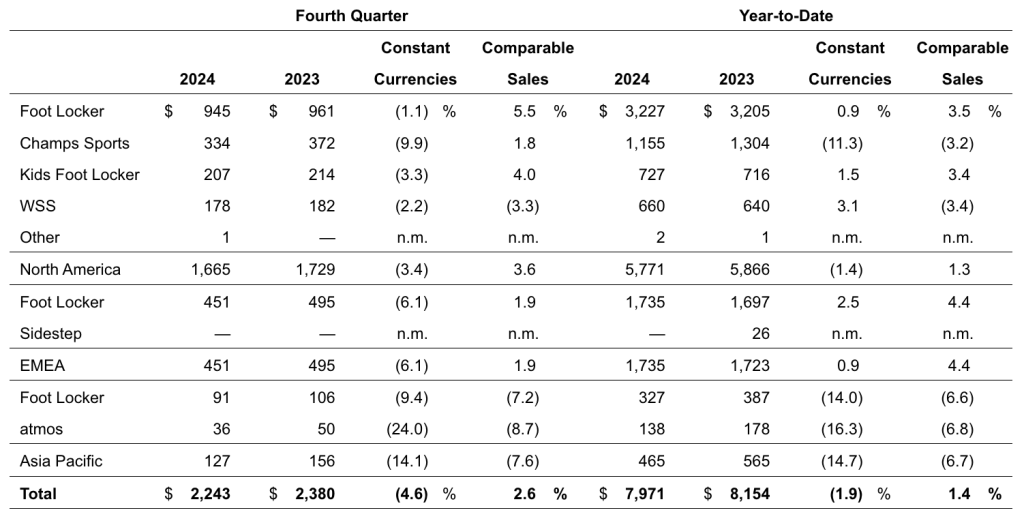

Foot Locker, Inc. reported that total 2024 fourth-quarter sales were down 5.8 percent to $2.24 billion, compared with sales of $2.38 billion in the fourth quarter of 2023. Results from 2023 included the effect of the 53rd week of the retail calendar, representing sales of $98 million.

Excluding the effect of foreign exchange rate fluctuations, total sales for the fourth quarter decreased by 4.6 percent.

Comparable sales increased by 2.6 percent in the fourth quarter, including global Foot Locker and Kids Foot Locker combined comparable sales growth of 3.6 percent, benefiting from “a strong build during peak holiday sales.”

Consensus estimates for total comp store sales was +2.25 percent.

Company EVP and Chief Commercial Officer Frank Bracken reported on the conference call with analysts that comparable store sales in Retail Stores channel were up slightly.

“While traffic was down to last year, we continue to see gains in conversion as well as average ticket led by positive AURs,” the CCO shared. “A special thank you to our amazing striper teams who delivered great customer service while driving conversion increases during the holiday season.”

Digital comps rose 12.4 percent for the fourth quarter. Bracken said they saw increases in traffic, AOV, and conversion as efforts to improve the customer digital experience continue to resonate. He said this included the launch of the new Foot Locker app, which he said “immediately drove conversion gains and an improved customer shopping experience.”

Sales by Banner and Region

North America overall comps were up 3.6 percent, including a 5.5 percent increase in comps at the Foot Locker North America banner.

“Our Foot Locker banner saw a record-breaking build in the business in the final week leading up to Christmas, led by gains in running, seasonal, as well as strong launches,” Bracken detailed.

Kids Foot Locker comped up 4 percent in the quarter, growing in both Stores and Digital.

“KFL delivered a strong performance in the quarter, mirroring many of the same dynamics driving the Foot Locker banner,” Bracken said. “In fact, towards the end of the quarter, we opened our first standalone Kids Foot Locker Reimagined location at Bay Plaza in the Bronx. We are thrilled to have our first KFL Reimagined store in the heart of New York City sneaker culture as a way to introduce our youngest sneaker enthusiasts to the category.”

While very early in the process, he said results from the Bay Plaza store have been very positive, which is validating of the Reimagined strategy as the company looks to add additional locations in 2025 and beyond.

Champs Sports delivered its “second consecutive quarter of positive comps since the banner’s repositioning began,” with gains of 1.8 percent.

