Shimano Group reported that interest in bikes and fishing tackle continued into the first quarter of fiscal year 2025, pushing consolidated net sales up 12.9 percent year-over-year (y/y) to ¥113.5 billion.

Operating income for the quarter increased 20.3 percent y/y to ¥16.1 billion, ordinary income decreased 46.6 percent y/y to ¥15.4 billion, and net income attributable to owners of parent decreased 58.7 percent y/y to ¥9.8 billion.

The company said the global economy maintained strong growth in the first quarter on the back of slowing inflation. Shimano also said that uncertainty about its outlook increased due to the prolonged unrest in Ukraine and the Middle East, the sluggish Chinese economy and policy trends in various countries. The company noted:

- Europe personal consumption recovered as inflation subsided, and the economy continued in a gradual recovery trend.

- U.S. consumer confidence declined due to changes in trade policies, but the economy remained strong on the back of a stable employment environment.

- The China economy remained weak due to stagnant domestic demand caused by the recession in the real estate sector.

- The Japan economy followed a moderate recovery trend due to favorable demand from inbound tourists and the pick-up in personal consumption due to improvements in the employment and income environment.

Bicycle Components

Bicycle Components segment net sales increased 15.6 percent y/y to ¥88.0 billion, and operating income increased 38.5 percent y/y to ¥14.5 billion.

“While the strong interest in bicycles continued as a long-term trend, market inventories remained high despite gradual adjustments,” the company said in its Q1 report summary.

- European market inventories reportedly remained at a “somewhat high level,” while the company said signs of recovery started to appear in retail sales of completed bicycles as demand stabilized.

- North American market retail sales of completed bikes remained weak, but market inventories were said to return to “appropriate levels.”

- In the Asian and Central and South American markets, Shimano said that although retail sales of completed bikes remained weak as personal consumption continued to be sluggish, the level of market inventories started to show signs of improvement.

“In the Chinese market, while demand was strong due to the popularity of cycling as a sport, market inventories have remained at a somewhat high level since the end of 2024,” the company said.

Japanese market inventories remained at “appropriate levels,” but retail sales were reported sluggish due to the “soaring price” of completed bicycles.

Under these market conditions, the Shimano Group received a favorable reception for its products, including Shimano 105, a component for road bikes, and Shimano GRX, a gravel bike component.

Fishing Tackle

Fishing Tackle segment net sales increased 4.5 percent y/y to ¥25.5 billion, and operating income decreased 44.7 percent y/y to ¥1.64 billion.

While the interest in fishing tackle continued, Shimano said sales remained weak as adjustments of market inventories made progress. In the Japanese market, although adjustments of market inventories progressed, sales were said to be lackluster due to cooling consumer confidence as a result of cold weather and price hikes.

- North American market inventories reportedly remained at an “appropriate level,” but sales flattish to Q1 2024 due to unfavorable weather.

- European market sales reportedly remained strong and market inventories remained at an “appropriate level.”

- Asian market sales were said to be “lackluster due to sluggish personal consumption and adverse weather conditions,” and market inventories remained somewhat high.

- The company described Australian market sales as “favorable,” with market inventories remaining at an “appropriate level” due to favorable weather and stable fishing conditions.

Under these market conditions, the new spinning reels Twin Power XD and the baitcasting reels Antares were well-received. In addition, order-taking continued to be brisk for the Poison Adrena rods.

Others

Other segment net sales increased 0.8 percent y/y to ¥98 million, and the company reported operating income of ¥1 million following an operating loss of ¥11 million for the Q1 period last year.

Assets, Liabilities and Net Assets

Total assets as of the end of the first quarter amounted to ¥912.7 billion, a decrease of ¥46.2 billion compared with the 2024 fiscal year-end. The company said the principal factors included an increase of ¥9.5 billion in construction in progress, an increase of ¥7.8 billion in notes and accounts receivable-trade, an increase of ¥4.7 billion in merchandise and finished goods, a decrease of ¥66.1 billion in cash and time deposits, and a decrease of ¥2.6 billion in buildings and structures.

Total liabilities amounted to ¥75.9 billion, an increase of ¥558 million compared with the 2024 year-end. The principal factors included an increase of ¥1.7 billion in accounts payable-trade, a decrease of ¥650 million in deferred income taxes, and a decrease of ¥300 million in provision for product warranties under long-term liabilities.

Net assets amounted to ¥836.9 billion, a decrease of ¥46.8 billion compared with the 2024 year-end level. The principal factors reportedly included a decrease of Y26.5 billion in foreign currency translation adjustments, a decrease of ¥16.9 billion in acquisition of treasury stock, and a decrease of ¥4.0 billion in retained earnings.

Forecast for the Fiscal Year Ending December 31, 2025

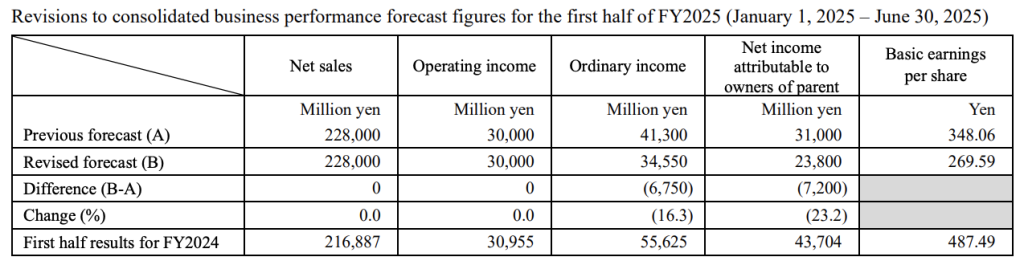

The company revised its consolidated business performance forecasts in light of factors such as non-operating expenses that it recorded due to the appreciation of Asian currencies caused by the weaker U.S. dollar during the first quarter of fiscal year 2025.

Image courtesy Shimano Group