Adidas AG accelerated to double-digit revenue growth for the 2024 full-year period, with currency-neutral (cn) revenues increasing 12 percent compared to the prior year. The company reported that the result was significantly better than its initially expected mid-single-digit increase and ahead of its latest guidance in October 2024, which had projected growth of ~10 percent.

The company reported that the double-digit growth reflects the strong momentum of the Adidas brand, which increased 13 percent year-over-year (y/y).

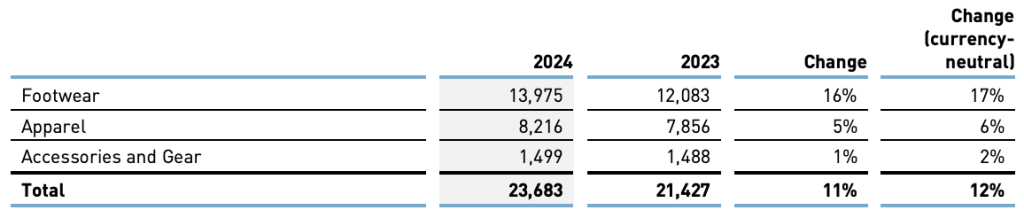

The sale of the remaining Yeezy inventory, which was successfully concluded during the fourth quarter, generated revenues of ~€650 million in the year, compared to ~€750 million in 2023. In euro terms, revenues increased 11 percent to €23.7 billion in 2024 from €21.4 billion in 2023.

Footwear led the company’s growth, increasing 17 percent cn, driven by strong double-digits in Originals, Football and Training. During the year, Adidas successfully broadened its footwear offering across a broader range of price points to meet consumer needs, leading to double-digit growth in Sportswear. In addition, increases in Running and Performance in Basketball contributed to the broad-based growth in Footwear.

Apparel revenues grew 6 percent in 2024. While the development in the first half continued to be impacted by a relatively conservative sell-in approach, particularly in North America, the company began introducing differentiated apparel ranges during the year. Apparel revenues in Originals benefited from the increasing popularity of the Three Stripes through Adicolor and Firebird offerings. In addition, as part of the company’s strategy to create a bigger lifestyle business in Football, Adidas successfully launched retro-inspired third jerseys featuring the iconic Trefoil logo. In Sportswear, newly introduced collections, including the brand’s Z.N.E. range, generated strong sell-through and led to a significant top-line acceleration towards the end of the year.

Accessories sales were up 2 percent reflecting significant improvements in the second half of the year. Across all product divisions, the global range was complemented by an assortment of locally relevant product that resonated well with consumers across markets.

In Lifestyle, currency-neutral revenues increased at a double-digit rate due to strong double-digit growth in Originals. Next to additional newness and depth for its iconic Samba, Gazelle, Handball Spezial, and Campus products, Adidas introduced and started to scale volumes in Retro Running with the SL72 and incubated franchises in the low-profile domain, including Tokyo and Japan. To leverage its successful Originals range with a larger consumer base, the company scaled commercial footwear propositions in Sportswear. It also introduced new concepts in apparel, leading to a significant top-line acceleration in Sportswear during the second half of the year. Demand for the overall Lifestyle offering continued to be fueled by collaborations with Bad Bunny, Wales Bonner, and Edison Chen.

In Performance, several categories contributed to high-single-digit cn growth, led by strong double-digit growth in Football, where Adidas launched new iterations of its iconic Predator boot and reintroduced its F50 franchise, activated by brand partnerships with Lamine Yamal, Jude Bellingham and David Beckham. Strong growth in the Football kit business was driven by jersey sales related to the UEFA Euro 2024 and the Conmebol Copa América, with the Adidas teams Spain and Argentina winning the tournaments. In Running, the company continued to generate strong double-digit growth with its record-breaking Adizero running shoe family. In addition, the revamped offering for everyday runners with the newly launched Supernova, Ultraboost and Adistar franchises led to increased shelf space allocation from key retailers and significant top-line growth in the second half of the year. Adidas also benefited from increased demand for its signature basketball shoe models, led by Anthony Edwards’ AE1, and recorded growth in Training following the launch of its Dropset 3 shoe for gym enthusiasts.

Channel Summary

Adidas posted double-digit growth in Wholesale and direct-to-consumer (DTC) channels.

Wholesale revenues increased 14 percent cn, reflecting strong sell-throughs and, as a result, significantly increased shelf space allocation.

DTC revenues grew 11 percent y/y, or +16 percent, excluding Yeezy in both years. Owned retail saw growth of 15 percent versus the prior year, driven by the strong sell-out rates in the company’s concept stores. E-commerce revenues increased 6 percent (+18 percent, excluding Yeezy). Growth in full-price sales was significantly stronger as Adidas focused on reducing discounting activity and improving the overall business mix on its owned online platforms.

