Shimano Inc. reported its 2025 first half results on Tuesday, July 29, signaling that that the global economy maintained a moderate recovery but the company’s outlook remained uncertain due to the impact of trade policies around the world, prolonged conflicts in Ukraine and the Middle East, and a slowdown in the Chinese economy.

- In Europe, personal consumption was described as “strong” as the pressure of inflation subsided, and the economy continued to grow moderately.

- In the U.S., the economy reportedly showed signs of weakness amid the cooling of consumer sentiment due to changes in trade policies.

- In China, the economic recovery was said to have remained lackluster, mainly due to the impact of the prolonged recession in the real estate sector and a slump in personal consumption.

- In Japan, the economy maintained a moderate recovery, with robust demand from inbound tourists and improvements in the employment and income environment.

In this environment, the company suggested that interest in bicycles and fishing tackle continued.

Net sales for the first half of fiscal year 2025 increased 9.5 percent year-over-year (y/y) to ¥237.4 billion ($1.75 billion). Operating income decreased 9.2 percent y/y to ¥28.1 billion ($207 million), ordinary income decreased 74.8 percent y/y to ¥14.0 billion ($103 million), partly due to valuation loss on foreign exchange, and net income attributable to owners of parent decreased 90.9 percent y/y to ¥3.96 billion ($29.1 million).

Net sales for the second quarter increased 6.5 percent year-over-year (y/y) to ¥93.5 billion ($687 million).

Segment Summary

Bicycle Components

Shimano said that while a strong interest in bicycles continued as a long-term trend, market inventories remained high in some regions and inventory adjustments continued. Bicycle Components segment net sales increased 11.6 percent y/y to ¥181.4 billion ($1.33 billion), and operating income decreased 2.9 percent to ¥23.6 billion ($174 million).

- Japan market inventories reportedly remained at appropriate levels, but retail sales were said to be “sluggish” due to the soaring price of completed bicycles.

- Europe retail sales of completed bicycles were reportedly “robust” thanks to favorable weather conditions in early spring. Market inventories decreased but still remained at a somewhat high level.

- North American retail sales of completed bicycles reportedly remained “weak,” but market inventories maintained appropriate levels.

- In the Asian and Central and South American markets, although retail sales of completed bicycles were said to remain “somewhat weak” as personal consumption continued to be sluggish, market inventories approached an appropriate level.

- Chinese market interest in cycling as a sport remained firm, but an adjustment continued in market inventories, which have remained at a somewhat high level.

Under these market conditions, Shimano said its products were well received, including XTR, a high-end model of renewed component for mountain bikes, as well as the Deore XT and Deore series, and Q’Auto, which features self-powered automatic gear-shifting system.

Fishing Tackle

While the interest in fishing tackle continued, sales remained weak but adjustments of market inventories made progress. Fishing Tackle segment net sales increased 3.1 percent y/y to ¥55.8 billion ($410 million), and operating income decreased 32.4 percent y/y to ¥4.49 billion ($33 million). In Japan, although adjustments of market inventories reportedly progressed, sales remained weak due to a slump in personal consumption as a result of price hikes.

North American market sales remained flat to the prior year and market inventories remained at an appropriate level.

Europe market sales were said to be “strong,” helped by favorable weather, and market inventories maintained an appropriate level.

Asian market inventory adjustments showed signs of easing – mainly in China – and sales were said to be “firm.”

Australia market sales were reported as “strong” and market inventories remained at an appropriate level, supported by stable fishing conditions. Under these market conditions, the new spinning reels Ultegra and the new baitcasting reels Antares were said to be well-received in the market. In addition, order-taking continued to be brisk for the baitcasting reels Metanium DC and the rods Expride.

Others Segment

Net sales from the Others segment increased 4.9 percent y/y to ¥233 million ($1.72 million) and operating loss of ¥1 million was recorded, following an operating loss of ¥24 million for the H1 period last year.

Balance Sheet and Cash Flows Summary

Total assets as of the end of the first half of fiscal year 2025 amounted to ¥903.8 billion, a decrease of ¥55.2 billion compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥10.1 billion construction in progress, an increase of ¥6.45 billion in notes and accounts receivable-trade, an increase of ¥1.32 billion investment securities, a decrease of ¥70.5 billion in cash and time deposits, a decrease of ¥2.15 billion machinery and vehicles, and a decrease of ¥1.24 billion in raw materials and supplies.

