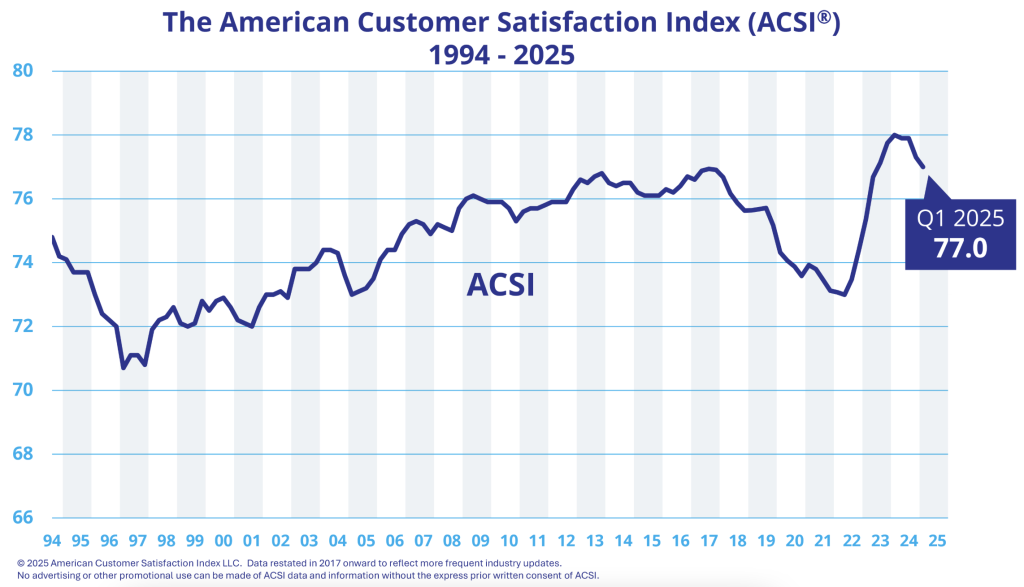

The American Customer Satisfaction Index (ACSI), a national economic indicator for over 25 years, has remained flat or dropped in four consecutive quarters, something that has not occurred since the COVID pandemic, according to a recent report from ASCI.org.

ACSI noted that as gross domestic product (GDP) contracted and consumer sentiment declined in the first quarter, overall U.S. customer satisfaction also fell 0.4 percent to a score of 77.0 (on a scale of 0 to 100).

It has been down 1.3 percent for the past year, led by slumps in the U.S. Postal Service, cell phones and apparel.

“ACSI measures quality of economic output (relative to price). GDP tracks the quantity of economic output. These two statistics often move together, but not always,” noted the ACSI team. “This time, both are negative, but their current relationship is spurious. GDP contracted due to a major surge in imports from inventory stockpiling, triggered by a threat of higher tariffs. Customer satisfaction is of no relevance in that context but has declined due to price increases and inconsistent service quality.”

ACSI said that weakening customer satisfaction has a negative effect on demand.

“Strengthening the buyer-seller relationship is important because it leads to exponentially increasing profits, especially at high levels of customer retention, and much improved cash flow stability,” ACSI continued. “This is especially relevant in industries where customer satisfaction elasticity of demand is high, such as subscription TV, credit unions, internet service providers, banks, wireless phone services, and financial advisors, but less so for supermarkets, gas stations, and social media.”

The data shows that U.S. Postal Service, cell phones, apparel, and online investment companies have declined the most in customer satisfaction over the past year and are also most at risk for revenue growth uncertainty.

“The general lack of strong business-customer relationships in the U.S. is problematic,” said Claes Fornell, founder of the ACSI and Donald C. Cook Professor (Emeritus) of Business Administration at the University of Michigan. “Customer satisfaction has not improved substantially over the past 12 years, despite vast corporate investments to do just that.

“The general lack of strong business-customer relationships in the U.S. is problematic,” said Claes Fornell, founder of the ACSI and Donald C. Cook Professor (Emeritus) of Business Administration at the University of Michigan. “Customer satisfaction has not improved substantially over the past 12 years, despite vast corporate investments to do just that.

Extrapolating the ACSI trajectory from the first decade of this century, customer satisfaction would be almost 6 percent higher than it is today and there would be much higher customer loyalty to boot. There is no evidence that inflated consumer expectations are to blame: The expectations-satisfaction gap has remained fairly constant over time. The problem lies in poor performance metrics and data analytics,” continued Fornell, shown right.

ACSI said the metrics generally fail to separate data noise from information. The data analytics are reportedly ill-suited for the many idiosyncrasies in customer data, making resource allocation for improving customer relationships more difficult.

“While analytical rigor and science-based measurement instruments are often absent, they are necessary for realizing the financial benefits from strong customer relationships: high returns/low risk,” ACSI concluded.

Methodology: The American Customer Satisfaction Index measures and analyzes customer satisfaction with approximately 400 companies in about 40 industries and 10 economic sectors, including various federal and local government agency services. The scores are reported on a scale of 0 to 100 and based on data from interviews with roughly 200,000 responses annually.

Images courtesy the ACSI, AdobeStock