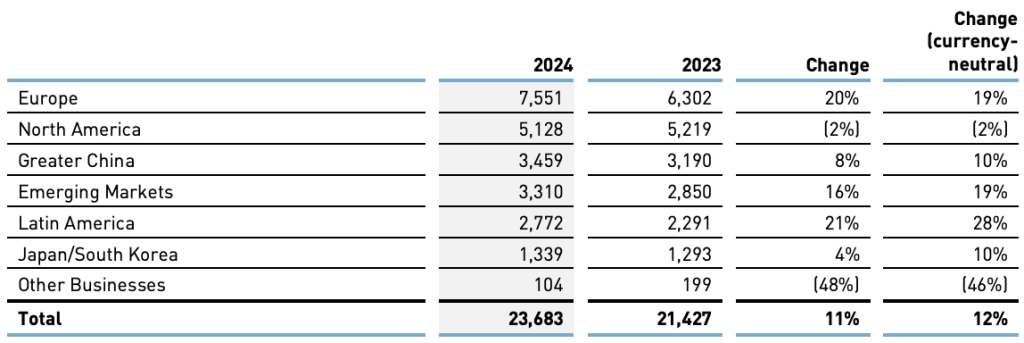

In Europe, the company’s largest market, currency-neutral net sales increased 19 percent cn in 2024, reflecting strong double-digit growth in wholesale and DTC and double-digit improvements in Greater China (+10 percent cn). Emerging Markets (+19 percent cn) and Latin America (+28 percent cn) were also driven by broad-based growth across the channels. In Japan/South Korea, revenues increased 10 percent cn, reflecting strong improvements in the company’s DTC business. Sales in North America declined 2 percent, “solely due” to significantly lower Yeezy sales. In response to still elevated inventory levels in the North America market, the company said its conservative sell-in approach to the Wholesale channel weighed on the top-line development in 2024. As these anticipated headwinds moderated toward the end of the year, Adidas started to grow double-digits in North America in the fourth quarter.

Income Statement Summary

- Gross Margin increased 3.3 percentage points y/y to 50.8 percent in 2024. The improvement was primarily driven by lower freight and product costs, a more favorable business mix and reduced discounting. In contrast, a negative currency effect weighed significantly on the gross margin, particularly in the first half of the year.

- Other Operating Income increased to €174 million from €71 million in 2023. The increase mainly reflects the release of the prior year’s accruals in the third quarter of 2024 of around €100 million following the Yeezy settlement; this was offset by provisions in a similar amount for further donations, which the company recorded within operating overhead expenses in Q3. As a result, these non-recurring items had no material impact on the company’s operating profit in 2024.

- Other Operating Expenses were up 9 percent y/y to €10.9 billion. As a percentage of sales, other operating expenses decreased 80 basis points to 46.2 percent from 47.0 percent in 2023. Marketing and point-of-sale expenses increased 12 percent to €2.84 billion in 2024 versus €2.53 billion in 2023. The company continued marketing investments to support its global brand campaign ‘You Got This’ and impactful activations around the Super Bowl, the UEFA Euro 2024, the Conmebol Copa América, and the Olympic and Paralympic Games in Paris.

- Marketing and point-of-sale expenses increased 20 basis points y/y to 12.0 percent in 2024.

- Operating Overhead Expenses increased 7 percent y/y to €8.10 billion. This development reportedly reflects ongoing investments to strengthen the company’s sales activities and provisions for further donations of around €100 million. In addition, operating overhead expenses include one-off costs of around €200 million, of which the majority were recorded in the fourth quarter. As a percentage of sales, operating overhead expenses decreased 1.0 percentage points to 34.2 percent from 35.2 percent in 2023.

- Operating Profit increased by over €1 billion y/y, reaching €1.34 billion in 2024 from €268 million in 2023. The sale of the remaining Yeezy inventory in 2024 contributed around €200 million to the operating profit development versus ~€300 million in 2023. The operating margin was 5.6 percent in 2024, 440 basis points above the prior-year level of 1.3 percent of net sales.

- Financial Income increased 28 percent to €101 million in 2024, compared to €79 million in 2023, primarily reflecting higher interest income. Financial expenses were up 12 percent to €317 million compared to €282 million in 2023. This development was mainly driven by higher financing costs in some markets, partly offset by lower negative effects related to hyperinflation in countries. As a result, the company’s net financial result was largely stable at a negative €215 million versus a negative €203 million in 2023. The company’s tax rate decreased to 26.5 percent in 2024 versus 189.2 percent in 2023, reflecting the normalization of profitability levels throughout the year.

