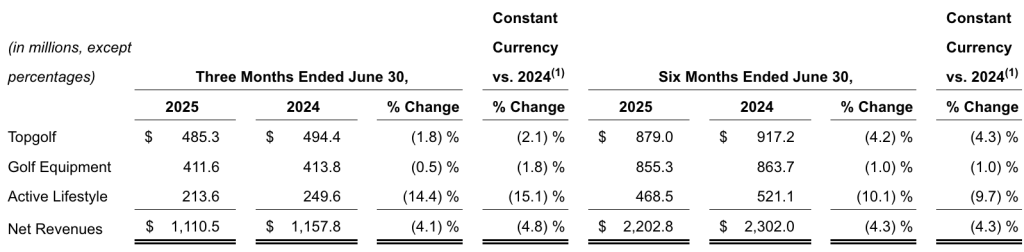

Callaway Brands recorded net revenue of $1.11 billion in the 2025 second quarter, a 4.1 percent year-over-year (y/y) decrease said to be primarily due to decreases in the Active Lifestyle segment, primarily as a result of the sale of the Jack Wolfskin business.

The consolidated results were reportedly better than expected, largely due to stronger-than-anticipated performance in both the Topgolf and Golf Equipment segments.

Segment Net Revenues

“We are pleased with our second quarter financial results as we met or beat expectations in all segments of our ongoing business and our consolidated revenue and Adjusted EBITDA surpassed our expectations going into the quarter,” stated Chip Brewer, CEO, Topgolf Callaway Brands. “These results reflect continued consumer strength in our golf equipment business, the benefits from our gross margin and cost savings initiatives across each segment of our business, as well as the success of Topgolf’s value initiatives, which have significantly improved traffic and sales trends in the venues. We are also pleased that these results, along with current trends, are allowing us to absorb the increased tariffs this year and increase our full year outlook for our ongoing businesses.”

On a GAAP basis, income from operations increased $2.8 million to $105.8 million. On a non-GAAP basis, income from operations of $121.2 million was approximately flat y/y. The company said it achieved these results while absorbing the impact of the new tariffs announced this year.

On a GAAP basis, net income was $20.3 million, a 67.3 percent y/y decrease, and was reportedly due to non-recurring charges related to the sale of Jack Wolfskin, as well as increased foreign currency hedge losses and increased income tax expense.

On a non-GAAP basis, net income was $45.6 million, a decrease of 45.1 percent y/y. These decreases were said to be primarily due to the increased foreign currency hedge losses and increased tax expense.

Adjusted EBITDA was $195.8 million, a decrease of 4.8 percent year-over-year.

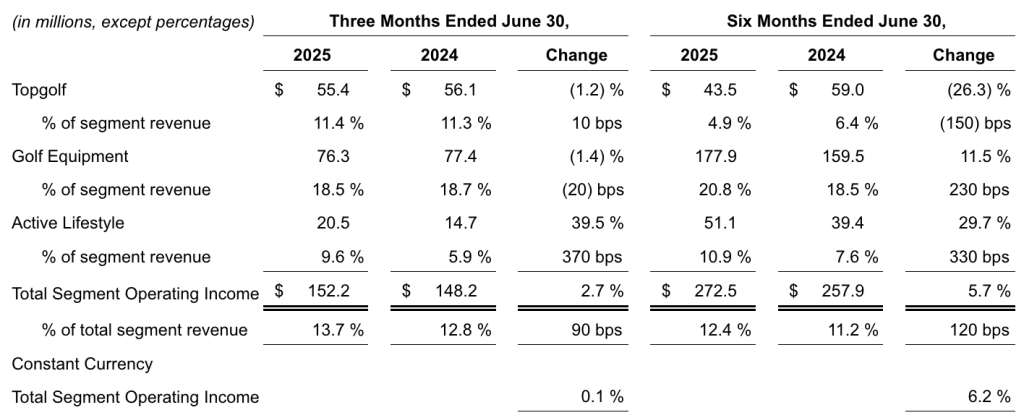

Segment Summary

Golf Equipment

Golf Equipment revenue decreased 0.5 percent to $411.6 million primarily due to a more competitive launch timing environment than last year.

Segment operating income decreased $1.1 million to $76.3 million, with gross margin and cost savings initiatives mostly offsetting incremental tariffs.

Active Lifestyle

Active Lifestyle revenue decreased $36.0 million to $213.6 million, primarily due to the Jack Wolfskin business, including the sale of that business on May 31, 2025.

Segment operating income increased $5.8 million, primarily driven by the sale of Jack Wolfskin, which incurs losses in the first half of the year due to seasonality.

Topgolf

Topgolf segment revenue decreased $9.1 million to $485.3 million in Q2, with a 6 percent decline in same-venue sales partially offset by revenue from new venues. While same-venue sales declined 6 percent y/y the number was said to be ahead of expectations, primarily due to improved traffic trends from new value initiatives.

