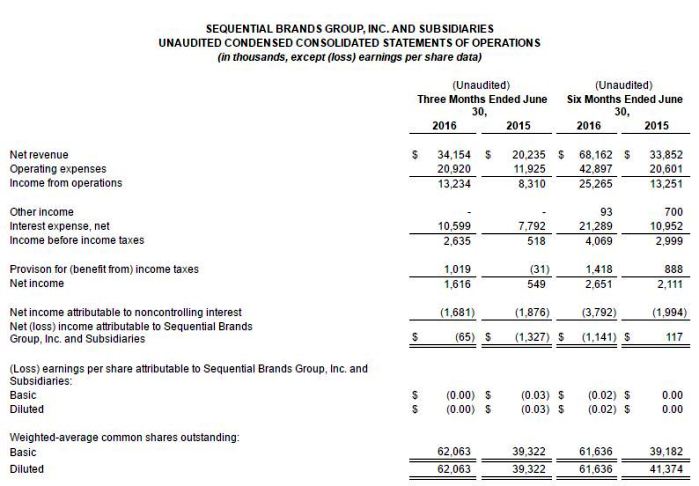

Sequential Brands Group Inc. (Nasdaq:SQBG) reported total revenue for the second quarter, ended June 30, increased to $34.2 million, compared to $20.2 million in the prior year’s comparable quarter.

The owner of the AND1, Avia, Revo, DVS and Heelys brands, which just acquired the Gaiam yoga brand, reported a net loss of less than $100,000, compared to a net loss of $1.3 million, or $(0.03) per diluted share, in the prior year’s comparable quarter. On a non-GAAP basis, Sequential reported net income of $3.6 million, or $0.06 per diluted share, compared to $3.3 million, or $0.08 per diluted share, in the prior year’s comparable quarter.

Adjusted EBITDA for the second quarter of 2016 was $17.3 million, compared to $12.4 million in the prior year’s comparable quarter. The company defines Adjusted EBITDA as net income attributable to Sequential Brands Group Inc. and subsidiaries, excluding interest income or expense, income taxes, depreciation and amortization, restructuring costs, acquisition-related costs, gain on sale of People’s Liberation brand, Martha Stewart Living Omnimedia, Inc. shareholder and pre-acquisition litigation costs and stock-based non-cash compensation.

“Second quarter revenue increased 69 percent over the prior year, reflecting the continued execution of our playbook,” said Sequential CEO Yehuda Shmidman. “In addition to being pleased with our financial results, we are excited to have announced several initiatives this past quarter, including the acquisition of the GAIAM brand, the launch of a new e-commerce business for the Martha Stewart brand, and a new partnership with Amazon for Chef Emeril. We are encouraged by the momentum across our business and focused on continuing to deliver strong financial results.”

Year-to-Date 2016 Results:

Total revenue for the six months ended June 30 increased to $68.2 million, compared to $33.9 million in the prior year’s comparable period. On a GAAP basis, net loss was $(1.1) million for the six months ended June 30, or $(0.02) per diluted share, compared to net income of $0.1 million, or $0.00 per diluted share, in the prior year’s comparable period. On a non-GAAP basis, net income for the six months ended June 30, was $6.2 million, or $0.10 per diluted share, compared to $4.6 million, or $0.11 per diluted share, in the prior year’s comparable period. Adjusted EBITDA for the six months, ended June 30, 2016, was $34.0 million, compared to $20.4 million in the prior year’s comparable period.

Financial Update:

For the year ending December 31, 2016, the company is reiterating its guidance of $155 to $160 million in revenue, GAAP net income of $12.7 to $14.6 million and Adjusted EBITDA of $88.0 to $91.0 million. The company’s contractual guaranteed minimum royalties for 2016 are over $100 million. Consistent with the company’s historical quarterly results, it expects revenue for 2016 to be weighted to the third and fourth quarters due to seasonality in the businesses of many of the company’s licensees.

Following the completion of the Martha Stewart Living Omnimedia Inc. merger integration, the company expects its twelve-month run rate to be $172 to $177 million of revenue, GAAP net income of $28.5 to $30.1 million and $112 to $115 million of Adjusted EBITDA. The company anticipates that the merger integration will be completed on schedule.