“Customers are responding to the banner’s updated head-to-toe sports style positioning with differentiated assortments from partners such as Nike, New Balance, Adidas, Asics, Brooks, and our CSG label,” Bracken discussed. “Champs Sports also continues to build momentum with its Run Club program and strong positioning of performance and lifestyle running products.”

He said Champs held 12 Run Club events in 2024 with strong brand partnership support from Nike, Asics, and Brooks. In 2025, the team is looking to scale this program to over 30 events and include even more brand partners as co-sponsors of Run Club.

WSS comparable sales were down 3.3 percent for the quarter.

“Despite strong results over the Black Friday sales period, we saw our WSS customers be cautious with their discretionary dollars into December and January as they contend with ongoing inflation as well as impacts from the Los Angeles fires,” Bracken explained. “Our WSS team continues to position the banner with compelling assortments with an emphasis on value, including below $80 footwear, as well as global football and workwear, as they support the local communities and neighborhoods they serve.”

He said the company will continue to take a “prudent approach” to capital with the WSS banner in 2025 when it comes to new store openings. He said they are planning for one new WSS store opening in 2025 as the company shifts investment into other real estate projects that are driving higher returns.

“Longer term, we still believe in the unit growth potential of the WSS banner, but we do believe a more conservative view in the near term is the right path,” Bracken suggested.

Europe Sales

Europe comps were up 1.9 percent for the fourth quarter. The environment in Europe was said to be choppy and competitive throughout the quarter. Bracken said the promotional environment included aggressive actions in both the footwear and apparel categories.

“Looking ahead, our team in Europe plans to continue to invest prudently in store refreshes to elevate the customer experience and improve our competitive positioning,” Bracken said. “Simultaneously, we will work with our brand partners to move back towards a pull market with more full-price selling. But we do expect that 2025 will be a transition year in the European marketplace.”

Asia Pacific Sales

Asia Pacific comps were down 7.6 percent in Q4. Foot Locker banner comps fell 7.2 percent in the region, reflecting competitive marketplace dynamics in Australia as consumers there continue to deal with prolonged inflation. Bracken also reminded participants that the company began to wind down its business in South Korea during the fourth quarter, including shutting down its e-commerce operations at the end of the calendar year. He said they expect that store operations will largely be wound down by the end of the fiscal first quarter of 2025. At Atmos, comps were down 8.7 percent reflecting the decision to shift sales to Foot Locker’s own digital site and away from less profitable third-party digital platforms.

Product Category Trends

Footwear comped positive in Q4, growing in the high single-digits year-over-year. Bracken said the base business and a strong launch calendar both drove comp sales in the quarter.

“These gains were led by growth and momentum from a broad portfolio of our brand partners,” he shared. “The Jordan brand delivered gains thanks to very compelling launches in the quarter and a complementary sportswear business. Meanwhile, Adidas, New Balance, On, Hoka, Asics, Saucony, Crocs, Ugg, and Timberland all contributed meaningfully to the success of our footwear business at holiday.”

Bracken said that as Nike rebalances their product portfolio and inventory levels in the short term in an effort to make way for future innovation, the company is continuing to navigate some impacts on its business.

“Throughout this process, we continue to align closely with them to optimize our merchandise mix and inventory levels to support full-price sales and partner with them to bring health back to critical consumer franchises like Air Force 1, Dunk, and the AJ1,” he said. “And as we look to 2025, we are encouraged by their innovation pipeline across basketball, performance running, Shox and the reinvigoration of the Max Air business.”

He said the lineups and community excitement for the Nike All-Star Backpack, the Kobe 6 and Galaxy Foamposite NBA at the All-Star activation in San Francisco demonstrated just how powerful the Nike brand is to Foot Locker’s core consumer.

In Basketball, Bracken said customers continue to respond to next-gen signature athletes such as Nike’s Ja 2, Sabrina 2, Adidas’ AE 1 and Puma’s Melo 04. He said they also had a phenomenal launch result with the Nike Kobe franchise, which brought renewed energy to the marketplace. “And as mentioned, Jordan delivered a powerful launch assortment this quarter led with premium executions of the Retro 9, Retro 3 and the Carolina Blue Retro 11, all of which were sellouts with consumers,” Bracken noted.

