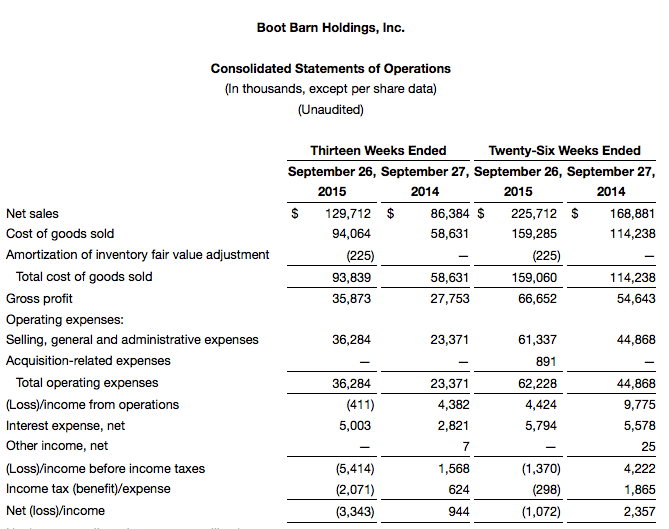

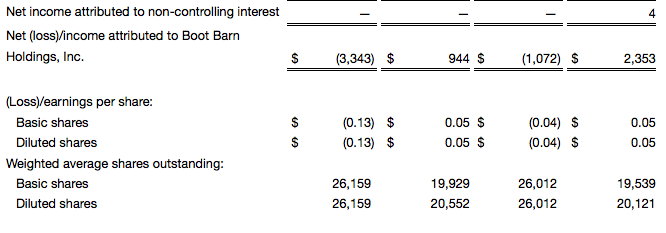

Boot Barn Holdings Inc. reported a loss of $3.3 million, or 13 cents a share, against earnings of $944,000, or 5 cents, a year ago.

Highlights for the quarter ended September 26, 2015, were as follows:

- Net sales increased 50 percent to $129.7 million;

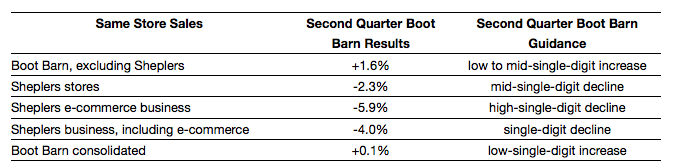

- Consolidated same store sales increased 0.1 percent;

- Core Boot Barn same store sales, which include bootbarn.com and exclude Sheplers, increased 1.6 percent;

- Pro forma adjusted net income (1) was $1.2 million, or $0.04 per diluted share (GAAP net loss was $3.3 million, or $0.13 per share); and

- Acquired 25 stores and opened 6 new stores.

1) Pro forma adjusted net income is a non-GAAP measure. An explanation of the computation of this measure and a reconciliation to GAAP net income is included in the accompanying financial data. See also “Non-GAAP Financial Measures.”

Jim Conroy, chief executive officer, commented, “I am pleased with our execution in the quarter. We significantly grew our market share through a combination of the Sheplers acquisition, 25 new stores and growth in same stores sales. Additionally, despite facing a number of external headwinds in certain markets, the core Boot Barn business continued to grow as we achieved our 24th consecutive quarter of positive same store sales growth. Finally, the integration of the Sheplers business is on track with the back office systems fully converted and rebranding expected to be completed before Thanksgiving.”

Operating Results for the Second Quarter Ended September 26, 2015

- Net sales increased 50 percent to $129.7 million from $86.4 million in the second quarter of fiscal 2015. Net sales increased due to contributions from recently acquired Sheplers, 25 new stores opened between the beginning of the third quarter of fiscal 2015 and the end of the second quarter of fiscal 2016, and a 1.6 percent increase in same store sales at the core Boot Barn business, excluding Sheplers.

- The following table illustrates the second quarter same-store sales results compared to the guidance provided by on August 4, 2015:

- Adjusted gross profit was $38.4 million or 29.6 percent of net sales (on a GAAP basis, gross profit was $35.9 million or 27.7 percent) in the second quarter of fiscal year 2016, an increase of $10.6 million or 38.3 percent from gross profit of $27.8 million, or 32.1 percent of net sales in the prior-year period. Adjusted gross profit excludes acquisition-related integration costs, including an adjustment to normalize the impact of sales of Sheplers’ discontinued inventory, contract termination costs and the amortization of inventory fair value adjustment. Adjusted gross profit increased as a result of the addition of the Sheplers business and the opening of 25 new stores. The decline in gross profit rate was primarily driven by the addition of the lower margin Sheplers business and the result of increases in store occupancy costs and depreciation expense associated with the increase in new store openings compared to the prior-year period. Merchandise margin rate at Boot Barn, excluding Sheplers, decreased 50 basis points as a result of higher freight, shrink and clearance markdowns, partially offset by an increased markup resulting from higher private brand penetration.