Total liabilities amounted to ¥77.0 billion, an increase of ¥1.69 billion compared with the figure as of the previous fiscal year-end. The principal factors included an increase of ¥3.04 billion others under current liabilities, an increase of ¥630 million accounts payable-trade, a decrease of ¥886 million deferred income taxes, a decrease of ¥681 million accrued employee bonuses, and a decrease of ¥657 million provision for product warranties under long-term liabilities.

Net assets amounted to ¥826.8 billion, a decrease of ¥56.9 billion compared with the figure as of the previous fiscal year-end. The principal factors included a decrease of ¥39.7 billion retained earnings and a decrease of ¥17.6 billion foreign currency translation adjustments.

Cash Flows As of the end of the first half of fiscal year 2025, cash and cash equivalents amounted to ¥458.7 billion, a decrease of ¥71,566 million with the figure as of the previous fiscal year-end.

Net cash provided by operating activities amounted to ¥31.5 billion with ¥52.5 billion provided for the same period of the previous year. The main cash inflows included foreign exchange losses (gains) amounting to ¥20.0 billion, income before income taxes amounting to ¥14.0 billion, depreciation and amortization amounting to ¥13.1 billion, and interest and dividend income received amounting to ¥10.0 billion. The main cash outflows included income taxes paid amounting to ¥10.5 billion, interest and dividend income amounting to ¥9.27 billion, and notes and accounts receivable amounting to ¥7.14 billion.

Net cash used in investing activities amounted to ¥26.7 billion with ¥15.8 billion for the same period of the previous year. The main cash outflows included acquisition of property, plant and equipment amounting to ¥20.6 billion acquisition of intangible assets amounting to ¥4.33 billion.

Net cash used in financing activities amounted to ¥44.5 billion with ¥29.4 billion for the same period of the previous year.

The main cash outflows were said to include acquisition of treasury stock amounting to ¥30.0 billion cash dividends to shareholders amounting to ¥13.8 billion.

Forecast for the Fiscal Year Ending December 31, 2025

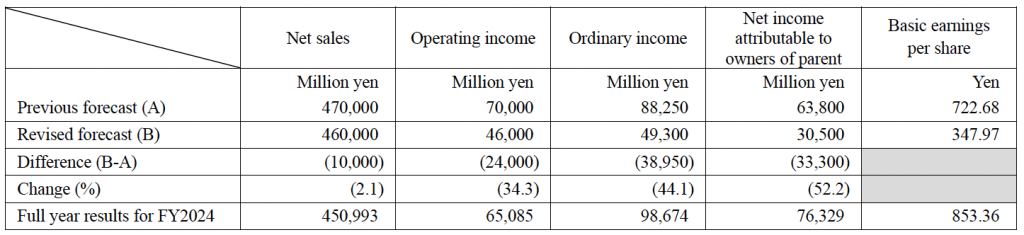

The consolidated business performance forecasts for fiscal year 2025 have been revised in light of the anticipated continuation of inventory adjustments in the Chinese market, leading to expected drop in profit margin due to an increase in expenses in a phase of production adjustments at factories, and an increase in non-operating expenses including foreign exchange losses associated with the appreciation of Asian currencies caused by the weaker U.S. dollar in the first half of fiscal year 2025.

The company considers the return of earnings to shareholders to be one of the most important issues for management. The company’s basic policy is to continue providing stable returns reflecting overall business performance and strategy. Pursuant to this policy, the company will strive to improve shareholder returns to reach a total return ratio of at least 50 percent, by continuing to enhance dividends and engaging in acquisitions of treasury stock on a flexible, ongoing basis.

In accordance with this policy, as announced in February 2025 (forecast), the company decided to pay out interim cash dividends of ¥169.50 per share for fiscal year 2025, an increase of ¥15 per share from the same period of the previous year. In addition, the year-end cash dividends will also be ¥169.50 per share, resulting in the cash dividends forecast for the full year of fiscal year 2025 amounting to ¥339 per share.

Image courtesy Shimano Inc.