HanesBrands, the parent of Champion, Hanes and Gear For Sports, announced strong third-quarter financial results driven by acquisition benefits, innovation, and enhanced profitability from global supply chain efficiency gains. The company raised its full-year adjusted EPS guidance for the third time this year based on quarterly results despite a continued environment of restrained consumer spending.

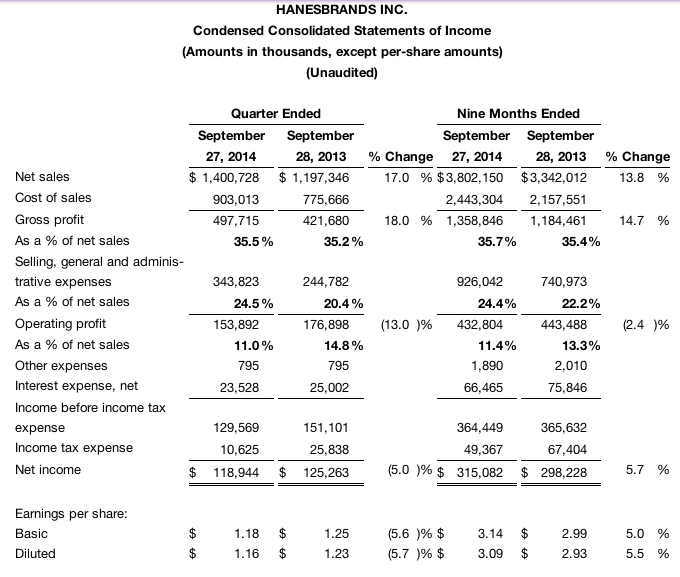

For the third quarter ended Sept. 27, 2014, net sales increased 17 percent to $1.40 billion, adjusted operating profit excluding actions increased 23 percent to $217 million, and adjusted diluted EPS excluding actions increased 41 percent to $1.73. (Unless noted, all consolidated measures and comparisons in this news release are adjusted to exclude third-quarter 2014 pretax charges of $63 million related to the acquisitions of DBApparel and Maidenform Brands, Inc., and other actions. On a GAAP basis, operating profit declined 13 percent to $154 million, and diluted EPS decreased 6 percent to $1.16. See the GAAP reconciliation section below.)

Hanes has delivered three consecutive quarters of double-digit growth in net sales, adjusted operating profit and adjusted EPS. Third-quarter results were aided by acquisition-related sales and profit contributions, modest base sales growth led by innovative products, and significant efficiency gains from global supply chain operations.

The companys updated 2014 full-year financial guidance includes an increase in expected adjusted EPS to a range of $5.55 to $5.65, up from a previous guidance of $5.40 to $5.60. The company continues to expect net sales of approximately $5.350 billion to $5.375 billion.

Our business continues to perform very well, particularly in an uncertain consumer environment, Hanes Chairman and Chief Executive Officer Richard A. Noll said. We have delivered more earnings in the first three quarters of 2014 than we did all of last year. Our Innovate-to-Elevate strategy, global self-owned supply chain, and acquisitions continue to generate shareholder value and give us confidence in our potential for many years to come.

Third-Quarter 2014 Financial Highlights and Business Segment Summary

Key accomplishments for the third quarter include:

Sales Growth in Each Business Segment. Net sales increased for each business segment. Maidenform contributed $115 million in the third quarter, and DBApparel contributed $81 million. Excluding the acquisition contributions, net sales on a constant currency basis increased 1 percent versus the year-ago quarter.

Supply Chain and Innovate-to-Elevate Drive Margin Improvement. Strong global supply chain performance and Innovate-to-Elevate drove a 100-basis-point improvement in adjusted operating profit margin year-over-year in the third quarter, excluding DBApparel. Overall, including DBA, adjusted operating margin increased 70 basis points.

Maidenform Integration Successfully Completed. Hanes completed the integration of Maidenform within one year of the acquisition closing. From here on, Maidenform brand results will be part of the companys core business in its Innerwear, International and Direct to Consumer segments. The company remains on schedule for capturing synergies from the acquisition and integration, including ramp up of internalized production of select Maidenform intimate apparel styles in Hanes self-owned supply chain.

DBApparel Acquisition Closed and Integration Planning Underway. Hanes closed on the acquisition of DBApparel, a leading marketer of intimate apparel and underwear in Europe, from Sun Capital Partners, Inc., on Aug. 29, 2014. Hanes has begun cross-company integration planning for DBA and expects to create significant synergies by applying Hanes Innovate-to-Elevate strategy in Europe and leveraging its primarily self-owned global supply chain. The company expects the acquisition and synergies to add approximately $1.00 of annual adjusted EPS within three to four years.

Key business highlights include:

Innerwear Segment. Innerwear net sales increased 16 percent in the third quarter as a result of the Maidenform acquisition, while the companys base business was up slightly compared with a year ago. Operating profit increased 29 percent on acquisition benefits and increased base-business profitability.

Retail Environment. Sales in the quarter were affected by a continued uneven and challenging retail environment. Sales growth of at least mid-single digits in socks, boys underwear, and panties were offset by softness in other Innerwear categories. Innovation platforms, including ComfortBlend and X-Temp underwear and Flexible Fit bras, continued to outperform their respective categories.

Profitability Improvement. Innerwears operating profit margin increased 200 basis points to 19.8 percent as a result of strong supply chain performance and Innovate-to-Elevate.

Activewear Segment. Activewear sales increased 5 percent, while operating profit declined 1 percent versus a strong year-ago third quarter.

