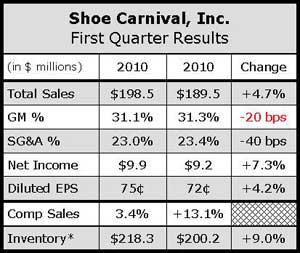

Led by running footwear, along with women’s sport styled sandals, Shoe Carnivals first quarter sales increased 4.7 percent to $198.5 million.

Comps increased 3.4 percent on top of a record 13.1 percent increase in Q1 2010. Earnings rose 7.6 percent to $9.9 million, or 75 cents per share, exceeding Wall Street’s consensus estimate of 72 cents a share.

Gross margins decreased to 31.1 percent of sales from 31.3 percent in Q1 2010. The merchandise margin decreased 0.4 points due primarily to the margin decrease in the toning category, while buying, distribution and occupancy costs decreased 0.2 points. SG&A decreased to 23.0 percent of sales from 23.4 percent due to sales leverage.

On a conference call with analysts, company EVP and GMM Cliff Sifford said Shoe Carnival saw increases in traffic, conversion rates, and average transaction size.

In the women’s non-athletic category, comps were up mid-single-digits and driven by molded footwear, sandalized wedges, sport sandals and vulcanized canvas. In men’s non-athletic, comps were down slightly although the performance was going against a comp increase in the mid-20 percent range in the first quarter of 2010. Sales are also driven by casual lifestyle product, like sandals, boat shoes, vulcanized canvas and traditional hikers.

Children’s delivered a low-single-digit comp increase as the later-than-normal Easter drove sales increases in sandals for both boys and girls and “new colorful athletic product drove double-digit gains in both boys and girls running,” said Sifford.

In adult athletic, comps were up mid-single-digits and came in spite of a comp decline in the toning category in the mid-30 percent range. Sifford noted the first quarter of 2010 was the retailers largest volume and margin producing quarter for the toning category. Adult athletics was driven primarily by the men’s and women’s running categories, with comp increases in the mid-20 percent range.

“As we have stated in the past, the commercials, magazines and news stories promoting the toning category have heightened demand for the entire athletic department,” said Sifford. “For the family channel, not only did this excitement drive the customer into our stores, but it proved to the vendor community that if the product is right, and the message is clear, our customer will pay for new technology. Our results for the first quarter bear this out, as our performance running product posted a high double-digit increase for the quarter.” Also showing increases were skate for men and women, along with men’s performance basketball, offering encouragement for the back-to-school season.

“I think running in total will continue its trajectory, lightweight running being the fastest-growing part of that category,” offered Sifford. He said they are also very bullish on basketball, which is expected to be strong for back-to-school and gain momentum through fall.

Inventories were up 6.6 percent on a per-door basis at quarter-end, primarily due to increased unit cost. Toning sales for Q1 were in line with expectations, and toning inventories were said to be on track to be aligned with sales by the end of Q2. Aged inventory remains low.

SCVL expects second quarter net sales to be in the range of $169 to $172 million with comps in the range of flat to an increase of 2 percent. Strong sales in technical running product are expected to offset the sales loss from toning. EPS is expected to be in the range of 27 cents to 31 cents a share. The company also reiterated that it expects to launch an e-commerce site during the second half of the year.