In Lifestyle footwear, Bracken said Adidas continues to see strength as the brand leads the Terrace trend, especially within the retailer’s women’s and kids’ segments. He said they were pleased that this momentum occurred on a global scale, positively impacting all regions and banners.

“In 2025, we will continue to diversify this category with energy from Handball Spezial and Superstar,” he shared.

In Running, New Balance continues to see momentum across the women’s, men’s, and kids’ businesses.

“Franchises like the 9060 have consistently ranked among our top sellers and we were pleased with the performance of other styles like the 1906 and 530 in which premium executions resonated strongly with our Sneaker Maven and Fashion Forward consumers,” Bracken said. “Brand searches, full price selling, and a pipeline of innovation give us confidence that New Balance will continue to be one of the fastest growing brands in the industry.

He said Asics continues to see global momentum across men’s and women’s with running-inspired styles such as the GEL-NYC, the 1130, and the GT-2160.

“We’re adding doors, elevating the presentation and ramping up our marketing with Asics as we look into 2025,” Bracken shared. “We expect both globally and across multiple banners in North America that Asics will continue to trend with young multicultural consumers and remain excited about growth potential with this important partner.”

Bracken also said that as Lifestyle Running continues to be a powerful connection point with consumers, the company is bringing in new ideas to keep the consumer engaged.

“We recently introduced Saucony into the assortment and have been pleased with customers’ response to styles such as the ProGrid Omni 9 and Millennium,” he said.

In Performance Running, Bracken said On and Hoka are continuing to resonate in the business.

“We continue to see healthy sales gains with these partners, and we plan to expand doors with them globally in 2025,” he noted.

Within Seasonal, Ugg reportedly played a leading role in the business in the fourth quarter, especially within the Global Foot Locker banner.

“With exciting content and must-have styles such as the Tasman and Ultra Mini, Ugg continues to drive excitement during the gifting season,” he said. “And the success we had with the sneaker-inspired Lowmel gives us confidence that there is a broader opportunity with this brand moving forward.”

He also called out strength in Timberland in the boot category as customers responded to their exciting collaborations and marketing.

In Apparel, challenges apparently persisted with comp declines down in the mid-teens for the period.

“While we continue to see innovation within apparel lagging compared to the footwear business, we are beginning to be even more aggressive in pursuing our private-label strategy, which has worked for us in recent quarters, particularly at Champs Sports,” he noted.

“Alongside that, we will continue to work upstream with our brand partners to encourage more newness in materials, silhouette, sneaker connectivity, and speed-to-market. We know that apparel allows for more exciting retail presentations, better integrated storytelling, and an opportunity to build the consumer’s basket,” he offered.

The Accessories business comped up in high-single-digits as shoppers responded to refreshed assortments through categories such as socks, headwear, and shoe care.

Income Statement Summary

Gross margin increased by 300 basis points year-over-year compared with the prior-year period, led by merchandise margin recovery against the prior year’s higher level of promotions and ahead of our revised expectations. This was reportedly achieved despite an elevated promotional environment across both the DTC and wholesale channels. Occupancy, as a percentage of sales, was said to be flat compared to the prior-year period.

SG&A, as a percentage of sales, improved by 10 basis points compared with the prior-year quarter, driven by savings from the cost optimization program, disciplined expense management and lower incentive compensation, partially offset by technology and brand-building investments.

Net income from continuing operations was $55 million, compared with a net loss of $389 million in the prior-year period. On a non-GAAP basis, net income from continuing operations was $82 million for the fourth quarter, as compared with net income of $36 million in the corresponding prior-year period.

Fourth quarter earnings per share from continuing operations was 57 cents per share, compared with a loss of $4.13 per share in the fourth quarter of 2023. Non-GAAP earnings from continuing operations were 86 cents per share in the fourth quarter, as compared with non-GAAP earnings per share of 38 cents in the corresponding prior-year period.

Wall Street was looking for 72 cents per share for the quarter.

