Asics Corporation has revised its forecast for the fiscal year ending December 31, 2025, reportedly due to actual business results through June 30, 2025, and expectations that net sales for the full year are expected to reach a record high.

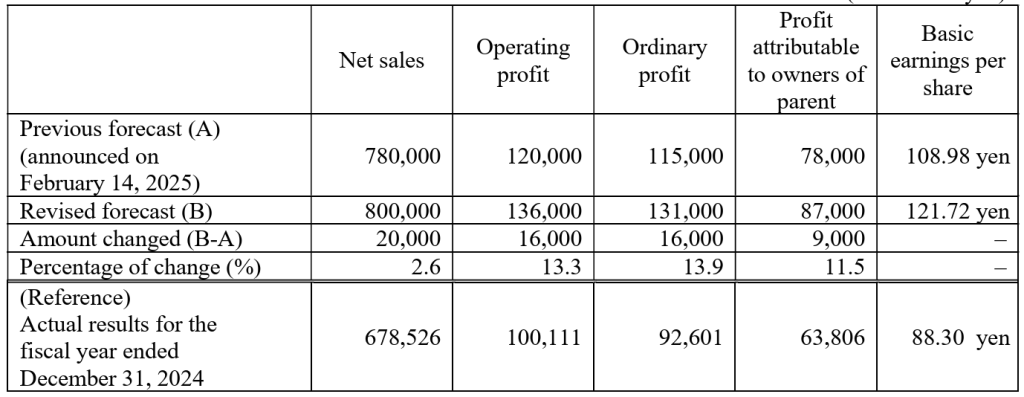

Full year 2025 revenues are now expected to reach ¥800 billion (~$5.33 billion), up from the initial forecast of ¥780 billion provided on February 14, 2025.

Asics Corporation reports in the Japanese yen (¥) currency. The exchange rate forecast for conversion to U.S. dollars remained the same at ¥150.0 billion.

From a category perspective, the Performance Running category, the SportStyle category, and the Onitsuka Tiger category are all expected to show strong growth. By region, the Japan region, the North America region, and the Europe region are also expected to exhibit strong growth.

Operating profit, ordinary profit and profit attributable to the owners of the parent company are also expected to exceed the previous forecast and reach record highs, respectively, supported by sales growth and an improvement in gross margin.

Revision of the 2025 Consolidated Business Results Forecast

(Millions of yen)

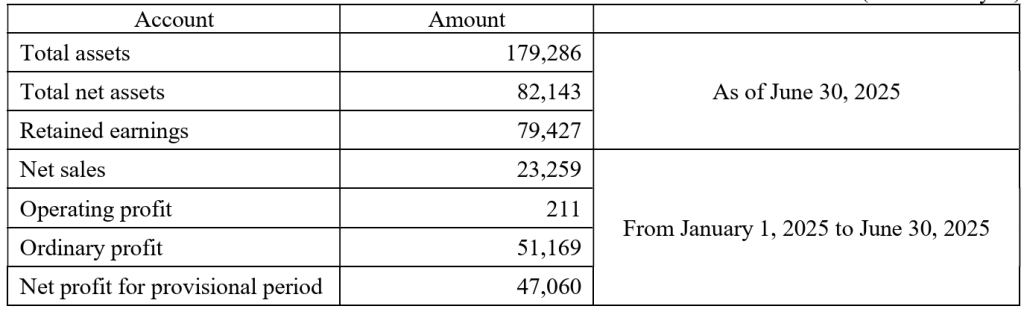

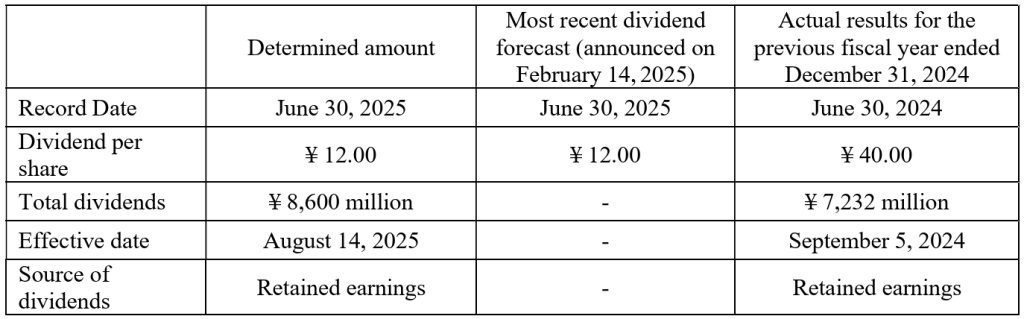

Interim Dividend and Provisional Account Closing

The company is also implementing the interim dividend for the fiscal year ending December 31, 2025, with a record date of June 30, 2025, and will conduct a provisional account closing as of June 30, 2025, adding the profit of the interim accounting period of the fiscal year ending December 31, 2025 (from January 1, 2025 to June 30, 2025) to the distributable amount (retained earnings).

Summary of Provisional Financial Statements

(Millions of yen)

Interim Dividend Details

The company explained the reasoning behind the dividend increase as its recognition of profit distribution to shareholders as one of the management’s top priorities. The company also considers profit distribution plans to achieve a total return ratio of 50 percent or higher during the mid-term plan period, as outlined in the “Mid-Term Plan 2026.”

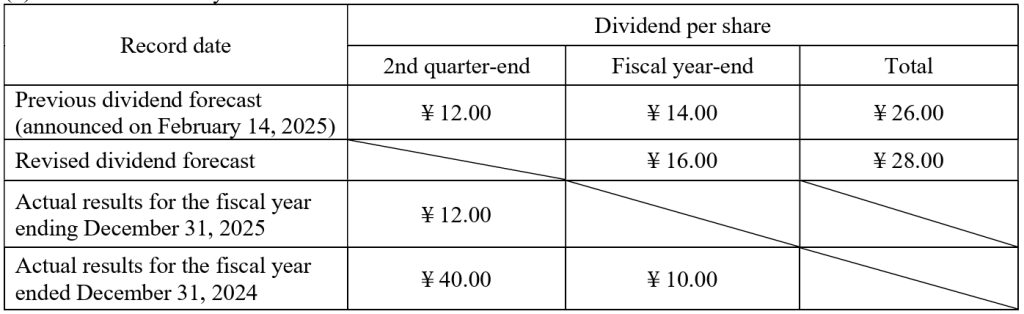

Revision of Fiscal Year-End Dividend Forecast

Based on the actual business results for the six-month period ended June 30, 2025, and the status of cash flow, the company will revise its year-end dividend forecast to ¥16.00 per share, an increase of ¥2.00 per share from the previous forecast. As a result, the company will further increase the annual dividend forecast from the previous record-high forecast of ¥26.00 per share at the beginning of the fiscal year and revise it upward to ¥28.00 per share.