Think about it. 168,000 fans. Two unforgettable days. One iconic comeback. That’s the tone the Vans brand set this past weekend as the company that birthed the Warped Tour resurrected perhaps one of the top marketing programs of all time in the lifestyle footwear space and came roaring back with its own 2.0 version of what the brand used to represent to the market.

“This past weekend at Long Beach’s Marina Green Park, Vans Warped Tour’s 30th anniversary resurgence was nothing short of monumental,” the brand said in a LinkedIn post. and as the Long Beach Post described it, attendees experienced “a colossal gathering of punk rock, SoCal culture and nostalgia.” In other words, that certain something that’s been missing for Vans.

Vans said the weekend saw a record-breaking crowd, representing Warped’s biggest sellout ever, with 168,000 fans in attendance.

“There were over 460,000 views across the Warped Tour YouTube and Twitch platforms, making the tour more accessible than ever,” Vans said. And to make it even more amazing, the Long Beach stop of the Tour donated more than 27,000 lbs of food to the Long Beach Food Bank n just one day.

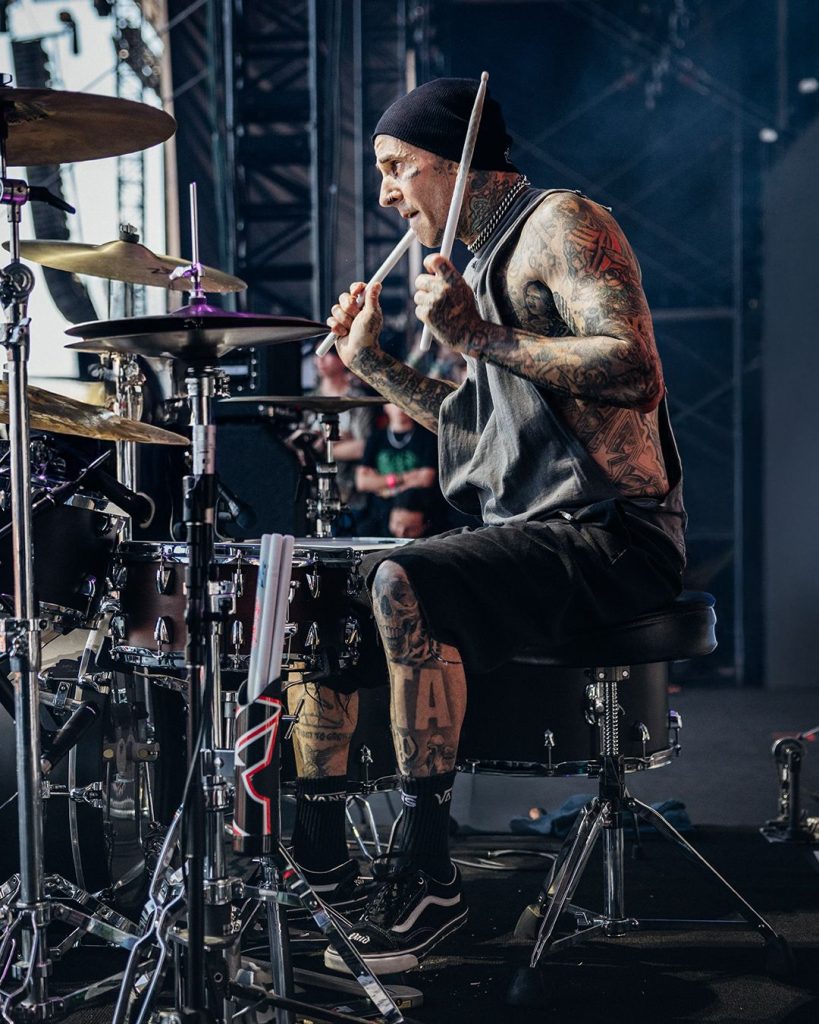

Vans said a dynamic mix of heavyweight acts — from hometown heroes Sublime returning to Long Beach, to legends like Pennywise, 311, Fishbone, Ice‑T, The Vandals, and All‑American Rejects — created an eclectic, high‑energy lineup.

The Vans Warped Tour, which was said to have helped jump-start the careers of artists like Blink-182, Fall Out Boy and Katy Perry, ended in 2018 after 24 years.

“We do not have plans to bring back the Warped Tour, although we’ve certainly crossed our mind and we’re talking about it a little bit,” was the response in February 2024 when a new CEO of Vans’ parent company was asked by an analyst on a conference call if there were plans to bring back the iconic event. “The Warped Tour was a really powerful thing, but it took time to build. It would take quite a bit of time to rebuild. I think the objective though, of making sure that we’re really deeply in the hearts and minds of the youth audience is mission-critical for us.”

Well, dang it, that new CEO, Bracken Darrell built it – with a lot of help from the Vans team in California – and made it a reality just two years after he first arrived on the scene at VF Corp. and Vans.

VF Corp. posted fiscal first quarter earnings on Wednesday, July 30, again pointing to a double-digit decline at Vans that was a drag on overall results. The downturn for the brand has been almost difficult to watch over the last few years as previous VF Corp. leadership proved time and again that they did not get this brand or its core consumer.

Vans Sees Q1 Sales Slide 14 Percent

Vans brand revenues totaled $498.0 million in the quarter, down 14 percent on a reported basis and 15 percent on a currency-neutral basis. By region, sales on a currency-neutral basis slum[ed 14 percent in the Americas, 16 percent in EMEA and 17 percent in APAC.

VF noted that excluding the impact of channel rationalization actions, revenue was down in the high-single digits. DTC revenues were impacted by the closure of non-strategic stores and lower traffic across regions with key EMEA cities outperforming. On the positive side, Americas sell-out trends were positive in non-value wholesale doors and sales from new products are growing, with momentum from Super Lowpro, Curren Caples Skate and OTW, more than offset by declines in the icons.

That CEO spent the most time on the company’s conference call discussing the Vans brand’s turnaround progress, acknowledging that investor sentiment around VF’s stock is significantly linked to returning Vans to growth.

If the energy experienced at the the tour stop over the weekend, a fire may have been lit. It has to be encouraging when “Vans Rocks,” was a rallying cry on social media posts.

Regaining Brand Heat

Regaining Brand Heat

Among the signs that Vans is regaining brand heat, Darrell cited a 50 percent increase in appointment bookings at Paris Fashion Week in June, including new accounts and accounts who have delisted Vans in recent years coming back. He also cited the “strong reaction” to skate-inspired silhouettes featured by many luxury brands in Paris this year.

“These are the style centers and the taste makers,” said Darrell. “Trends start in the luxury market, as we saw in Fashion Week for Timberland with Louis Vuitton last June. I’m not suggesting that Vans will be growing 9 percent a year from now, but I am excited to see the tide turning on skate style shoes and luxury where trends start.”

He also said Vans team, led by former Lululemon executive Sun Choe, is moving past an “old product creation process as each quarter passes” and will be accelerating new product roll-outs, including in the newer Premium range. Vans is also further investing in increasing supply and variety in styles currently seeing “strong interest,” including the Super Lowpro, the Current Caples Skate and OTW, it Pinnacle offering. Finally, Vans is seeing “encouraging signs” in one of its classics lines, the Authentic.

Darrell still cautioned that Vans remains committed to exiting lower-value distribution channels “to set us up for high-quality, sustained and profitable growth,” and those actions are expected to continue to impact sales through the end of the calendar year. He added, “As we exit the year, our channels should be at our future state.”

Channel Rationalization Cuts into Sales

Channel Rationalization Cuts into Sales

The channel rationalization is showing some benefits. In the Americas, sell-out trends continue to improve as non-value accounts grew again this quarter. In DTC over the last two years, about 140 stores were closed, or about 20 percent of Vans’ global network, improving Vans’ profitability. Darrell noted that Vans has reoriented about 90 percent of its full-price Americas stores to provide greater gender clarity and is also better showcasing newness and footwear in stores. A pilot store on Fifth Avenue delivered positive comps in Q1, significantly outperforming the rest of Vans’ fleet in the Americas.

In Europe, an elevated London stores generated a 15 percent better revenue performance than the rest of the EMEA fleet, supported by 35 percent higher prices due to increasing Premium offerings. Darrell said, “Based on these early successes, we’ll be rolling out our new retail playbook to improve assortment, curation and navigation to other regions.”

He conceded that the brand’s current marketing approach “simply hasn’t driven enough traffic” and said other changes to Vans’ marketing strategy are in development. Maybe his opinion will change after this past weekend.

Darrell concluded, “We’re on track with the turnaround and could be more excited about what’s coming next. Keep watching. We are well on our way to transforming V.F. and this quarter is another step in the right direction. Our powerful portfolio of brands and the sustainable growth model we’re creating will help us accelerate growth and improve margins. We’re on a path to achieve our targets and build a stronger V.F. Our focus is on growth.”

Vans also said on the call it saw strong consumer engagement and reach driven by its Lil Uzi partnership, Pinnacle bookings at Paris Fashion Week, and the return of Vans Warped Tour.

Darrell hailed the return of the Vans Warped Tour. He said all three concert events sold out in hours with one held in Long Beach this past weekend hosting 168,000 attendees, the most for a concert event in Vans’ history. Darrell said, “People came because they love music and they love Vans, and they’re inseparable for many.”

Next stop: Orlando, November 15–16, 2025.

Images courtesy Vans Warped Tour

See below for additional SGB Executive coverage of Vans, The North Face, Timberland, Altra, and other VF Brands:

EXEC: VF Corp. CEO Bullish on Return to Growth as The North Face and Timberland Both Shine in Q1