“We delivered fourth-quarter results above our previously revised expectations, as our investments and execution drove positive comparable sales and meaningful gross margin improvement compared to the prior year,” said Mary Dillon, president and CEO of Foot Locker, Inc. “Reflecting on 2024 overall, we made significant progress in elevating our in-store experience with our new Reimagined doors and store refresh program, enhancing our digital and mobile capabilities, expanding engagement with our FLX Rewards Program, and leaning into brand building through compelling campaigns and partnerships. Our return to positive comparable sales growth, gross margin expansion, and positive free cash flow in fiscal 2024 serve as proof points that our Lace Up Plan is working.”

Balance Sheet Summary

At quarter-end, the company had cash and cash equivalents of $401 million, and total debt was $446 million.

As of February 1, 2025, the company’s merchandise inventories were $1.53 billion, 1.1 percent higher than at the end of last year’s fourth quarter. Excluding the effect of foreign currency fluctuations, merchandise inventories increased by 2.5 percent compared to last year’s fourth quarter.

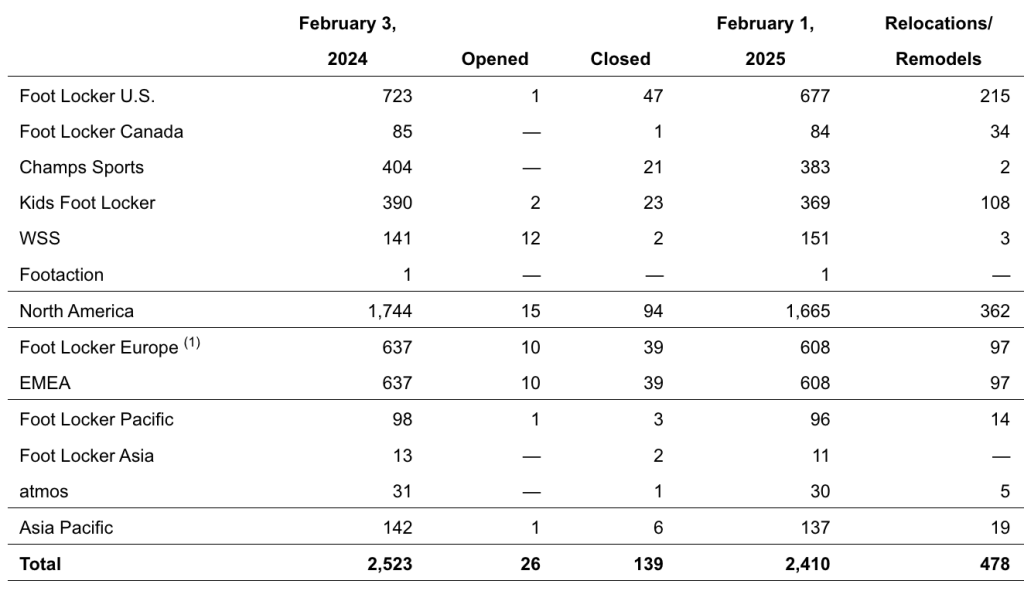

Store Base Update

During the fourth quarter, the company opened seven new stores and closed 47 stores. Also during the quarter, the company remodeled or relocated 21 stores and refreshed 160 stores to our updated design standards, which incorporate key elements of our current brand design specifications.

As of February 1, 2025, the company operated 2,410 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 224 licensed stores were operating in the Middle East, Europe, and Asia.

Issuing Full-Year 2025 Sales and Non-GAAP EPS Outlook

“Looking ahead, we will continue to prioritize our customer-facing investments, keep our inventories controlled, and manage our expense base with discipline to improve our profitability,” Dillon continued. “While we expect consumer and category promotional pressures to remain uncertain into 2025, especially within the first half, our Lace Up Plan strategies continue to resonate with our customers and brand partners. We started the year with one of our largest basketball activations in the company’s history at NBA All-Star 2025, underscoring how we are capitalizing on our basketball leadership and our strong brand partnerships. We are confident that our strategies and actions will enable us to achieve our growth expectations in 2025 and are committed to delivering sustainable shareholder value creation.”

The company’s full-year 2025 outlook, representing the 52 weeks ending January 31, 2026, is as follows: