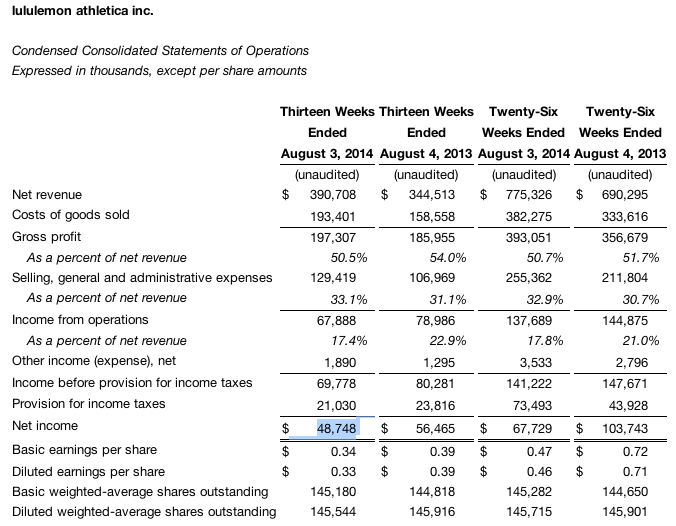

Lululemon Athletica reported second-quarter earnings slid 13.7 percent to $48.8 million, or 33 cents a share, but results exceeded Wall Street’s consensus estimate of 33 cents a share. Comps declined 5 percent in constant dollars and gross margins eroded to 50.5 percent for the quarter from 54.0 percent. Lululemon raised its forecast for the year by a penny to $1.72 to $1.77 a share.

For the second quarter ended August 3, 2014:

- Net revenue for the quarter increased 13 percent to $390.7 million from $344.5 million in the second quarter of fiscal 2013.

- Total comparable sales, which includes comparable store sales and direct to consumer, remained flat for the second quarter on a constant dollar basis. Comparable store sales for the second quarter decreased by 5 percent on a constant dollar basis and direct to consumer revenue increased 30 percent on a constant dollar basis.

- Direct to consumer revenue increased to $63.5 million, or 16.2 percent of total company revenues, in the second quarter of fiscal 2014, an increase from 14.3 percent of total company revenues in the second quarter of fiscal 2013.

- Gross profit for the quarter increased 6 percent to $197.3 million, and as a percentage of net revenue gross profit decreased to 50.5 percent for the quarter from 54.0 percent in the second quarter of fiscal 2013.

- Income from operations for the quarter decreased 14 percent to $67.9 million, and as a percentage of net revenue was 17.4 percent compared to 22.9 percent of net revenue in the second quarter of fiscal 2013.

- The effective tax rate for the second quarter of fiscal 2014 was 30.1 percent compared to 29.7 percent a year ago.

- Diluted earnings per share for the quarter were $0.33 on net income of $48.7 million, compared to diluted earnings per share of $0.39 on net income of $56.5 million in the second quarter of fiscal 2013.

For the twenty-six weeks ended August 3, 2014:

- Net revenue for the first two quarters of fiscal 2014 increased 12 percent to $775.3 million from $690.3 million in the same period of fiscal 2013.

- Total comparable sales increased 1 percent for the first two quarters on a constant dollar basis. Comparable store sales for the first two quarters decreased by 5 percent on a constant dollar basis and direct to consumer revenue increased 27 percent on a constant dollar basis.

- Direct to consumer revenue increased 25 percent to $129.5 million, or 16.7 percent of total company revenues, in the first two quarters of fiscal 2014, an increase from 15.0 percent of total company revenues in the first two quarters of fiscal 2013.

- Gross profit for the first two quarters of fiscal 2014 increased 10 percent to $393.1 million, and as a percentage of net revenue gross profit was 50.7 percent for the first two quarters as compared to 51.7 percent in the same period of fiscal 2013.

- Income from operations for the first two quarters of fiscal 2014 decreased 5 percent to $137.7 million, and as a percentage of net revenue was 17.8 percent as compared to 21.0 percent of net revenue in the same period of fiscal 2013.

- Tax expense for the first two quarters was $73.5 million, which included a non-recurring adjustment of $31.3 million related to the repatriation of foreign earnings that will be used to fund the share buyback program. The normalized tax rate before the $31.3 million non-recurring tax adjustment would have been 29.9 percent, compared to 29.7 percent a year ago. The tax rate for the first two quarters of fiscal 2014, including the non-recurring tax adjustment, was 52.0 percent.

- Excluding the non-recurring tax adjustment, diluted earnings per share were $0.68 in the first two quarters of fiscal 2014. Including the non-recurring tax adjustment, diluted earnings per share for the first two quarters of fiscal 2014 were $0.46, which included a $0.22 per share impact from the non-recurring tax adjustment.

- The company ended the second quarter of fiscal 2014 with $725.1 million in cash and cash equivalents compared to $610.3 million at the end of the second quarter of fiscal 2013. Inventory at the end of the second quarter of fiscal 2014 totaled $176.5 million compared to $163.0 million at the end of the second quarter of fiscal 2013. The company ended the quarter with 270 stores.

Laurent Potdevin, Lululemons CEO, stated: “We are pleased to be on track with the implementation of our strategic road map, and are starting to see the results of our work across product, brand and international expansion.” Mr. Potdevin continued: While there is still much to be done, we are making meaningful progress on building a scalable foundation for our next phase of global growth, and Im excited about the collaboration between our Whitespace team and ambassadors to accelerate innovation into the future.”

Updated Outlook

For the third quarter of fiscal 2014, we expect net revenue to be in the range of $420 million to $425 million based on a total comparable sales increase in the low single digits on a constant-dollar basis. Diluted earnings per share are expected to be in the range of $0.36 to $0.38 for the quarter. This guidance assumes 144.7 million diluted weighted-average shares outstanding and a 30.2 percent tax rate. The guidance does not reflect potential future repurchases of the company’s shares.

For the full fiscal 2014, we now expect net revenue to be in the range of $1.780 billion to $1.800 billion based on a total comparable sales increase in the low single digits on a constant-dollar basis. Diluted earnings per share are expected to be in the range of $1.51 to $1.56 for the full year, or $1.72 to $1.77 normalized for the non-recurring tax adjustment incurred in the first quarter of fiscal 2014 related to the repatriation of foreign earnings that will be used to fund the share buyback program. This guidance assumes 145.2 million diluted weighted-average shares outstanding and a 38.5 percent tax rate, which includes the above tax adjustment, or 30.2 percent before the tax adjustment. The guidance does not reflect potential future repurchases of the company’s shares.