Continued Strong Profitability. The segments operating profit margin was 16.1 percent in the third quarter, and the year-to-date operating margin of 14.1 percent is 95 basis points better than a year ago.

Mixed Sales Environment. Retail Activewear sales increased by 1 percent, while Gear for Sports sales increased by double digits.

International Segment. The acquisitions of Maidenform and DBApparel contributed to International sales growth of 63 percent and operating profit growth of 74 percent in the third quarter, while foreign exchange rates on currency continued to have a negative impact on both measures. On a constant-currency basis, base International net sales decreased 3 percent in the quarter and operating profit decreased 1 percent.

Direct to Consumer Segment. Net sales for the Direct to Consumer segment increased 13 percent and operating profit increased 6 percent in the third quarter, with the acquisition of Maidenform contributing to both comparisons versus the year-ago quarter.

2014 Guidance

Based on third-quarter results, Hanes has increased its 2014 outlook for full-year adjusted EPS and other financial measures. The companys previous guidance for the 53-week year was updated Sept. 3, 2014, at the time the DBApparel acquisition completion was announced.

All guidance for adjusted performance measures exclude charges related to the acquisitions of DBA and Maidenform and other actions. (See the GAAP reconciliation section below.)

Hanes guidance range for net sales remains approximately $5.350 billion to $5.375 billion. The company has increased guidance for adjusted operating profit to a range of $750 million to $770 million, up from the previous guidance range of $735 million to $755 million.

Hanes expects interest expense and other expense of approximately $93 million. The DBA acquisition is expected to have a slightly positive effect on the companys corporate tax rate, and Hanes anticipates the 2014 tax rate to be in the range of approximately 13 percent to 14 percent. The company expects approximately 103 million diluted weighted average shares outstanding in 2014.

Adjusted EPS guidance for 2014 has been increased to a range of $5.55 to $5.65, up from previous guidance of $5.40 to $5.60.

The new full-year guidance implies fourth-quarter guidance of approximately $1.55 billion to $1.57 billion in net sales; a range of $187 million to $207 million for adjusted operating profit; and a range of approximately $1.35 to $1.45 for adjusted EPS. The fourth-quarter guidance includes estimated contributions from DBA of approximately €155 million to €175 million in net sales, or $194 million to $219 million, and approximately €14 million in adjusted operating profit, or approximately $17 million, with an expected currency exchange rate of approximately $1.25 to the euro.

The company expects net cash from operating activities to be in the range of $550 million to $600 million for the year, compared with the previous guidance range of $500 million to $600 million. Any cash generated in 2014 by DBA is expected to be substantially offset by cash closing expenses for the acquisition. The company continues to expect to make pension contributions of approximately $60 million and net capital expenditures of approximately $70 million.

Charges for Actions and Reconciliation to GAAP Measures

Adjusted EPS, adjusted net income, adjusted operating profit (and margin), adjusted SG&A, adjusted gross profit (and margin), and EBITDA are not generally accepted accounting principle measures. Hanes has chosen to provide these non-GAAP measures to investors to enable additional analyses of past, present and future operating performance and as a supplemental means of evaluating company operations. Non-GAAP measures should not be considered a substitute for financial information presented in accordance with GAAP and may be different from non-GAAP or other pro forma measures used by other companies.

Hanes incurred pretax charges of $63 million in the third quarter, $24 million in the second quarter and $43 million in the first quarter for actions related to the acquisition and integration of Maidenform, the acquisition of DBApparel, and for actions primarily related to supply chain optimization and regional alignment of commercial operations.

Adjusted EPS is defined as diluted earnings per share excluding actions and the tax effect on actions. Adjusted EPS for the third quarter 2014 was $1.73, while on a GAAP basis, diluted EPS was $1.16 in the quarter versus $1.23 a year ago.

Adjusted operating profit is defined as operating profit excluding actions. Adjusted operating profit for the third quarter was $217 million, while on a GAAP basis, operating profit for the quarter was $154 million versus $177 million a year ago.

Adjusted net income is defined as net income excluding actions and the tax effect on actions. Adjusted gross profit is defined as gross profit excluding actions. Adjusted SG&A is defined as selling, general and administrative expenses excluding actions. The company believes that these measures provide investors with additional means of analyzing the companys performance absent the effect of acquisition-related expenses and other actions.

EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Although the company does not use EBITDA to manage its business, it believes that EBITDA is another way that investors measure financial performance. See Table 2 attached to this press release to reconcile EBITDA with the GAAP measure of net income.

For the companys 2014 guidance, adjusted EPS is defined as diluted EPS excluding actions and the tax effect on actions, and adjusted operating profit is defined as operating profit excluding actions. Hanes current estimate for pretax charges in 2014 for the Maidenform and DBA acquisitions and other actions is approximately $180 million to $190 million but actual charges could vary significantly. The company believes guidance for adjusted EPS and adjusted operating profit provides investors with an additional means of analyzing the companys performance absent the effect of acquisition-related expenses and other actions.

On a GAAP basis, full-year 2014 diluted EPS will vary depending on actual performance, charges and tax rate. GAAP diluted EPS could be in the range of approximately $3.95 to $4.15. GAAP operating profit for 2014 could be in the range of approximately $560 million to $590 million.

HanesBrands brands include Hanes, Champion, Playtex, DIM, Bali, Maidenform, Flexees, JMS/Just My Size, Wonderbra, Nür Die, Lovable and Gear for Sports. The company sells T-shirts, bras, panties, shapewear, mens underwear, childrens underwear, socks, hosiery, and activewear.