The company defines same-venue sales for its Topgolf business as sales for the comparable venue base, which is defined as the number of company-operated venues with at least 24 full fiscal months of operations in the year of comparison.

Segment operating income decreased 1.2 percent to $55.4 million in Q2, said to be due primarily to higher depreciation from new venues. Adjusted EBITDA increased $1.3 million to $110.8 million. This increase reportedly reflects the company’s on-going cost reduction efforts including labor efficiency initiatives in the venues, which more than offset the impact of the decline in same venue sales.

Balance Sheet and Cash Flow Summary

Inventory decreased $38.2 million year-over-year to $608.9 million, primarily due to a decrease of $112.5 million as a result of the sale of Jack Wolfskin, more than offsetting increases in Golf Equipment inventory due to year-over-year timing differences and the normalization of golf ball inventory due to a supplier factory fire in 2024.

Available liquidity, which is comprised of cash on hand plus availability under the Company’s credit facilities, increased $377.9 million to $1.16 billion compared to June 30, 2024, primarily driven by approximately $290 million of cash proceeds from the sale of Jack Wolfskin, as well as proceeds from lease financing and cash from operations.

Topgolf Leadership Update

On July 31, Callaway announced the resignation of Topgolf CEO Artie Starrs, who is expected to remain with the company through September 2025 to assist with an orderly transition. He is reportedly moving to Harley-Davidson where he will become president and CEO, effective October 1, 2025.

The company said it remains committed to the separation of its Topgolf and Core businesses, and continues to pursue a spin-off or sale of Topgolf. In light of Starrs’ departure, it is likely that a spin-off transaction would not occur until 2026, after a new CEO is in place.

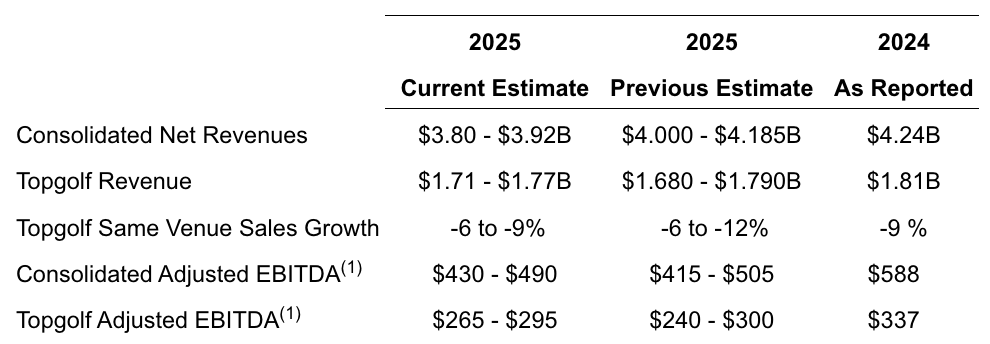

2025 Outlook Update

Callaway updated its guidance to reflect the sale of the Jack Wolfskin business and raised the full year financial outlook for its continuing businesses.

The company sold its Jack Wolfskin business on May 31, 2025 and is therefore updating its full year guidance to reflect the exclusion of the JW business for June – December. This reduces its full year forecasted revenue by $265 million and forecasted EBITDA by $26 million.

Excluding the Jack Wolfskin business, the company is increasing the midpoint of its revenue guidance by approximately $30 million and its Adjusted EBITDA guidance by approximately $25 million for its continuing businesses to reflect the better than expected second quarter performance and improved outlook for the year.

With regard to Topgolf, the company increased the midpoint of its revenue guidance by $5 million and the midpoint of its Adjusted EBITDA guidance by $10 million to reflect the better-than-expected 6 percent y/y decline in same-venue sales performance in the second quarter. The company also increased the midpoint of its full-year same-venue sales guidance to a decline of 7.5 percent y/y compared to the midpoint of its prior guidance of a decrease of 9 percent year-over-year.

2025 Full Year Outdook

(in $ millions, except where noted otherwise and for percentages and per share data)

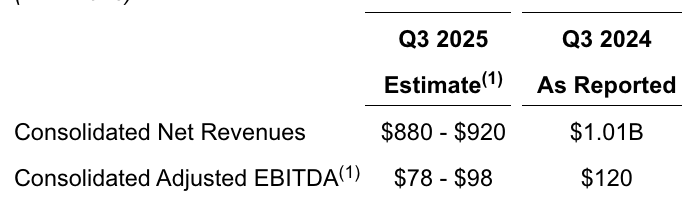

2025 Third Quarter Outlook

2025 Third Quarter Outlook

(in $ millions)

(1) Non-GAAP measure.

The company’s estimates for the third quarter of 2025 reflect the sale of the Jack Wolfskin business. The third quarter 2024 results included Jack Wolfskin revenue of $108 million and Adjusted EBITDA of $1 million. The decrease in third quarter Adjusted EBITDA is primarily related to the forecasted decrease in Topgolf same-venue sales and the incremental tariffs.

Image courtesy Travis Mathew/Topgolf Callaway Brands