- Net Income from Continuing Operations improved to €824 million, compared to a net loss of €58 million in 2023. As a result, basic and diluted earnings per share (EPS) from continuing operations reached €4.24 per share in 2024, compared to a loss of €0.67 per share in 2023.

Balance Sheet Summary

- Inventories increased 10 percent to €4.99 billion at the end of December 2024, compared to €4.53 billion at the end of December 2023. The company said this was to support the continued double-digit growth of the Adidas brand in 2025. On a currency-neutral basis, inventories increased 11 percent.

- Accounts Receivable increased 27 percent y/y to €2.41 billion at the end of December 2024, mainly reflecting higher sell-in and a more sizable wholesale business when compared to the prior year. On a currency-neutral basis, receivables were up 26 percent y/y.

- Accounts Payable increased 36 percent y/y to €3.10 billion at the end of December 2024, primarily reflecting higher sourcing volumes. On a currency-neutral basis, accounts payable were also up 36 percent.

- Average Operating Working Capital, as a percentage of sales, decreased 5.9 percentage points y/y to 19.7 percent, compared to 25.7 percent in 2023, reflecting the slight increase of average operating working capital against the background of significantly higher net sales.

- CapEx increased 7 percent y/y to €540 million in 2024. Investments in new or remodeled owned retail or franchise stores, including shop-in-shop presentations of Adidas products in customers’ stores, represented half the total. The remainder consisted of investments in IT and the company’s administration and logistics infrastructure.

- Adjusted Net Borrowings on December 31, 2024, decreased to €3.62 billion from €4.52 billion in 2023, and the company’s ratio of adjusted net borrowings over EBITDA improved to 1.5x versus 3.3x in 2023.

The Adidas AG Executive and Supervisory Boards will recommend paying shareholders a €2.00 per dividend-entitled share at its Annual General Meeting on May 15, 2025. The total payout of €357 million reflects a payout ratio of 43 percent of net income from continuing operations. The proposal reflects the company’s better-than-expected performance in 2024, improved financial profile and management’s confident outlook for the future. This payout ratio is within the target range of 30 percent to 50 percent of net income from continuing operations.

Fourth Quarter Summary

Adidas reported that 2024 fourth quarter currency-neutral revenues increased 19 percent. The Adidas brand reportedly grew 18 percent, reflecting strong growth across all markets, channels and product divisions. The sale of the remaining Yeezy inventory generated revenues of around €50 million in the quarter. In euro terms, revenues grew 24 percent to €5.97 billion from €4.81 billion.

Footwear revenues increased 26 percent on a currency-neutral basis during the quarter, led by strong double-digit growth in Originals, Football, Training, Performance Basketball and Sportswear. In Sportswear, the brand’s expanded commercial footwear offering resonated strongly with consumers, while several other categories, notably Running, also accelerated in response to revamped product ranges introduced for the fall/winter season. As a result, double-digit increases in Running, Golf, and Specialist Sports also contributed significantly to the broad-based growth in footwear.

Apparel sales were up 11 percent, driven by double-digit growth in Football, Running, Golf, and Sportswear. In addition, several other categories posted significant growth in apparel, including Originals and Basketball. Also in apparel, consumers and partners responded positively to improved product ranges, leading to an acceleration of growth across several categories. Accessories continued to grow and increased 7 percent during the quarter.

Lifestyle revenues increased strong double digits in currency-neutral terms in the fourth quarter. Sportswear recorded double-digit growth across product divisions. Next to successful Sportswear footwear franchises, the company also benefited from the introduction of its revamped Adidas Essentials apparel range.

Performance also posted another double-digit revenue increase in the fourth quarter.

Wholesale revenues increased 25 percent cn, while DTC sales were up 15 percent cn. Within DTC, owned-retail posted growth of 18 percent y/y, reflecting strong double-digit growth in both concept stores and factory outlets. E-commerce revenues increased 10 percent amid an ongoing focus on full-price sales on the company’s online platforms.

In Europe, currency-neutral net sales continued to grow at strong double-digit rates (+25 percent cn), Emerging Markets (+21 percent cn), and Latin America (+31 percent cn). In addition, top-line growth significantly accelerated in both Greater China (+16 percent cn) and North America (+15 percent cn). In both markets, the growth was said to be broad-based, reflecting double-digit improvements in the Wholesale channel as well as the company’s owned-retail stores. Revenues in Japan/South Korea grew 9 percent cn in the fourth quarter.

Gross Margin increased 520 basis points to 49.8 percent during the fourth quarter. The improvement was said to be mainly driven by lower product and freight costs, a more favorable business mix, as well as reduced discounting. As expected, negative currency effects faded during the fourth quarter.