- Adjusted income from operations was $5.8 million in the second quarter of fiscal year 2016, an increase of 24.6 percent compared to $4.6 million in the prior-year period. Adjusted income/loss from operations excludes acquisition-related expenses and integration costs, loss on disposal of assets, contract termination costs and the amortization of inventory fair value adjustment incurred in the second quarter of fiscal year 2016. Adjusted income from operations in the second quarter of fiscal year 2015 has also been adjusted to reflect costs that the Company estimates would have been incurred had the Company been a public company during that quarter in addition to $0.9 million of due diligence costs related to Sheplers. On a GAAP basis, loss from operations was $0.4 million in the second quarter of fiscal year 2016 and income from operations was $4.4 million in the prior-year period.

- During the second quarter, the Company acquired 25 Sheplers stores and closed five of these stores. The Company also opened six Boot Barn stores and closed one, ending the quarter with 201 stores in 29 states.

- Pro forma adjusted net income was $1.2 million, or $0.04 per diluted share compared to $2.0 million or $0.08 per diluted share in the prior-year period. On a GAAP basis, net loss was $3.3 million, or $0.13 per share. Net income was $0.9 million or $0.05 per diluted share in the prior-year period.

Operating Results for the Six Months Ended September 26, 2015

- Net sales increased 33.7 percent to $225.7 million from $168.9 million in the prior-year period. Net sales increased due to contributions from recently acquired Sheplers, 25 new stores opened between the beginning of the third quarter of fiscal 2015 and the end of the second quarter of fiscal 2016 and a 3.6 percent increase in same store sales at the core Boot Barn business.

- Adjusted gross profit was $69.2 million or 30.6 percent of net sales (on a GAAP basis, gross profit was $66.7 million or 29.5 percent) in the first six months of fiscal year 2016, an increase of $14.5 million, or 26.6 percent from gross profit of $54.6 million, or 32.4 percent of net sales in the prior-year period. Adjusted gross profit increased as a result of the addition of the Sheplers business and the opening of 25 new stores. The decline in gross profit rate was primarily driven by the addition of the lower margin Sheplers business and the result of increases in store occupancy costs and depreciation expense associated with the increase in new store openings compared to the prior-year period. Merchandise margin rate at Boot Barn, excluding Sheplers, increased 10 basis points.

- Adjusted income from operations was $11.5 million in the first six months of fiscal year 2016, an increase of 23.3 percent compared to $9.3 million in the prior-year period. On a GAAP basis, income from operations was $4.4 million in the first six months of fiscal year 2016 and $9.8 million in the prior-year period.

- The Company acquired 25 Sheplers stores, opened 13 Boot Barn stores, closed five Sheplers and one Boot Barn store, and ended the period with 201 stores in 29 states.

- Pro forma adjusted net income was $4.2 million, or $0.16 per diluted share compared to $3.9 million or $0.15 per diluted share in the prior-year period. On a GAAP basis, net loss was $1.1 million, or $0.04 per diluted share, compared to net income of $2.4 million or $0.05 per diluted share in the prior-year period.

A reconciliation of adjusted gross profit, adjusted income from operations, pro forma adjusted net income and pro forma adjusted net income per diluted share, each a non-GAAP financial measure, to their most directly comparable GAAP financial measures is included in the accompanying financial data.

Balance Sheet Highlights as of September 26, 2015

- Cash: $7.5 million

- Total debt: $263.2 million

- Total liquidity (cash plus availability on $125 million revolving credit facility): $63.4 million

Fiscal Year 2016 Outlook

For the fiscal year ending March 26, 2016, including Sheplers, the Company now expects:

- To open 22 new stores, with 9 expected to open in the second half of the fiscal year.

- Consolidated same store sales growth of low single digits.

- Pro forma adjusted income from operations between $46.5 million and $48.5 million, compared to the Company’s prior outlook of $49.3 million and $51.5 million.

- Pro forma adjusted net income of $20.5 million to $21.7 million, compared to the Company’s prior outlook of $23.2 million to $24.5 million.

- Pro forma adjusted net income per diluted share of $0.76 to $0.80 based on 27.1 million weighted average diluted shares outstanding, compared to the Company’s prior outlook of $0.85 to $0.90 per diluted share.

- Capital expenditures of approximately $33.0 million, which includes $13.0 million related to Sheplers.

For the fiscal third quarter ending December 26, 2015, the Company expects:

- Same store sales growth for the Boot Barn business, excluding Sheplers, to be in the flat to low-single digits.

- Sheplers business to increase mid-single digits for the quarter.

- Total same store sales growth for Boot Barn, including Sheplers, to be in the low-single digits.

- Pro forma adjusted net income per diluted share of $0.47 to $0.49, based on 27.2 million weighted average diluted shares outstanding.

Our Fiscal 2016 outlook for pro forma adjusted income from operations and net income excludes merger and integration costs and other non-recurring expenses, including losses on the disposal of assets and contract termination costs, acquisition-related expenses, acquisition-related integration costs, amortization of inventory fair value adjustment, markdown of discontinued Sheplers inventory, and the write off of debt discount as part of the June 29, 2015 refinancing.

Boot Barn now operates 205 stores in 29 states, in addition to an e-commerce channel, including both www.bootbarn.com and www.sheplers.com.