KMD Brands Limited, parent of the Rip Curl, Oboz and Kathmandu brands, is reporting preliminary results for the 10-month year-to-date period through May 2025.

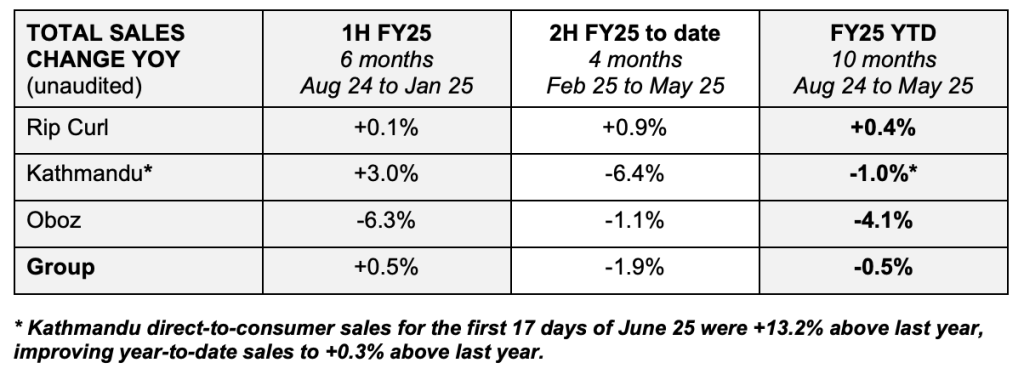

Total sales results (unaudited) for the ten months to the end of May were as follows:

KMD Brands reports in Australian dollars (A$).

Rip Curl’s global direct-to-consumer sales continued to grow year-over-year (YOY) through the second half of fiscal 2025 to date, with strong comparable sales results in North American flagship stores. While Wholesale sales trends continued to improve from the first half, they remained below last year’s levels through the second half of May.

Oboz Wholesale sales were below last year’s through May, but the category improved in the second half with the launch of new season styles ahead of the North American summer hiking season. Oboz online sales have been variable since the announcement of global tariffs by the U.S. but remain above the comparative 10-month period last year.

Kathmandu weekly sales have shown marked volatility over the past four months. Unseasonably warm weather in Australia reportedly had a material adverse impact on the Insulation product category, while Kathmandu achieved sales growth year-over-year in other key product categories, including Rainwear, Fleece, Knits, and Footwear. The recent shift to cooler weather in New Zealand and Australia has reignited sales momentum, with the first 17 days of June delivering a 13.2 percent year-over-year sales growth.

The company reported that school holidays and the start of the ski season offer further opportunities to continue Kathmandu’s momentum for the remainder of the financial year.

“While the volatility of Kathmandu’s sales performance is frustrating, we acknowledge that unseasonably warm weather in Australia, including Victoria’s warmest Autumn on record, has negatively impacted sales,” offered Group CEO and Managing Director Brent Scrimshaw. “Kathmandu’s significant sales improvement, including strong online momentum in recent weeks, reinforces our enduring brand health and strengthens our confidence in the future growth opportunity.”

Group online sales continue to be a key growth opportunity, with fiscal 2025 YTD online sales increasing 10.7 percent year-over-year.

KMD stated that Kathmandu recently upgraded its online trading platform, resulting in a significant improvement to the “consumer journey.” Since its implementation in May, online sales have been up 26.1 percent year-over-year, with the recent Australian public holiday marking the highest online sales day in over two years. The Group will roll out the new online trading platform to both Rip Curl and Oboz during the fiscal 2026 first half.

Group gross margin for fiscal 2025 YTD is 140 basis points lower YOY “as all brands focus on generating cashflow in a highly competitive global market.” Kathmandu is reportedly focused on maintaining market share in a competitive consumer environment.

KMD reported that it continues to closely monitor the fluid U.S. tariff situation and that it remains too early to estimate the impact on consumer demand in the U.S. Given the uncertainty in the U.S. market, KMD stated that agility remains its top priority heading into fiscal 2026.

“The Group is proactively working on a range of initiatives to unlock future growth opportunities across the portfolio, address short-term market challenges and improve medium to long-term performance and value for shareholders,” added Scrimshaw.

EBITDA

The Group anticipates tariffs to impact fiscal 2025 EBITDA by approximately A$1 million.

With the Kathmandu winter trade ongoing and the Rip Curl summer trade in the U.S. and Europe commencing, the Group expects FY25 underlying EBITDA to be in the range of $15 million to $25 million, with material trade to come.

Balance Sheet Summary

KMD now expects net debt at fiscal year-end to be approximately A$70 million, with direct-to-consumer sales performance as the key cash flow driver for the remainder of the financial year. The company reports that all brands are continuing to actively manage working capital and expect inventory levels to be lower than those in FY24.

Group inventory commitments for fiscal 2026 remain strategically moderated, along with targeted clearance of end-of-line styles for the remainder of the financial year.

The Group continues to work constructively with its banking syndicate and has proactively agreed to amended FCCR and leverage banking covenants for the next two measurement periods. The Group expects to be fully compliant with all amended covenants by July 31, 2025.

Image courtesy Rip Curl