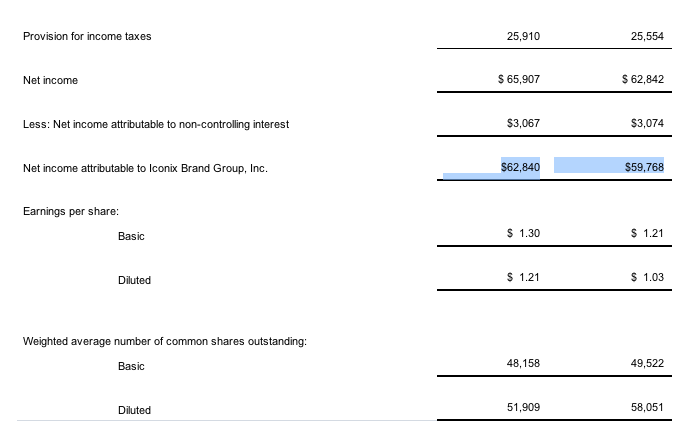

Iconix Brand Group Inc. reported earnings rose 5.1 percent in the first quarter, to $62.8 million, or $1.21 a share.

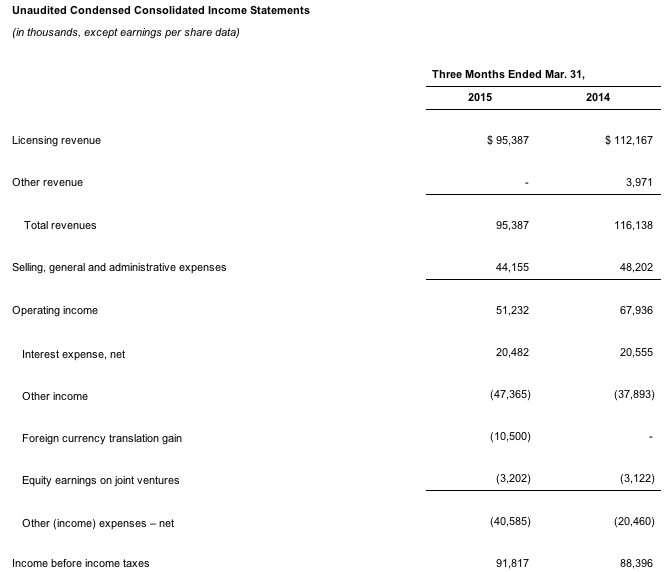

Licensing revenue for the first quarter of 2015 was approximately $95.4 million, a 15 percent decrease as compared to approximately $112.2 million in the first quarter of 2014. After excluding $17.1 million of revenue recorded in the first quarter of 2014 related to the 5-year renewal of the Peanuts specials with ABC, licensing revenue in the first quarter of 2015 was approximately flat to the prior year quarter. Other revenue was $0 in the first quarter of 2015 as compared to $4.0 million of other revenue recorded in the first quarter of 2014 for the Lee Cooper transaction.

EBITDA attributable to Iconix for the first quarter of 2015 was approximately $52.4 million, a 25 percent decrease as compared to $69.8 million in the prior year quarter. On a non-GAAP basis, as described in the tables below, net income attributable to Iconix was $26.7 million, a 32 percent decrease as compared to the prior year quarter of approximately $39.3 million. Non-GAAP diluted EPS for the first quarter of 2015 was $0.54, a 27 percent decrease as compared to $0.74 in the prior year quarter. GAAP net income attributable to Iconix for the first quarter of 2015 was approximately $62.8 million, a 5 percent increase as compared to $59.8 million in the prior year quarter, and GAAP diluted EPS for the first quarter of 2015 increased approximately 17 percent to $1.21 compared to $1.03 in the prior year quarter. Free cash flow attributable to Iconix for the first quarter of 2015 was approximately $30.1 million, a 39 percent decrease as compared to the prior year quarter of approximately $49.4 million.

In the first quarter of 2015, the company acquired the remaining 50 percent of its Iconix China joint venture and, as a result, recognized a $47.4 million pre-tax non-cash gain related to the re-measurement of its initial investment. Similarly, in the first quarter of 2014, the company acquired the remaining 50 percent of its Latin America joint venture and, as a result, recognized a $37.9 million pre-tax non-cash gain. Both of these gains are excluded from the company's non-GAAP metrics.

In addition, in the first quarter of 2015, the company recognized a $10.5 million pre-tax foreign currency translation gain. This gain is excluded from the company's non-GAAP metrics.

Neil Cole, Chairman and CEO of Iconix Brand Group, Inc. commented, “In the first quarter we continued to execute on our global strategy and remain focused on international, entertainment and sports as key drivers of our growth. Our international business continued to grow in the first quarter with our joint ventures in Australia, India, Southeast Asia and the Middle East, as well as our Latin America business, each delivering double-digit gains. Our Peanuts brand had a strong quarter and we are excited about the opportunities around the global release of the Peanuts movie in the fourth quarter. We expect our Strawberry Shortcake and PONY acquisitions will generate increasing value throughout the year for our entertainment and sports platforms, and our core licensing business remains healthy. Reflecting these drivers, and the strong results we expect to achieve in the second half of the year, we believe we are on track to deliver on the 2015 guidance we provided earlier this year.”

2015 Guidance for Iconix Brand Group, Inc.:

The company is maintaining its 2015 guidance as follows:

- 2015 revenue guidance of $490-$510 million

- 2015 Non-GAAP diluted EPS guidance of $3.00-$3.15

- 2015 free cash flow guidance of $208-$218 million

- The company is increasing its 2015 GAAP diluted EPS guidance to $3.65-$3.79 from $3.06-$3.20 to reflect the gain in the first quarter of 2015 related to the company's acquisition of full ownership and control of its Iconix China joint venture.

This guidance relates to the company's existing portfolio of brands and does not include any additional acquisitions following the first quarter.

About Iconix Brand GroIconix Brand Group, Inc. owns, licenses and markets a growing portfolio of consumer brands including: Candie's, Bongo, Badgley Mischka, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Sharper Image, Umbro, Lee Cooper, Ecko Unltd. and Marc Ecko . In addition, Iconix owns interests in the Artful Dodger, Material Girl, Peanuts, Ed Hardy, Truth Or Dare, Billionaire Boys Club, Ice Cream, Modern Amusement, Buffalo, Nick Graham and Pony brands.