Nordstrom, Inc. reported earnings per diluted share of 66 cents for the first quarter ended May 2, which were in-line with company expectations, compared with 72 cents a year ago. Total company net sales increased 9.8 percent and comparable sales increased 4.4 percent, compared with the same period last year.

The company continued its progress in executing its customer strategy while maintaining disciplined execution around inventory and expenses. First quarter results reflected store and online growth including:

- Two full-line store openings: in Ottawa, Ontario, its second store in Canada, and in San Juan, Puerto Rico

- 10 Nordstrom Rack store openings supporting its accelerated store expansion

- Over 50 percent sales growth in Nordstromrack.com and HauteLook, on a combined basis, driven by the launch of Nordstromrack.com in the second quarter 2014

- The acquisition of Trunk Club in the third quarter 2014

- Based on first quarter performance, the company reiterated its annual outlook for earnings per diluted share of $3.65 to $3.80, net sales increase of 7 to 9 percent, and comparable sales increase of 2 to 4 percent.

FIRST QUARTER SUMMARY

First quarter net earnings were $128 million compared with $140 million during the same period last year. Earnings before interest and taxes were $245 million, or 7.9 percent of net sales, compared with $265 million, or 9.3 percent of net sales, for the same quarter last year. The impact of the Trunk Club acquisition and ongoing entry into Canada reduced earnings before interest and taxes by $19 million.

Total company net sales of $3.1 billion for the first quarter increased 9.8 percent compared with net sales of $2.8 billion during the same period in fiscal 2014. Total company comparable sales for the first quarter increased 4.4 percent.

Nordstrom comparable sales, which consist of the full-line and Nordstrom.com businesses, increased 4.2 percent. Top-performing merchandise categories included Women's and Men's Apparel.

Full-line net sales increased 0.9 percent compared with the same period last year. Comparable sales increased 0.5 percent, reflecting ongoing improvement in sales trends. The Northwest and Southeast were the top-performing geographic regions.

Nordstrom.com net sales increased 20 percent, primarily driven by continued expansion of merchandise selection.

Nordstrom Rack net sales increased $90 million, or 12 percent, compared with the same period in fiscal 2014, reflecting 10 new stores in the first quarter. Nordstrom Rack comparable sales decreased 0.2 percent, on top of last year's increase of 6.4 percent, consistent with its two-year stacked trend.

Nordstromrack.com/HauteLook net sales increased 51 percent, primarily driven by expanded merchandise selection related to the launch of Nordstromrack.com.

Gross profit, as a percentage of net sales, of 35.9 percent increased 7 basis points compared with the same period in fiscal 2014.

Ending inventory increased 19 percent compared with the same period in fiscal 2014, which outpaced the net sales increase of 9.8 percent. Ending inventory was in-line with company expectations, reflecting planned inventory investments to support store and online growth, including Nordstrom Rack, Nordstromrack.com and Canada.

Selling, general and administrative expenses, as a percentage of net sales, of 31.2 percent increased 141 basis points compared with the same period in fiscal 2014, reflecting planned growth initiatives related to Trunk Club, Canada and continuing fulfillment and technology investments.

The Nordstrom Rewards loyalty program continued to contribute to overall results, with members shopping three times more frequently and spending four times more on average than non-members. The company opened over 285,000 new accounts in the first quarter. With 4.4 million active members, sales from members increased 11 percent in the first quarter and represented 38 percent of sales.

During the first quarter, the company repurchased 0.4 million shares of its common stock for $33 million. A total of $969 million remains under its existing share repurchase board authorization. The actual number and timing of future share repurchases, if any, will be subject to market and economic conditions and applicable Securities and Exchange Commission rules.

Return on invested capital (ROIC) for the 12 months ended May 2, 2015 was 12.2 percent compared with 13.3 percent in the prior 12-month period. This decrease reflected the acquisition of Trunk Club in addition to ongoing store expansion and increased technology investments. A reconciliation of this non-GAAP financial measure to the closest GAAP measure is included.

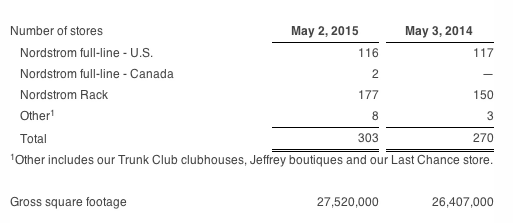

EXPANSION UPDATE

This year, the company announced plans to open a full-line store in Norwalk, Connecticut in 2018 and Nordstrom Rack stores in Virginia Beach, Virginia, Novi, Michigan and Pittsburgh, Pennsylvania in 2016. During fiscal 2015, the company plans to open a total of five full-line stores, including two in Canada, and 27 Nordstrom Rack stores. In the first quarter of 2015, Nordstrom opened two full-line stores and 10 Nordstrom Rack stores:

FISCAL YEAR 2015 OUTLOOK

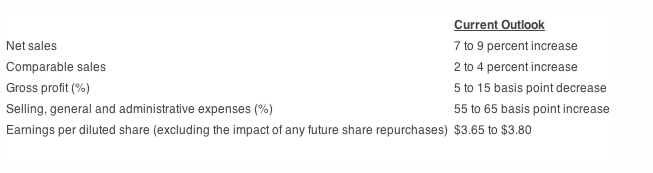

The company's annual earnings per diluted share expectations are unchanged, incorporating first quarter results and the impact of share repurchases in the first quarter. Nordstrom's expectations for fiscal 2015 are as follows:

Current Outlook

Earnings per diluted share growth in the second quarter is expected to be below the full-year outlook range of a 2 percent decrease to a 2 percent increase, primarily due to the ongoing entry into Canada and the acquisition of Trunk Club in the third quarter 2014.