Royalty and Commission Income increased to €26 million (2023: €17 million), while other operating income increased to €53 million (2023: €10 million), mainly due to the sale of a warehouse in North America.

Other Operating Expenses increased 17 percent to €2.99 billion. As a percentage of sales, other operating expenses decreased 290 basis points to 50.2 percent. Marketing and point-of-sale expenses were up 13 percent to €754 million in the quarter. The increase reportedly reflects continued investments into the global brand campaign ‘You Got This,’ investments into the brand’s partner portfolio with signings as well as support for new product launches such as the Adidas Essentials apparel range.

Sales, Marketing and POS Expenses were down 120 basis points to 12.6 percent of net sales.

Operating Overhead Expenses grew 19 percent to €2.24 billion, reflecting ongoing investments aimed at strengthening the company’s sales activities and one-off costs of around €150 million. As a percentage of sales, operating overhead expenses decreased 170 basis points to 37.5 percent.

Operating Profit amounted to €57 million in the fourth quarter, compared to an operating loss of €377 million in the prior-year quarter. The sale of the remaining Yeezy inventory contributed an “immaterial amount” to the company’s operating profit in the fourth quarter.

Net Financial Expenses increased to €86 million from €38 million in 2023, said to be mainly due to higher financing costs in select countries and negative currency impacts.

Against a loss before taxes of €29 million in Q4 versus a loss of €415 million in Q4 2023, the company recorded income taxes of negative €2 million in the fourth quarter versus negative €14 million in the prior-year period.

The net loss from continuing operations amounted to €27 million in the fourth quarter, compared to a net loss of €401 million in Q4 2023. Basic and diluted EPS from continuing operations were a loss of €0.26 in Q4 2024, compared to a loss of €2.36 in Q4 2023.

Outlook for 2025

Despite persisting macroeconomic and geopolitical challenges, Adidas expects to gain market share and grow the company’s currency-neutral sales at a high-single-digit rate in 2025; this reflects continued double-digit growth for the Adidas brand. A significantly better, broader, deeper product range combined with an increased focus on local consumer preferences and improved retailer relationships will be the main drivers of the projected top-line increase. In addition, impactful marketing initiatives will further increase the company’s brand momentum and fuel the expected top-line growth.

Currency-neutral revenues are projected to grow strong in all markets in 2025. Specifically, the company expects sales for the Adidas brand to grow double-digit in North America, Greater China, Emerging Markets, and Latin America. Revenues in Europe and Japan/South Korea are projected to increase at a high-single-digit rate—operating profit to increase further to between €1.7 billion and €1.8 billion.

While Adidas will continue to increase marketing and sales investments, operating overhead efficiencies will allow the company to leverage its strong top-line growth. Combined with continued gross margin expansion, Adidas expects this to lead to further significant bottom-line improvements in 2025. As a result, the company projects operating profit to increase to between €1.7 billion and €1.8 billion in 2025.

Having completed the sale of the remaining Yeezy inventory in 2024, the company’s outlook does not include any Yeezy revenues (~€650 million in 2024), or profits (~€200 million in 2024) in 2025.

Tariff Impact

While tariff changes may not have been figured in to the company 2025 forecast at this early stage of the process, company CEO Bjorn Gulden shared during a Wednesday meeting with media that expanding U.S. tariffs on imports would cause prices to rise and consumers to buy fewer products.

“If there are 25 percent duties coming and it is on more countries, inflation will go up and volumes will go down,” Gulden told the media. “We know that, but how much? I mean, we can give you a number, but the only thing we know is we will have to adjust very, very quickly.”

Gulden said Adidas has not estimated the potential impact of U.S. tariffs on Vietnam, its top manufacturing country, which President Trump has threatened with higher levies as well. He appeared to minimize the the impact of higher U.S. tariffs on Chinese goods, saying only a small portion of its product sold in the U.S. is made in China, according to reporting from Reuters. “We have less than 5 percent of our volumes going to the U.S. is China,” he said.

Adidas said Vietnam accounts for 27 percent of total Adidas production, followed by Indonesia at 19 percent and China at 16 percent.

Herzogenaurach Job Cuts

In other Adidas corporate news, the company confirmed on its conference call that it was cutting approximately 500 “obsolete” roles after a strategic review of operations at its Germany headquarters.

“We worked with different departments and different processes and identified work streams how can we reduce complexity and be more right in what we’re doing in a more simple way,” Gulden revealed. “And these work streams identified that most of the complexities are actually being created in headquarters. And we did then define that we have up to 500 roles here in the headquarter that are obsolete.”

Gulden said the company has ~62,000 employees around the globe.

Image courtesy Adidas AG